October is the most volatile month in the stock market calendar. The price of shares in world stock markets rise and fall like a yo yo in October compared to other months. I don’t know why, but maybe October is when investors realise that their expectations of corporate profits are not going to be met by year-end and they react accordingly. Anyway, the great stock market crash of 1929 which kicked off the Great Depression of the 1930s started in October. The huge crash in stock prices in 1987 was in October and the crash of October 2007 heralded the ensuing banking meltdown and the Great Recession of 2008-9.

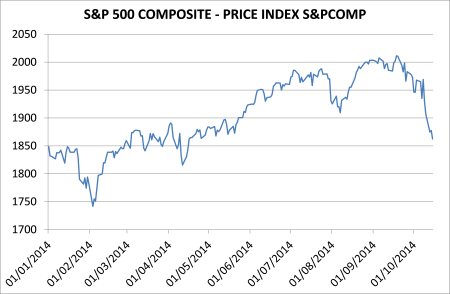

But usually, any October ‘correction’ is followed by a rally from November to Xmas, the so-called Santa Claus rally. That’s what happened in 1987. So what will happen this time? Well, so far, stock markets have fallen from their peak by 10%.

The media is screaming, but a 10% fall is not really a crash. On the other hand, there is a big difference between 1987 and 2014.

In 1987, the major economies were experiencing rising profitability in the corporate sector that began in 1982 and global investment and growth was accelerating. In 2014, it’s different. Global profitability is static and, as this blog has argued incessantly, global real GDP growth and investment is way below trend – an indicator of a Long Depression. And the Eurozone and Japan are close to a new recession (see my posts,

http://thenextrecession.wordpress.com/2014/10/10/draghis-answer-to-euro-depression/and

http://thenextrecession.wordpress.com/2014/10/13/japan-the-failure-of-abenomics/.

Indeed, profits for US top companies, shortly to be announced for the last quarter, are expected to show the weakest growth since 2009.

The world’s major central banks have been pumping credit into their economies by ‘printing’ money like there was no tomorrow. Only last month Draghi at the ECB announced a new round of credit injections. But these huge injections have turned out to be just more fictitious capital. The money has ended up in the banking system and then been used to lend to banks, hedge funds, pension funds, asset managers and corporate treasurers at very low rates and they have speculated with the credit in stocks and bonds. Thus there has been a huge rally since 2009 in the world’s stock markets and in government bonds, even of those governments with huge debts and no economic recovery like Greece, Portugal, Spain and Italy.

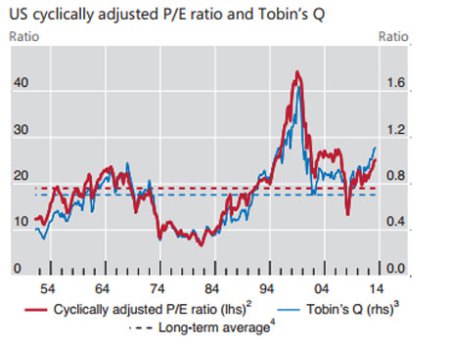

None of this credit has reached the so-called ‘real’ economy, or the productive sectors, for investment in new technology and skilled employment. The money has been hoarded and speculated with. So stock and bond prices have increasingly got out of line with real economic growth based on value created by labour power globally, as this graph of Tobin’s Q, a measure of stock prices against the real stock of capital, shows (i.e. the blue line is well above average, if not as high as in 2000).

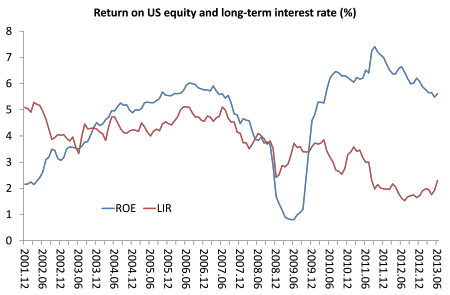

This is unsustainable. Indeed, unlike 1987, this is a bear market for stocks that began back in 2000 (see my post http://thenextrecession.wordpress.com/2014/02/07/waste-bear-markets-and-fictitious-capital/). In that post, I pointed out that the huge boom in the stock markets in the last four years is way above even the substantial rise in the mass of profits in many major economies since the trough of 2009. The return (in corporate earnings) against investing in the stock market rose to highs by late 2011. But since then it has been falling back as stock prices rose much faster than earnings could keep up.

The graph was done before this October ‘correction’ so the blue line (the return on investing in stocks) has dropped back further. But there is still plenty of room for further downside.

What has triggered this October crash is the fear among investors that economic growth and profitability is starting to drop and central banks’ injections of credit have stopped propping things up. Indeed, the US Federal Reserve has an economy that is doing better (a bit) than others and ended its ‘quantitative easing’ this October and has been talking about hiking interest rates some time next year. So the cheap money ‘gravy train’ appeared to be coming to an end. This is the contradiction that I raised in another recent post (http://thenextrecession.wordpress.com/2014/08/01/the-risk-of-another-1937/).

Now it may be that this October stock market ‘correction’ will be reversed by a Santa Claus rally in November, especially if the Fed lets markets know that it will delay its planned rate hike and the ECB decides to extend its credit injections to ‘full’ QE by buying the bonds of distressed Eurozone governments like Italy, Spain or Greece. But the Germans are vehemently opposed to such ECB bond purchases and the Fed is still looking at its overblown balance sheet and any sign of wage inflation in the US economy. So neither the Fed nor the ECB may go for any more injections of fictitious capital, especially as they are not working to boost the economy.

The stock markets are rallying today as I write this. It remains to be seen if this is just a short period of relief or the end of the ‘correction’ and investors recover their nerve and start a new round of bets with our money.

No comments:

Post a Comment