Only last February, I posted that there had been a burst of optimism about the state of the world economy in 2023. The consensus view then was that the G7 economies (with the sorry exception of the UK) would avoid a slump this year. Sure, there will be a slowdown compared to 2022, but the major economies were going to achieve a ‘soft landing’ or even no landing at all, but just motor on, if at a low rate of growth. The international agencies like the World Bank, the OECD and the IMF upgraded their forecasts for global growth.

However, all that optimism has proven “unfounded” as I suggested then. Even in the best performing G7 economy, the US, a recession (ie ‘technically’ two consecutive quarters of contraction in real GDP) now seems probable. Even the US Federal Reserve accepts that a recession is unavoidable. At its last meeting, its economists agreed that there would be a ‘mild recession’ in US economic activity this year.

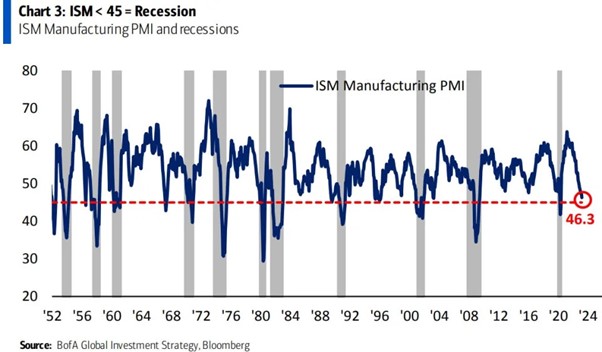

And according to economists at the Bank of America, there are plenty of signals that suggest a recession in the US has not been avoided and they provide several charts to back that up. First, there was the significant decline in manufacturing activity. “March ISM was 46.3, lowest since May 2020. In past 70 years whenever manufacturing ISM dropped below 45, recession occurred on 11 out of 12 occasions (exception was 1967),” BofA said. Indeed, globally there appears to be a manufacturing recession.

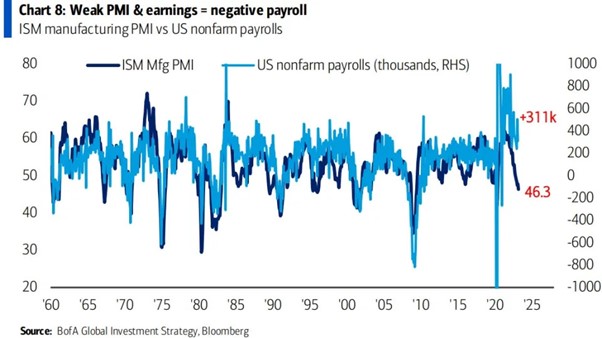

Second, the current ‘buoyant’ jobs market won’t last because it often follows manufacturing activity downwards – it’s a lagging indicator.

“Weak ISM manufacturing PMI suggests US labor market will weaken next few months,” BofA said, adding that it viewed the February and March jobs report as “the last strong payroll reports of 2023.”

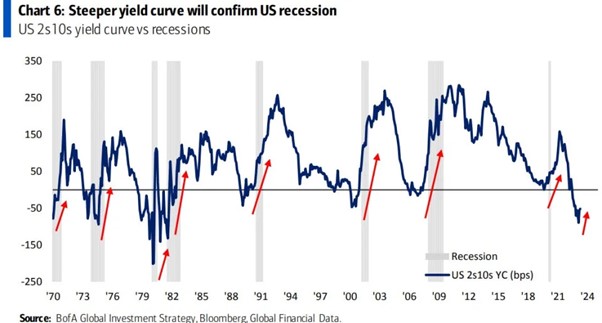

Then there is the inverted bond yield curve that always presages a recession.

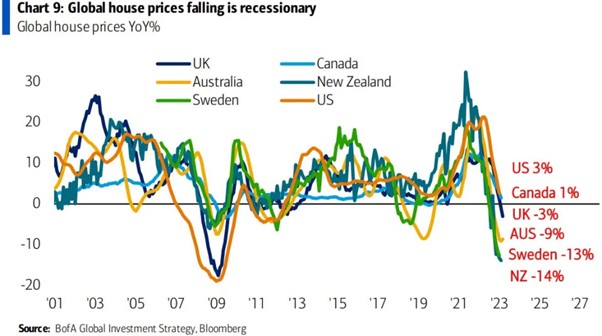

Also, global house prices are falling, creating a slump in construction and real estate development.

