If you agree that there is an imperialist bloc of countries that dominates and controls the world, then Australia should be included. It may be a new and smaller entrant to the bloc, and it may be just a satellite of US imperialism in the Asia-Pacific, but it still fits the bill as part of the bloc.

And increasingly, the ruling strategists of Australian capital also see it that way. Australia has a general election tomorrow (21 May); it has one every three years (a leftover from its early days of democratic development) and the ruling National-Liberal Coalition government has been sounding the war bells. During the election campaign, Australia’s defence minister Peter Dutton told the country to “prepare for war”, capping what analysts have called a “khaki campaign” by Scott Morrison’s right-wing government. Dutton ramped up the rhetoric, telling Australians: “The only way you can preserve peace is to prepare for war and be strong as a country, not to cower, not to be on bended knee and be weak.”

And where is the threat of war to come from? China, of course. To counter what it sees as a threat from China, the Morrison’s government has in recent years sealed what is called the Aukus security pact with the US and UK and promised billions of dollars of defence and cyber security spending – all designed to resist the ‘threat’ of China – or to be more exact to follow the strategy of US imperialism to ‘contain’ and stop China becoming a rising economic power in the region and globally.

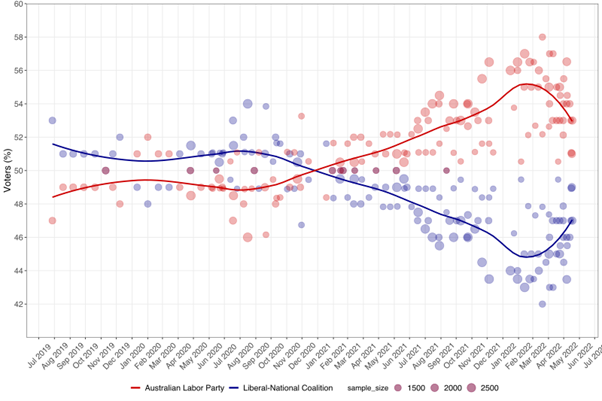

In the public opinion polls, ‘Trumpist’ Morrison trails Labor leader Anthony Albanese, with 54 per cent of voters backing the opposition compared with 46 per cent for the government, according to the latest Newspoll survey.

But don’t expect Albanese to alter Australia’s anti-China strategy. Labor fully backs the Aukus pact and if he wins, Albanese will join the meeting of the Quad — a security grouping of the US, Australia, India and Japan —which is due to take place in Tokyo only three days after Saturday’s election, with US president Joe Biden set to attend. Most analysts say that Biden “would be comfortable” with a Labor victory.

While the strategists of imperialism will be happy, Australia’s working people have more pressing problems. There are three issues dominating the election: the huge rise in house prices driven beyond the means of most Australians; the sharply rising cost of living where prices are rising much faster than wages; and climate change, with ever more destructive heatwaves, drought and floods affecting people’s lives.

