Today, former head of the US Federal Reserve, Ben Bernanke launched his own economics blog through the Brookings Institution (http://www.brookings.edu/blogs/ben-bernanke). As Ben put it, “Now that I’m a civilian again, I can once more comment on economic and financial issues without my words being put under the microscope by Fed watchers. I look forward to doing that—periodically, when the spirit moves me—in this blog. I hope to educate, and I hope to learn something as well”.

Well, can we learn something from Ben’s blog? After all, this is the economist who is supposedly an expert on the Great Depression of the 1930s and its causes; and vowed back in 2002, when addressing a celebration of Milton Friedman, the great exponent of monetarism, that he and the Fed had learned the lesson that by judicious use of monetary policy (lowering interest rates and boosting money supply through ‘quantitative easing’ or even through cash handouts to the banks), depressions could be avoided.

https://thenextrecession.wordpress.com/2013/10/06/bernanke-banking-crashes-and-recessions/

“We won’t let it happen again” said Ben at the time. And ‘helicopter Ben’, as he became known, for advocating monetary largesse on an industrial scale dropped from helicopters on the countryside if necessary in times of slump, duly applied Friedman’s monetary injections during the Global Financial Crash and the Great Recession.

But did such policies of low interest rates and helicopter money work? Well, you can read my many posts on that for the efficacy of QE and Bernanke-style monetary policy.

https://thenextrecession.wordpress.com/2014/01/05/bernanke-has-failed/

https://thenextrecession.wordpress.com/2012/09/03/bernanke-in-a-hole/

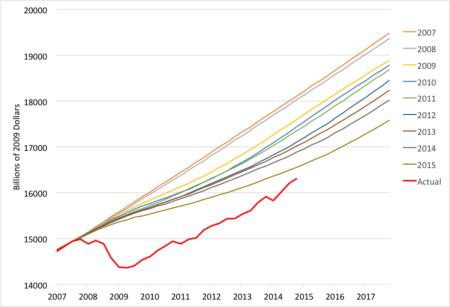

But the outcome is clear: the weakest recovery from a slump in the post-war period and forecast for future growth have been steadily downgraded, as this graph shows.

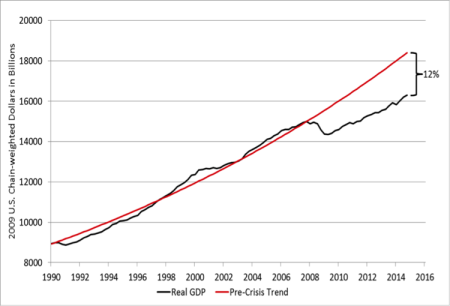

Current US real GDP is some 12% below where it would have been now without the Great Recession and subsequent weak recovery..

It would seem that monetary policy is not anywhere near enough to get even the US capitalist economy going and ‘return to normal’.

And it seems that Bernanke in his first blog post today agrees. Ben tells us that low interest rates are here to stay, but not because of lax monetary policy but because the real rate of return on assets (both tangible and financial) are staying low

(http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/30-why-interest-rates-so-low).

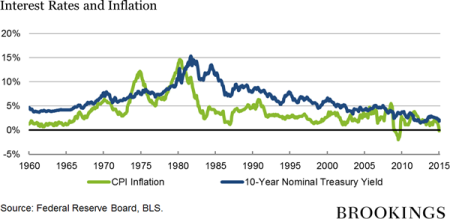

Ben points out that interest rates along with inflation have been in a downward trend since the early 1980s. Indeed, real rates (after inflation) are actually negative now.

And this is a “not a short-term aberration, but part of a long-term trend.” Now this may be a revelation to Ben, the former Fed Chairman, but it is not to readers of my blog or my book, The Great Recession, where I point out in some detail that capitalism in its long-term downward phase in production prices (in what has been called the Kondratiev cycle, after the Russian economist who first identified this cycle) –

https://thenextrecession.wordpress.com/2014/02/16/tendencies-triggers-and-tulips/

But Bernanke asks the question: “Why are interest rates so low? Will they remain low? What are the implications for the economy of low interest rates?” Well, they are low not because the Fed and other central banks have pumped too much money into the economy – although that used to be what Ben said he wanted to do. No, the reason for low interest rates is the low rate of return on capital investment. Well, well. “The real interest rate is most relevant for capital investment decisions, for example. The Fed’s ability to affect real rates of return, especially longer-term real rates, is transitory and limited. Except in the short run, real interest rates are determined by a wide range of economic factors, including prospects for economic growth—not by the Fed.”

Ben invokes the work of Knut Wicksell, the pre 1914 Swedish economist who introduced the concept of the equilibrium real interest rate. This equilibrium interest rate is the real interest rate consistent with full employment of labour and capital resources. And the problem is that the equilibrium real rate is low because “investment opportunities are limited and relatively unprofitable.” What this tells you is that monetary policy is restricted in its impact by what is going on in the ‘real’ economy, more specifically, the dominant capitalist sector. “The bottom line is that the state of the economy, not the Fed, ultimately determines the real rate of return attainable by savers and investors.”

So Ben’s argument that it is the underlying real rate of return on investment that decides things, not Federal Reserve monetary policy, is really to justify and defend his actions as Fed chair against criticism from the Austrian school and the neoliberal camp that he kept interest rates artificially too low; and from Keynesian camp that he did not intervene enough. You see, the critics are wrong about Fed policy because the Fed has little say in the underlying growth or otherwise of the US capitalist economy. That depends on its underlying profitability, or in Wicksell’s language the ‘equilibrium ‘natural rate of return’.

“The state of the economy, not the Fed, is the ultimate determinant of the sustainable level of real returns. This helps explain why real interest rates are low throughout the industrialized world, not just in the United States.” By why is the real rate of return so low? Ben will tell us in future posts.

Don’t hold your breath.

No comments:

Post a Comment