Another reliable indicator is the Leading Economic Index (LEI) published by the Conference Board. The LEI for the US fell for the 11th straight month in February, which is the longest slump since the collapse of Lehman Brothers in 2008. “While the rate of month-over-month declines in the LEI have moderated in recent months, the leading economic index still points to risk of recession in the US economy,” said Justyna Zabinska-La Monica, senior manager at the Conference Board.

These are some indicators of a forthcoming recession, but they are not the causes. I have argued that there are two principal drivers of a slump: falling profits and profitability; and rising interest costs. These are the two closing scissors that cut off the accumulation of capital and force companies to stop investing, reduce employment and, among the weaker brethren, go bust.

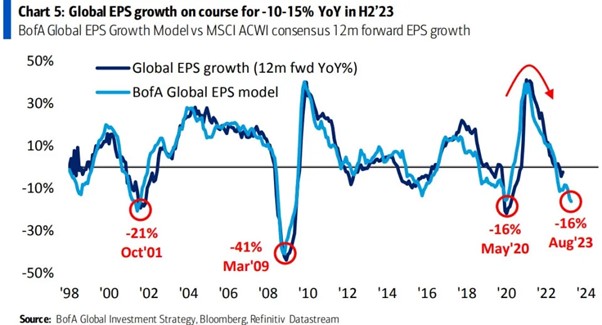

The BoA economists also recognise these factors. They note that a decline in manufacturing often coincides with lower earnings.

And their global earnings model also suggests imminent decline in corporate earnings.

Much has been made on the left about the huge rise in corporate profit margins after the end of the pandemic. And this is undoubtedly the main contributor to the inflationary spiral experienced in all the major economies in the last 18 months – not any wage-cost push as the Keynesians argue; or too much money supply as the monetarists argue. A January study from the Federal Reserve Bank of Kansas City found that “markup growth”—the increase in the ratio between the price a firm charges and its cost of production—was a far more important factor in driving inflation in 2021 than it had been throughout economic history.

University of Massachusetts Amherst economists Isabella Weber and Evan Wasner published a paper that has been widely taken up entitled, “Sellers’ Inflation, Profits and Conflict: Why Can Large Firms Hike Prices in an Emergency?”. It found that corporations engaged in “price gouging” during the pandemic. The authors went on to argue that price controls may be the only way to prevent the “inflationary spirals” that could come as a result of this gouging.

Albert Edwards, a global strategist at the 159-year-old bank Société Générale, has now followed up on this thesis that has come to be called ‘Greedflation’. Corporations, particularly in developed economies like the US and UK, have used rising raw material costs amid the pandemic and the war in Ukraine as an “excuse” to raise prices and expand profit margins to new heights, Edwards said.

There is no doubt that corporate margins have been at record highs. Both in the US and in Europe. But I have thrown some doubt on the explanation that current high inflation has been caused mainly by ‘price-gouging’ from monopolistic corporations.

And the Kansas Fed paper cited above agrees. The authors reckon that “although our estimate suggests that markup growth was a major contributor to annual inflation in 2021, it does not tell us why markups grew so rapidly. We present evidence that the timing and cross-industry patterns of markup growth are more consistent with firms raising prices in anticipation of future cost increases, rather than an increase in monopoly power or higher demand. First, the timing of markup growth in 2021, as well as earlier in the pandemic, does not line up neatly with the spike in inflation during the second half of 2021. Instead, the largest growth in markups occurred in 2020 and the first quarter of 2021; in the second half of 2021, markups actually declined. Therefore, inflation cannot be explained by a persistent increase in market power after the pandemic. Second, if monopolists raising prices in the face of higher demand were driving markup growth, we would expect firms with larger increases in current demand to have accordingly larger markups. Instead, markup growth was similar across industries that experienced very different levels of demand (and inflation) in 2021.“

The authors cast doubt on the simple explanation of “greedflation,” understood as either an increase in monopoly power or firms using existing power to take advantage of high demand. So the post-Keynesian mark-up theory of inflation and the policy conclusion of price controls looks faulty.

I wrote a post last September that, anyway, profit margins were beginning to fall. The average profit margin for the top 500 US companies 2022 is estimated at 12.0%, down from 12.6% in 2021, if still well above the ten-year average margin of 10.3%. And as overall economic growth in the US slows – corporate sales revenue growth is slowing too.