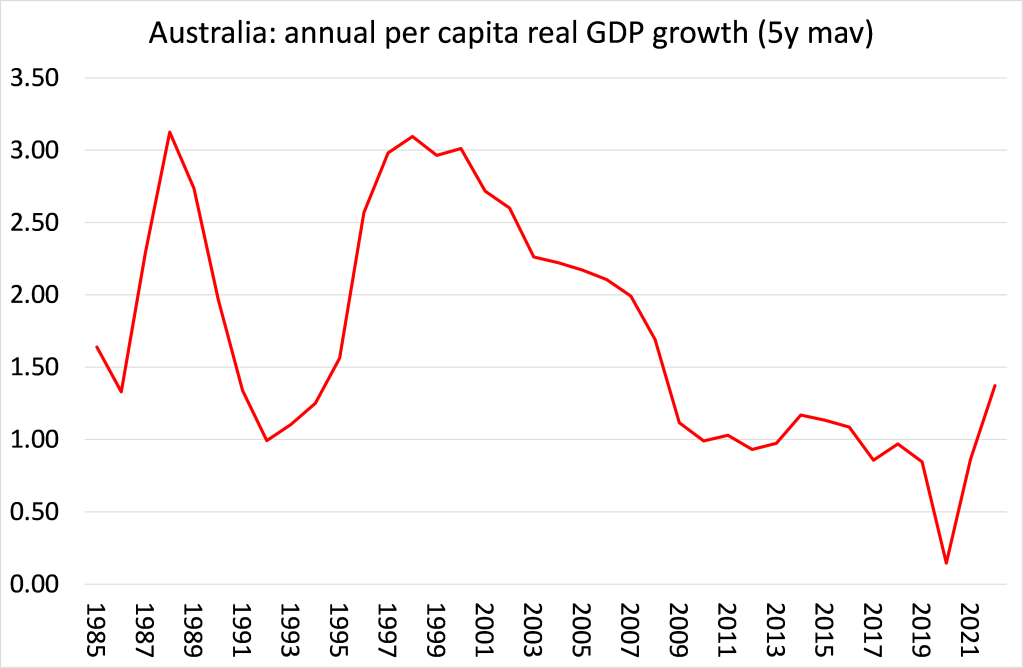

Australia used to be called the ‘lucky country’ where people could emigrate to and start a new and prosperous life in an economy that had not suffered a recession of any note for decades. But the signs that this was changing have been there since the Great Recession of 2008-9 and subsequent Long Depression that ensued up to the COVID pandemic slump in 2020. After taking into account population growth, average annual real GDP per person grew by about 2% a year in Australia up to the Great Recession. However, since then, per capita growth has averaged half that rate.

Of course, this is a phenomenon found in nearly all major advanced capitalist economies since the Great Recession, but it has affected the ‘lucky country’ too.

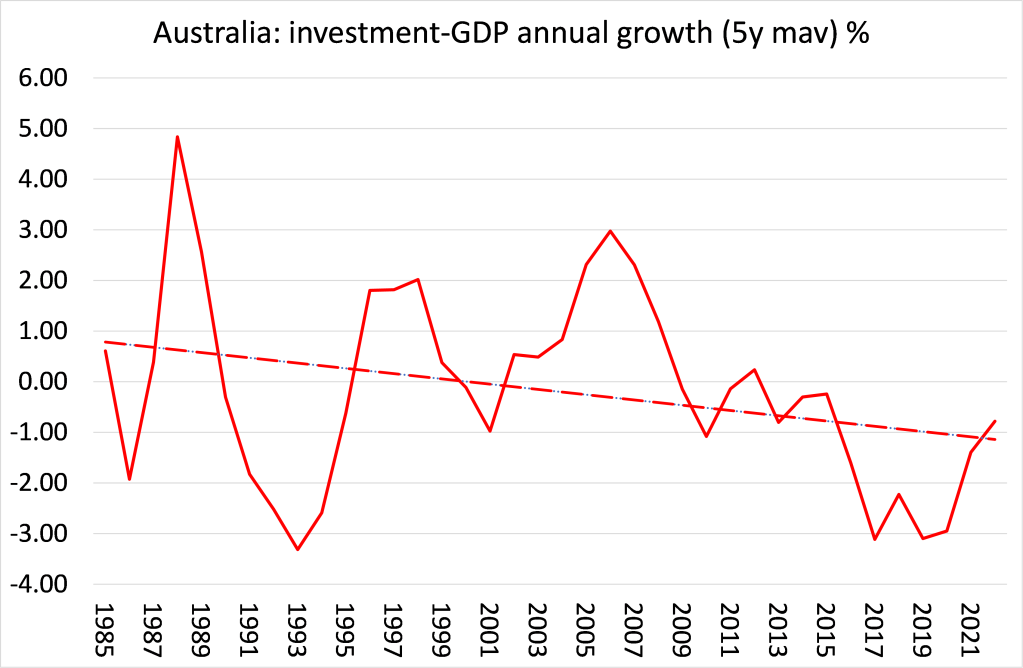

As elsewhere, the slowdown in economic growth can be connected to the slowdown in productive investment growth. Indeed, investment to GDP has declined sharply since the Great Recession.

