So the Fed finally bit the bullet and decided to hike its policy rate from 0.25% to 0.50%. It also suggested that it would continue to raise its rate by another 1% point in 2016 and further 1% point in 2017 to reach 3.5% by the end of the decade.

The Fed’s policy rate sets the floor for all borrowing rates in the US economy and further afield for credit in dollars for many economies. So this is an important policy move. It would appear that the era of cheap money, QE and ‘unconventional’ monetary policy is over – at least for the US. The Fed now expects US annual inflation to rise from near zero now to 2% (on its measure of consumer spending) by 2019. That means real interest rates (after deducting inflation) will rise from zero to 1.5%, if these projections hold. That’s clearly a tighter money policy.

That tighter policy showed its effects straight away as US banks started hiking their borrowing rates while holding down what they pay savers for their deposits – so an immediate boost to bank profits.

Stock markets rose on the news of the Fed hike. That was because investors were relieved that the uncertainty was over and now they knew what was coming and it did not look too bad. They were encouraged by the comments of Fed chief, Janet Yellen, who claimed that the US economy “is on a path of sustainable improvement.” and “we are confident in the US economy”, even if borrowing rates rise.

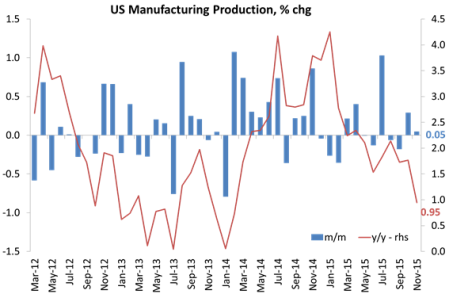

This was ironic because just before the Fed hiked its interest rate, the figures for US industrial production in November came and they showed the worst fall since December 2009 at the end of the Great Recession. Industrial production and manufacturing output are now contracting at 1% a year rate.

This is partly due to the collapse in energy production as oil prices plummet, but not entirely. It seems that the manufacturing of things in the US is weakening badly, given a strong dollar making exports difficult, and because of low profitability in the productive sectors. It’s true that manufacturing is just 15% of the US economy but growth in this important productive sector has spillover effects into the wider economy, as many ‘services’ depend on manufacturing industries. So a sharp slowdown in this productive sector will hurt.

The Fed reckons that US real GDP growth will zoom along without any slump at the ‘break-neck’ speed of 2% a year from now on. This is some 40% below the post-war average growth rate and even slightly lower than the sluggish pace of the last five years. Yet Yellen calls this “sustainable improvement”!

So despite recent weak manufacturing and retail sales data, near zero inflation and real GDP growth stuck at around 2% a year, the Fed is starting to raise interest rates. Why? It’s a mixture of things.

First, US unemployment is now relatively low (although still above pre-crisis levels) and the Fed fears workers will gain bargaining power and may be able to drive up wages as a result and cause inflation. But there is little sign of that given that most of the new jobs are in low-paid sectors, part-time or temporary contracts.

Second, the central bank would like to ‘regain control’ of monetary policy and ‘normalise’ things. When interest rates are zero, then the Fed has no control over interest rates in general. With positive rates, it can exert some control. It even says that if things go wrong, it can cut rates when they are positive which it cannot do when they are zero. This is a weird argument. It’s like saying it is best if I cut my wrists now so they can start healing earlier, rather than holding off as I am going to have to do it some time.

Finally, there is a (vain) belief that the US economy is reaching full capacity and is ready to invest and grow steadily for the foreseeable future.

Well, not everybody agrees. Stock markets may be happy for now with the Fed move but many mainstream economists are not, especially the Keynesians. Paul Krugman considers it a big mistake and the Keynesian-influenced British newspaper, The Guardian, called it “premature and risky”.

Just before the Fed meeting, leading Keynesian economist and big wheel former US Treasury secretary Larry Summers wrote in the FT that it would be silly to hike rates because there were long term factors in the global economy that would keep real interest rates low; namely weak global growth, slowing population growth, rising savings rates, poor productivity growth and a cap on the improvement in the human capital skills. This is the basis of what some economists like Summers and Robert J Gordon have called ‘secular stagnation’. To hike rates in an environment of permanent stagnation was a mistake.