Indeed, I found that the final data on US pre-tax corporate profits in Q4 2022, show a 5-6% fall in each of the last two quarters of 2022, or a 12% fall from the peak in mid-2022. Profits fell year-on-year for the first time since the pandemic slump. The post-pandemic corporate profits boom is over.

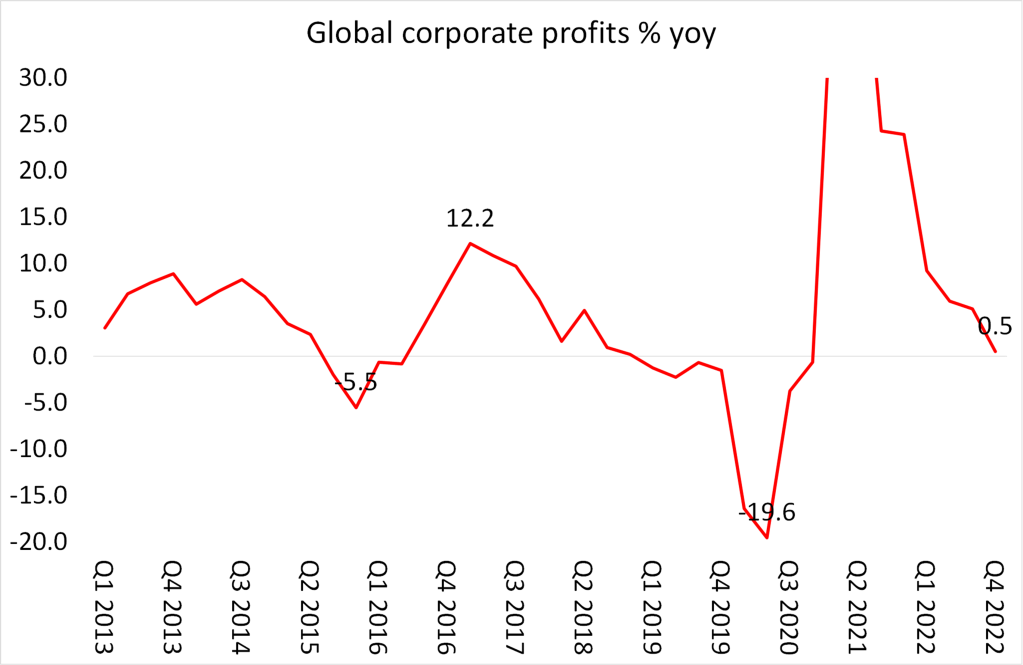

The slowdown in US corporate profits is replicated in all the major economies. Here is my latest estimate of global corporate profits based on five key economies. The pandemic slump recorded a 20% fall in global corporate profits in 2020, followed by a 50% recovery in 2021, but now profits growth has slowed to just 0.5% in Q4 2022. And note, as I have done before, that profits had stopped rising through 2019 even before the pandemic, suggesting that the major economies were heading for a slump before COVID emerged.

Then there is the credit squeeze from rising interest rates and monetary tightening (ie a fall in money supply growth). This is happening because the major central banks are still determined to try and ‘control inflation’ with high interest rates (even though this has been shown to misunderstand the causes of current inflation).

In its minutes, the Fed put it this way: “With inflation remaining unacceptably high, participants expected that a period of below-trend growth in real GDP would be needed to bring aggregate demand into better balance with aggregate supply and thereby reduce inflationary pressures.” So even a recession will be needed to bring inflation down. In that, the Fed is right – indeed inflation rates will stay well above pre-pandemic elevls unless there is a slump.

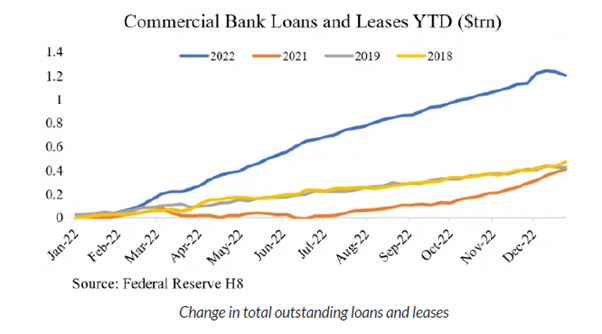

After the pandemic, central banks tried to return to the easy money policy adopted during the long depression of the 2010s in order to boost economic recovery. A tremendous credit boom took place in 2022, which led to a surge in US bank lending of $1.5trn.