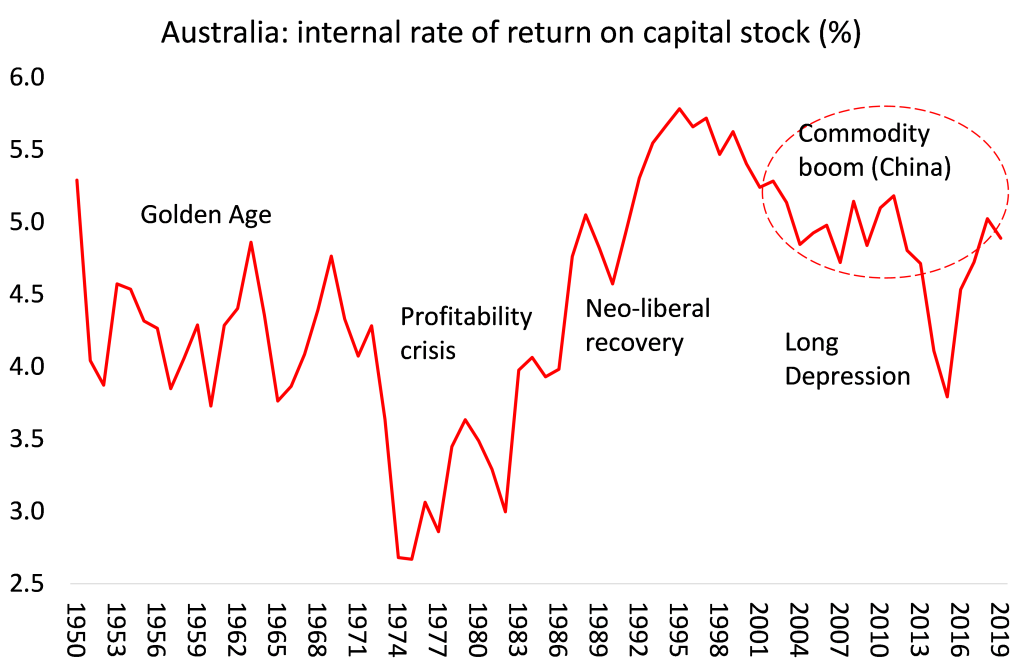

What lies behind the slowdown in real GDP and investment growth? It’s the same cause that applies to all the major capitalist economies in the last two decades: falling profitability of capital. The great boom and revival of profitability in Australian capital from the 1980s, led by Australia’s exploitation of resources in minerals, agricultural products and energy, and the huge expansion of a skilled workforce with ‘liberalised’ labour markets, started to falter in the late 1990s. And although there was a short uptick in profitability during the commodity boom up to 2010, driven by demand from China for Australia’s commodities, in the last decade, the decline in profitability resumed. Profitability is still as high as it was in the Golden Age of the 1960s (unlike most other major capitalist economies), but the trend is downwards.

