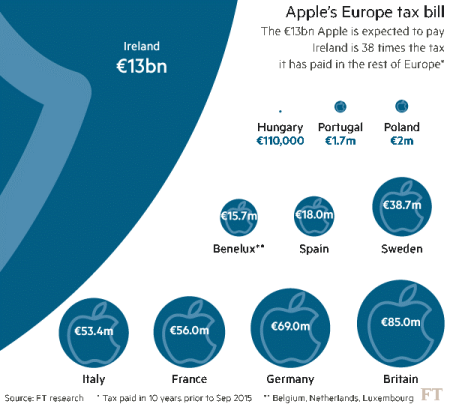

The tech giant Apple has accumulated an enormous cash hoard of $246bn, larger than Sri Lanka’s estimated 2016 GDP. If Apple’s cash pile was its own public company, it would be the 13th largest in the world. Much of this cash pile ($215bn) is held abroad to avoid paying the higher rate of corporation tax that the US applies. For example Apple paid only 0.005 per cent tax in Ireland in 2014. The EU Commission is trying to force Apple pay a proper tax amount to Ireland on the grounds that its profits in Europe have not been taxed properly because it accounts for its sales through Ireland. The Irish government has sided with Apple in this dispute!

But Apple’s cash pile is not actually “cash” nor “on hand”. Apple has only about $16.7 billion in cash and equivalents on its balance sheet. The rest is stashed in long-term marketable securities, meaning Apple plans to let those funds — roughly $177 billion — accrue interest for more than a year.

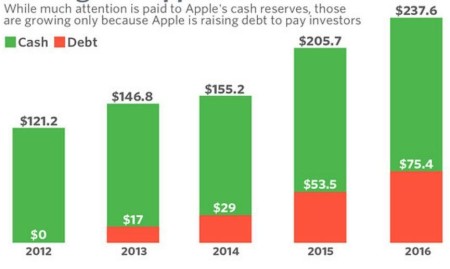

Everybody notices the high cash hoards that some of the largest US companies are accumulating but do not notice that their debt has rocketed too. Apple’s debt has exploded. It has $80bn in debt, which since 2012 is essentially an increase of $80bn. That’s right, a few years ago, Apple had near-zero debt levels and now has a solid $80bn worth.

And while cash and securities pile up overseas, Apple is piling up debt in the US. Apple – even before this latest borrowing – had more debt than the telecom and cable companies which typically carry the most debt since they have stable cash flow and slow growth. The company currently sits on about $53.2 billion in long-term debt obligations as well as $32.2 billion in “non-current liabilities,” after executing a series of bond sales including the largest in history for a nonfinancial U.S. business, making it the fourth most-indebted company in the Standard & Poor’s 500.

By borrowing instead, Apple gets cash to pay dividends and buy back shares of stock without hauling its billions stored overseas back to the US, which could trigger a ‘tax event’. Apple is a little more than three-quarters of the way through a $200 billion capital-return program that it believes will set a corporate record for stock buybacks. There is another $47 billion promised to shareholders. There is no doubt that Apple is raking in cash with its massive hardware sales and has plenty of ammunition for potential acquisitions. But Apple is actually borrowing to finance the promises it has already made.

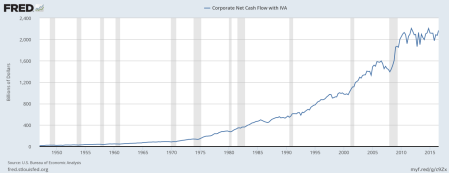

And it’s the same story behind the so-called cash hoards that have built up in other very large US multi-national corporations.

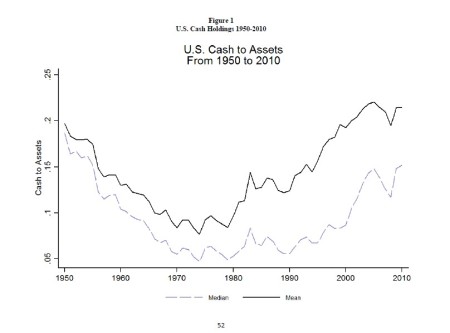

A recent study of multinational cash holdings found that “since corporate assets tend to grow over time, the dollar amount of cash holdings would grow even if the ratio of cash to assets stays constant.” And that is what has been happening. Cash reserves have risen but cash to asset ratios have not. “Using all non-financial and non-regulated public firms with assets and market capitalization greater than $5 million per year in the US, the average cash/assets ratio is 20.18% in 2009-2010 compared to 20.50% in the 2004-2006 pre-crisis period.” That’s down.

The median ratio is higher by 0.87% in 2009-2010 than in 2004-2006 and the asset-weighted ratio is higher by 0.74% in the recent period. That tells you large firms have increased their cash holdings more. This confirms the recent OECD study that found that the huge profits gained since the end of the Great Recession have been mostly confined to the large companies: “just a few mega companies hold most of the cash while thousands of small and medium enterprises (SMEs) hold little cash and much more debt

The big rise in cash holdings took place in the global credit boom of the early 2000s. From 1998-2000 to 2004-2006, the average cash/assets ratio in US corporations increased by 3.77%, the median by 6.39%, and the asset-weighted average by 3.62%. And this appears to be a US phenomenon.

The study found that cash/assets ratios increased across the world in the 2000s compared to the late 1990s. But the increase in average cash holdings across the world was smaller than the increase in the US. Indeed median cash holdings in the US in the late 1990s were lower than median cash holdings in foreign countries, but the opposite was true by 2010. And after 2010, there is little evidence of an increase in average cash holdings for foreign firms.

Why have cash to asset ratios risen since 1998? The study finds that cash holdings may have changed simply because firm characteristics have changed. If this were the case, there might be nothing abnormal about the large cash holdings of American firms in recent years. Bates, Kahle, and Stulz (2009) show that changes in firm characteristics explain much of the increase in cash holdings in the 1980s and 1990s. US multinationals held comparable amounts of cash than purely domestic firms in the late 1990s, but now hold significantly more cash than similar purely domestic firms.

The tax treatment of remittances made it advantageous for multinationals to keep their earnings abroad. But the increase in cash holdings of multinationals is strongly related to their R&D intensity, so that multinationals with no R&D expenditures do not have an increase in abnormal cash holdings compared to domestic firms with no R&D expenditures. In sum, what this study shows is that cash hoarding is really confined to large hi-tech multinationals which keep cash for high risk R&D spending that burns cash, while borrowing and issuing debt to pay shareholders their dividends and buy back shares, as this is cheap and tax efficient.

This confirms previous studies such as that in the Journal of Finance (2009), Why firms have so much cash, which found that in order to compete, companies increasingly must invest in new and untried technology rather than just increase investment in existing equipment. That’s riskier: “the greater importance of R&D relative to capital expenditures also has a permanent effect on the cash ratio. Because of lower asset tangibility, R&D investment opportunities are costlier to finance than capital using external capital expenditures. Consequently, greater R&D intensity relative to capital expenditures requires firms to hold a greater cash buffer against future shocks to internally generated cash flow.”

So companies have to build up cash reserves as a sinking fund to cover likely losses on research and development. This partly explains why there was a growing gap between cash held by corporations and investment in means in production between 1998 and 2008

No comments:

Post a Comment