Alongside bank loans there was an explosion in what is called low-quality lending that brought debt loads in corporate America to record highs. The total US stock of “subprime” corporate debt (junk bonds, leveraged loans, direct lending) has reached $5tn. Total non-financial corporate debt (bonds and loans) stands at $12.7tn, making low-quality debt as much 40% of the total.

This debt financed very speculative or highly indebted companies either in the form of a loan (“leveraged loans”) or non-investment grade bonds (“junk bonds”) and includes corporate loans sold into securitizations called Collateralized Loan Obligations (CLOs) as well as loans extended privately by non-banks that are completely unregulated. Years of growth, evolution, and financial engineering have spawned a complex, highly fragmented, and under-regulated bond market.

And this was replicated globally. The annual report from the Global Financial Stability Board on the so-called Non-Bank Financial Institutions (NBFI) found that the “NBFI sector grew by 8.9% in 2021, higher than its five-year average growth of 6.6%, reaching $239.3 trillion. […] The total NBFI sector increased its relative share of total global financial assets from 48.6% to 49.2% in 2021.”

Central banks have no idea of what is causing inflation and how to control it, but they go on hiking rates even if it causes bank failures, corporate bankruptcies and a slump. Fed governor Kocherlakota noted that “central bankers have expressed concerns that above-target inflation could lead “inflation to become unmoored” (Bernanke 2011) or “inflation to become entrenched” (Powell 2022).” That could give rise to the follow-up need to bring down “inflation expectations” through a severe recession. As Bernanke (2011) saids, “the cost of that in terms of employment loss in the future, as we had to respond to that, would be quite significant… To the best of my knowledge, there are no macroeconomic models in the academic world that integrate possibilities of this kind. “ So not a clue.

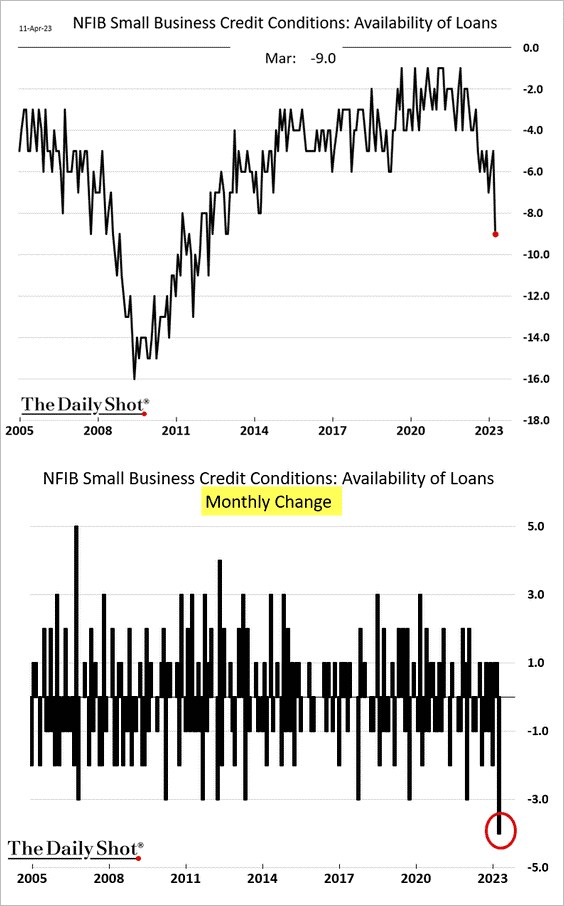

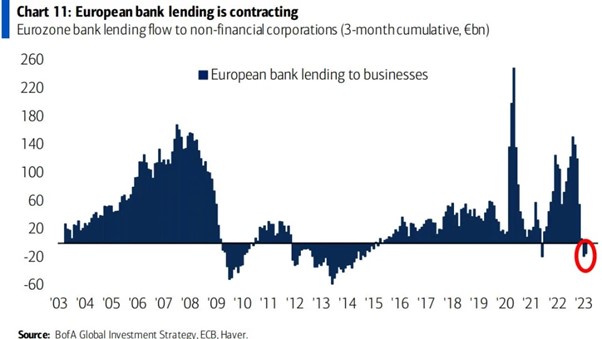

The recent US banking crisis was a result of the growing credit squeeze on banks, mainly smaller ones, and on companies. And it is not over – either in the US or Europe. As interest rates rise, depositors are switching their money from weak banks into better yielding accounts such as money market funds, fleeing those banks that put their customer deposits into loss-making assets like government bonds. This has led to a sharp decline in bank lending to companies across the US.

and in Europe.