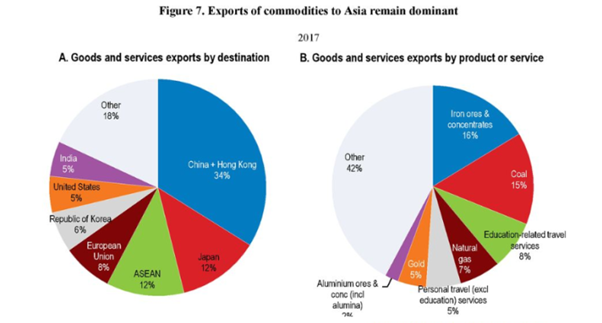

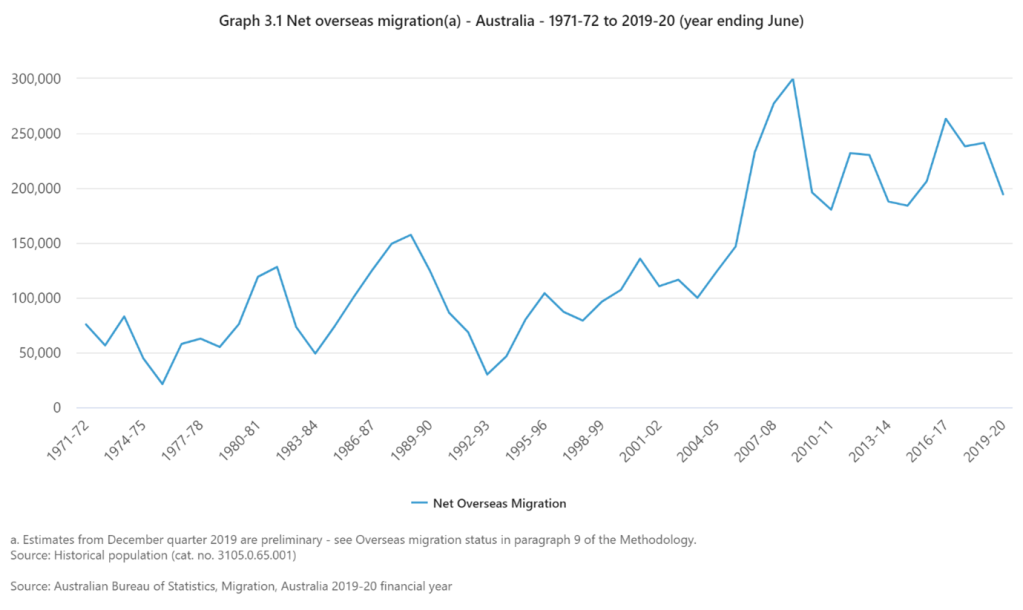

The irony in the sabre-rattling of the coalition government against China is that Australia had been ‘lucky’ because of its close proximity to China, the fastest growing economy over the last 25 years. As one commentator put it: “Australia was uniquely placed to benefit from China and Asia’s long-term growth by exporting resources, agricultural produce and services to the region”. Also the economy benefited from an influx of skilled labour through immigration from all parts but also immigrants who came with wealth of their own to invest.”

And Australia remains heavily dependent on its exports to China and world growth in general. Until the pandemic, China was the largest source of foreign investment in Australia, leapfrogging the US. But strategy of American imperialism is now overriding economic reality.

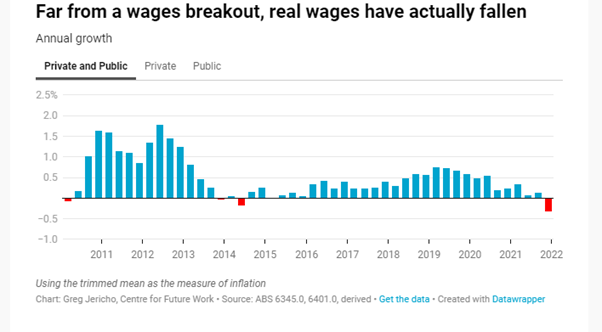

The domestic issues in the election campaign centre round the sharply rising rate of inflation – something hitting all the major capitalist economies – and with little prospect of any solution from either government or opposition. Inflation in the prices of goods and services in Australia is rising much faster than wages. The annual inflation rate is currently 5.1% (a 21-year high) and set to rise further, while average wages are rising at just 2.4%. So real wages are falling at a rate not seen for decades.

As in the US and Europe, the only answer offered by the authorities is for the Reserve Bank of Australia (RBA) to hike interest rates, while calling for wage restraint. The RBA has now increased interest rates (by 0.25% to 0.35%) for the first time in more than eleven years – and the first hike in the middle of an election campaign since 2007.

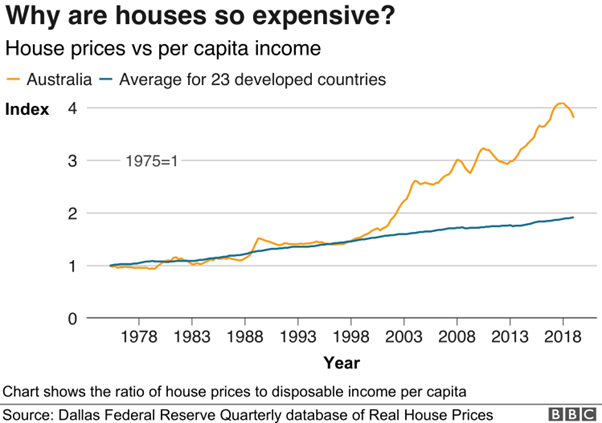

These rate rises threaten the homes of millions of Australians. The housing bubble had already reached shocking proportions.