In his FT piece, Summers refers to a paper by two Bank of England economists with approval for his secular stagnation thesis. Global interest rates and secular growth – BoE The paper presents the argument for expecting real interest rates to stay low or even fall further because: the world economy will slow; inequality of incomes within major economies will rise driving up saving and lowering consumption growth; the education and skills of the global workforce will fail to improve much; and the great technological revolution of robots and AI will fail to deliver higher productivity growth. “Although there is a great deal of uncertainty, if we add up all the factors analysed above, we think we can come up with a reasonable case for why global growth could slow by up to 1pp over the next decade or so.”

The BoE paper reckons that the global labour supply growth is in the midst of a sharp slowdown. Labour supply growth has already slowed by between 0.5pp and 1pp since the mid-1980s and looks set to slow further. In the near-term, other labour market dynamics could offset this trend. A sustained rise in labour force participation driven by: rising female participation; better education (to reduce skills mismatch); or better healthcare (to reduce long-term sickness); could all mitigate the fall. “But such factors can only postpone the decline in labour force growth – not prevent it from occurring.”

The paper notes that a key driver of global economic growth in the past decades has been productivity catch-up in the so-called emerging economies. As countries accumulate more capital and improve efficiency by adopting the latest technologies from overseas, productivity per worker rises. But the economists show that this is somewhat of an illusion: “history reveals a pattern that is anything but smooth over the past. Between 1980 and 2010, GDP per capita growth in the US was actually faster than the average across the rest of the world in 15 out of 30 years – so the rest of the world spent just as long falling further behind the frontier as catching up.”

The BoE paper dismisses the optimistic view of a robot-led technological breakthrough and sides with the pessimistic view of Robert J Gordon on future low gains in productivity from an ICT boom: “Overall, our reading of the above arguments is that Gordon’s characterisation of recent history and the near-future is the most compelling. US productivity growth has been weak since the 1970s, was lifted temporarily by the ICT boom, but has since fallen back. In the absence of clear advances in technology, it seems reasonable to assume this trend will continue going forward – particularly given the recent weakness in productivity globally.”

Amazingly the paper, along with Summers, reckons that regulation of the banks and the new capital requirements since the Global Financial Crash are too tight and do not allow the banks to help the real economy. “In the past, in the face of tighter prudential policy, monetary policy could have been loosened to maintain growth. But in the future, if monetary policy is more constrained, then this mix of tighter prudential policy and looser monetary policy may not be available – so changes in prudential policy could have more significant impacts on growth.” So regulation of banking, whether ‘light’ or ‘strict’ does not work to get financial resources into an economy. It’s another argument for public ownership and control of banking.s-time-to-take-over-the-BanksLR.pdf. That’s something that does not seem to be on the agenda of any major leftist group.

This really is a dismal picture of the capitalist future over the next couple of decades. Summers concludes that the major capitalist economies will thus just stumble along trying to boost the economy with credit bubbles, then suffer financial busts and drop back again.

So the Fed may think the US economy is heading for ‘sustainable improvement’ but some Bank of England economists don’t. And none of these forecasts take into account the high probability of a new slump or economic recession before this decade is out. I have already weighed up the likelihood of that in previous posts.

Suffice it to say that faster economic growth depends on higher and ‘sustainable’ productive investment but that is not taking place because profitability in the major economies is still too low (indeed it is near post-1945 lows), while debt, particularly corporate debt is too high. And now it is likely to get more expensive to service as the Fed raises dollar borrowing rates.

As former Fed Chair Ben Bernanke explained recently in a moment of clarity, the low real interest rates that Summers is all worked up about are really a product of low profitability. “The state of the economy, not the Fed, is the ultimate determinant of the sustainable level of real returns. This helps explain why real interest rates are low throughout the industrialized world, not just in the United States.”

In the BoE paper, the two economists point out that the rate of return on capital has fallen since the early 1990s, but not by as much as the ‘risk free interest rate’ – so that the cost of borrowing for risky investment has increased by around 100bps. In other words, the cost of borrowing to invest has stayed up while profitability on investment has fallen, squeezing the ‘profitability of enterprise’ and lowering the incentive to invest. The BoE paper refers to the IMF World Economic Outlook April 2014 where the IMF finds that “investment profitability has markedly declined in the aftermath of the global financial crisis, particularly in the euro area, Japan, and the United Kingdom.”

Back in 1937, the US Fed concluded that the US economy had sufficiently recovered then to enable it to start raising interest rates. Within a year, the economy was back in a severe recession that it did not recover from until America entered the world war in 1941. The Fed then had failed to take into account the weak profitability of US capital and its unwillingness to invest for growth. It’s an argument I presented more than a year ago, but it’s still relevant now. Will history repeat itself?

No comments:

Post a Comment