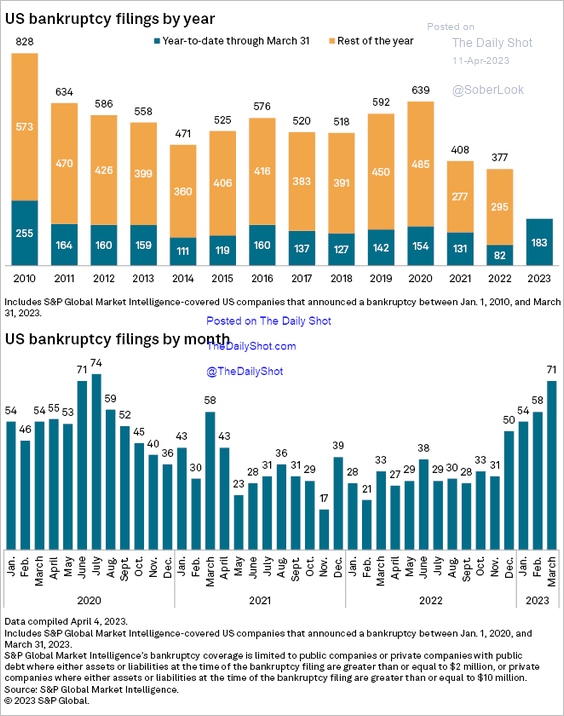

So there are less funds for investment and survival and at higher interest rates. Up to now, because corporate profits had risen so much, even though corporate debt to GDP had risen to all-time highs, most US firms have been able to cover the debt servicing costs comfortably. But that is over. The infamous zombie companies (up to 20% of all firms in the US and Europe) are facing bankruptcy.

Bankruptcy filings have spiked across major industries. In March, 42,368 new bankruptcies were filed, up 17% from a year back. It was also the third straight month of bankruptcy increases. Meanwhile, venture capital funding for start-ups declined by 55% in the first quarter of 2023 compared to the same period a year ago. This is the lowest level in over five years.

And here is how John Plender of the FT put it: “the most draconian tightening in four decades in the advanced economies with the notable exception of Japan, will wipe out much of the zombie population, thereby restricting supply and adding to inflationary impetus. Note that the total number of company insolvencies registered in the UK in 2022 was the highest since 2009 and 57 per cent higher than 2021.”

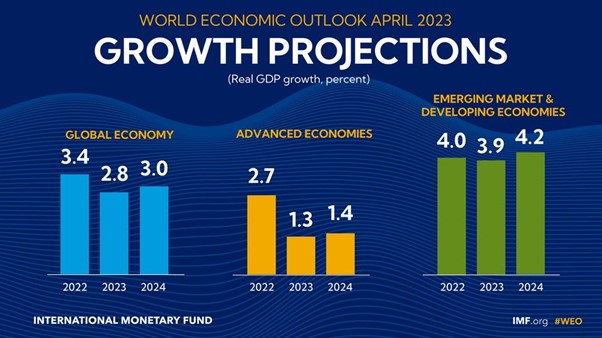

In its latest economic report, the IMF says the world economy is experiencing “a rocky recovery”. It forecasts that global growth (which remember, includes China, India and other large ‘developing’ economies) will slow this year to 2.8%. And that’s the base forecast. If credit tightens further and interest rates stay high, global growth could drop to just 1%. The G7 economies will grow little more than 1% this year and, after accounting for population growth, hardly at all. The UK and Germany will contract.

UNCTAD follows the IMF with an even more pessimistic forecast for global growth this year – just 2.1%. It concludes that “This could set the world onto a recessionary track…. With the era of cheap credit coming to an end at a time of “polycrisis” and growing geopolitical tensions, the risk of systemic calamities cannot be ruled out. The damage to developing countries from unforeseen shocks, particularly where indebtedness is already a source of distress, will be heavy and lasting.”