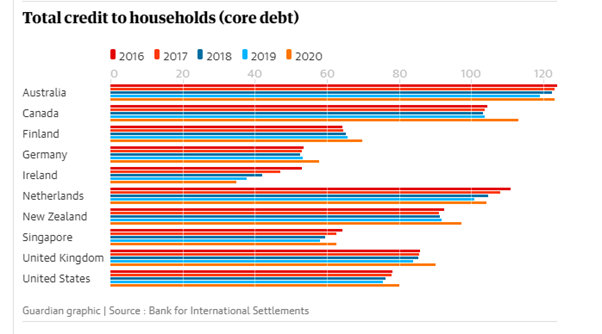

Australian households are now among the most indebted in the world. Chris Martin, a senior research fellow in UNSW’s City Futures Research Centre, said data from the Bank of International Settlements showed total credit to Australian households amounts to about 120% of annual GDP.

Major banks have already lifted interest rates for mortgages and other loans, matching the RBA’s 0.25 basis point increase. The RBA governor, Philip Lowe, said the cash rate could increase to 2.5% while investors are tipping it will rise to about 3.75% by May 2023. -If so, it’s estimated that 300,000 Australians could default on their mortgages as repayments increase. Each percentage point increase adds on average A$323 in monthly repayments, although some cities, such as Sydney are much higher at A$486, according to CoreLogic data. Car loans and credit card debt will also be more costly to repay at a time when the price for fuel and many other goods is rising, adding to families’ financial stress, Martin said.

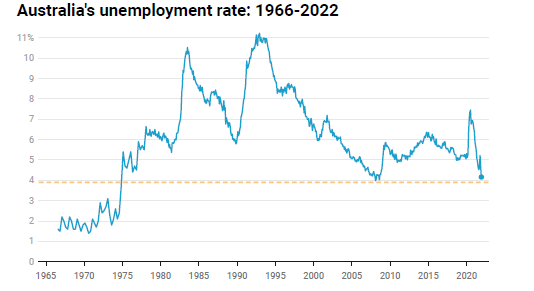

Supposedly, the saving grace for Australians is ‘full employment’ to pay for these price rises.

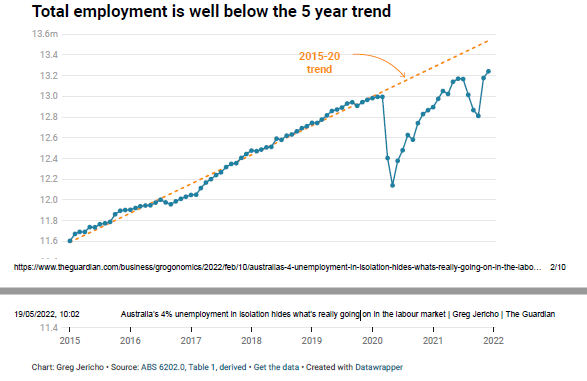

But the headline unemployment rate hides the reality that employment has not recovered yet from the pandemic slump. Prior to 2020, employment was growing around 4.2% every two years, but since then it has increased just 2.1% – in effect at half the speed it had been in the period up to the pandemic.

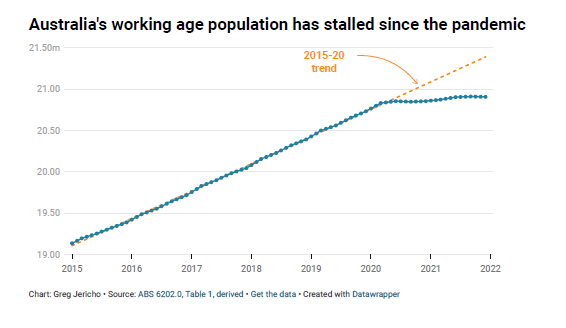

Moreover, the working age population beginning to stall.

Australian capital is running out of more labour, especially as immigration restrictions have stopped net immigration expanding. The pool of working age people has barely grown at all.

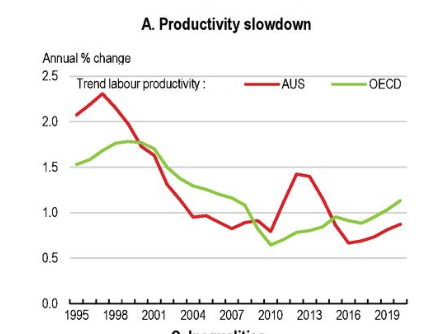

Increasingly, Australian capital must rely on boosting productivity growth to expand and raise profitability. But investment growth is dropping off and productivity growth has been in a downward trend.

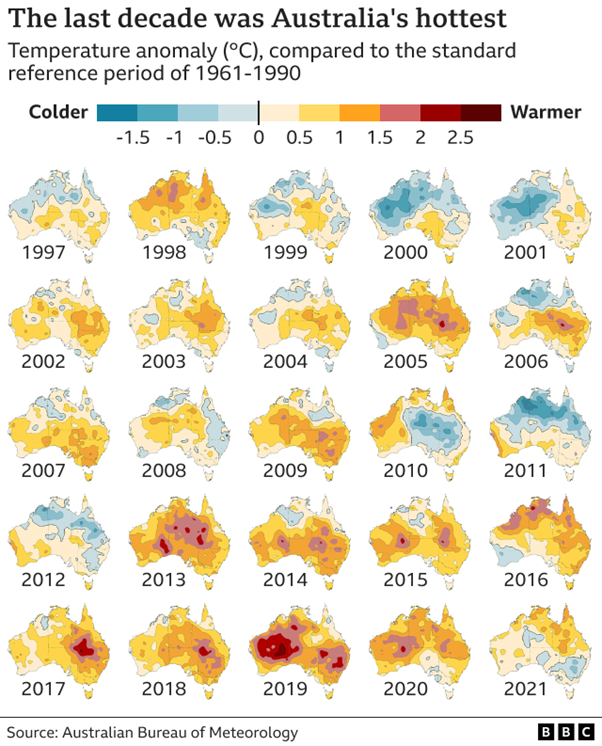

And on top of all this is the disaster of global warming and climate change that is beginning to hit Australia for a cricket six. Climate change in Australia has been a critical issue since the beginning of the 21st century. Australia is becoming hotter and will experience more extreme heat and longer fire seasons. In 2014, the Bureau of Meteorology released a report on the state of Australia’s climate that highlighted several key points, including the significant increase in Australia’s temperatures (particularly night-time temperatures) and the increasing frequency of bush fires, droughts and floods, which have all been linked to climate change.

In the past three years, record-breaking bushfire and flood events have killed more than 500 people and billions of animals. Drought, cyclones and freak tides have gripped communities. Queensland has been ravaged by floods in recent months. In February, the state capital Brisbane had more than 70% of its average yearly rainfall in just three days. Australia is facing an “insurability crisis” with one in 25 homes on track to be effectively uninsurable by 2030, according to a Climate Council report. Another one in 11 are at risk of being underinsured.

Yet the economy depends very much on its fossil fuel exports and developing the mining industry. Non-renewable fossil fuels still account for about 85 percent of Australia‘s electricity generation. Australia is one of the world’s largest per capita emitters –producing some 1.3 percent of global carbon emissions with only 0.3 of the world’s population. For a nation so exposed to climate change, Australia remains one of the world’s biggest emitters per head of population. The government has promised to reduce emissions by 26% by 2030. Labor has pledged a 43% cut. Both promises are below the 50% recommended by the Intergovernmental Panel on Climate Change.

The Chinese economy has slowed down, and with it the demand for Australia’s exports. Anyway, the imperialist bloc wants Australia to disengage from China. The cost of living is rising sharply; rising interest rates risk a serious housing crisis; and global warming is out of control. Neither government nor opposition have any answers. Australia’s luck is turning for the worse.

No comments:

Post a Comment