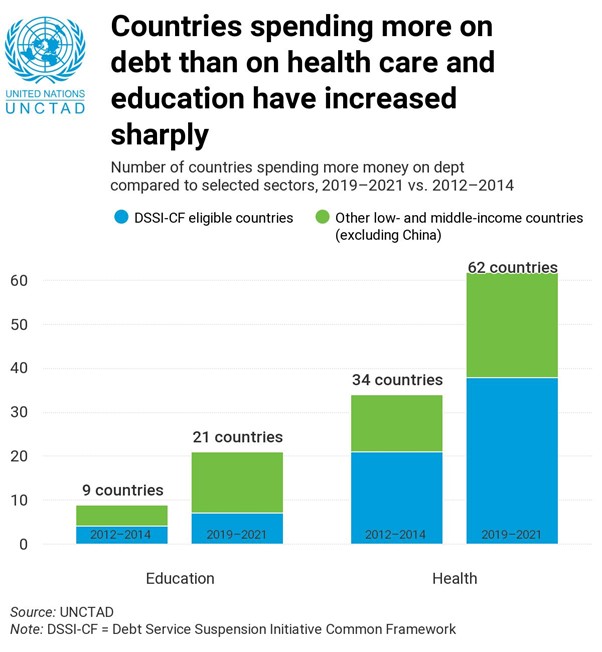

UNCTAD points out that debt servicing costs have consistently increased relative to public expenditure on essential services. The number of countries spending more on external public debt service than healthcare increased from 34 to 62 during this period.

Vítor Gaspar, head of fiscal policy at the IMF, said that by 2028, the world’s public debt burden was on course to match the value of goods and services produced in the world. “By the end of our projection horizon — 2028, public debt in the world is expected to reach almost 100 per cent of GDP back to the record levels set in the year of the pandemic”.

His answer was a new bout of ‘austerity’ (ie cutting public spending and raising taxes). “Fiscal tightening can help by moderating the growth of aggregate demand and therefore contributing to more moderate increases in policy rates,” he said, adding that this in turn would “ease the pressures on the financial system” triggered by the surge in borrowing costs over the course of 2022.

According to Fitch Rating, national debt defaults are at a record high. There have been 14 separate default events since 2020, across nine different sovereigns, a marked increase compared with 19 defaults across 13 different countries between 2000 and 2019.

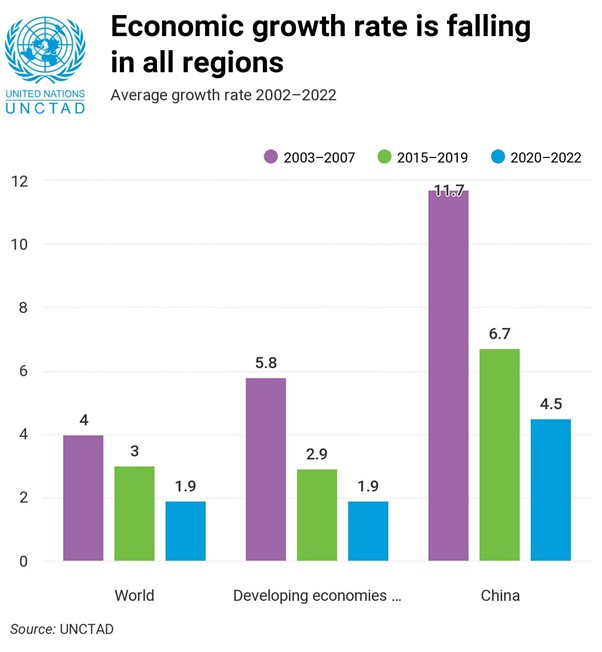

The long depression of the 2010s is continuing into the 2020s. The World Bank’s latest economic report makes dismal reading for the world economy. “The global economy’s “speed limit”—the maximum long-term rate at which it can grow without sparking inflation—is set to slump to a three-decade low by 2030.” Between 2022 and 2030 average global potential GDP growth is expected to decline by roughly a third from the rate that prevailed in the first decade of this century—to 2.2% a year. For developing economies, the decline will be equally steep: from 6% a year between 2000 and 2010 to 4% a year over the remainder of this decade. These declines would be much steeper in the event of a global financial crisis or a recession.

“A lost decade could be in the making for the global economy,” said Indermit Gill, the World Bank’s Chief Economist. Unless, of course, Generalised Artificial Intelligence with ChatGPT saves the day for capitalism.

No comments:

Post a Comment