Christine Lagarde, the head of the European Central bank (ECB), made an important ‘keynote’ speech last week to the US Council of Foreign Relations in New York.

It was important because she analysed recent developments in global trade and investment and assessed the implications of the apparent move away from the hegemonic dominance of the US economy and the dollar in the world economy and the move towards a ‘fragmented’, ‘multipolar’ world economy – where no one economic power or even the current imperialist bloc of the G7-plus will dominate global trade, investment and currencies.

Lagarde explained: “The global economy has been undergoing a period of transformative change. Following the pandemic, Russia’s unjustified war against Ukraine, the weaponisation of energy, the sudden acceleration of inflation, as well as a growing rivalry between the United States and China, the tectonic plates of geopolitics are shifting faster.”

You may not agree with the causes that Lagarde offers, but she concluded that “We are witnessing a fragmentation of the global economy into competing blocs, with each bloc trying to pull as much of the rest of the world closer to its respective strategic interests and shared values. And this fragmentation may well coalesce around two blocs led respectively by the two largest economies in the world.”

So it’s fragmentation and a coalescence into a battle between a US-led bloc and a China-led bloc. This is the worry for Lagarde and the US-led imperialist bloc – a loss of global control and a fragmentation of global economic power not seen since the inter-war period of the 1920s and 1930s.

Lagarde talked nostalgically of the post-1990 period after the collapse of the Soviet Union, supposedly heralding a period of global dominance by the US and its ‘alliance of the willing’. “In the time after the Cold War, the world benefited from a remarkably favourable geopolitical environment. Under the hegemonic leadership of the United States, rules-based international institutions flourished and global trade expanded. This led to a deepening of global value chains and, as China joined the world economy, a massive increase in the global labour supply.”

Yes, these were the days of the globalization wave of rising trade and capital flows; the domination of Bretton Woods institutions like the IMF and the World Bank dictating the terms of credit; and above all, the expectation that China would be brought under the imperialist bloc after it joined the World Trade Organisation (WTO) in 2001.

However, it did not work out as expected. The globalization wave came to an abrupt end after the Great Recession and China did not play ball in opening up its economy to the West’s multi-nationals. That forced the US to switch its policy on China from ‘engagement’ to ‘containment’ – and with increasing intensity in the last few years. And then came the Russian invasion of Ukraine and the renewed determination of the US and its European satellites to expand its control eastwards and so ensure that Russia fails in its attempt to exert control over its border countries and permanently weaken Russia as an opposition force to the imperialist bloc.

Lagarde comments on the economic implications of this: “But that period of relative stability may now be giving way to one of lasting instability resulting in lower growth, higher costs and more uncertain trade partnerships. Instead of more elastic global supply, we could face the risk of repeated supply shocks.” In other words, globalization and the easy movement of supply, trade and capital flows that benefited the imperialist bloc so much (see our paper The economics of modern imperialism) had come to an end.

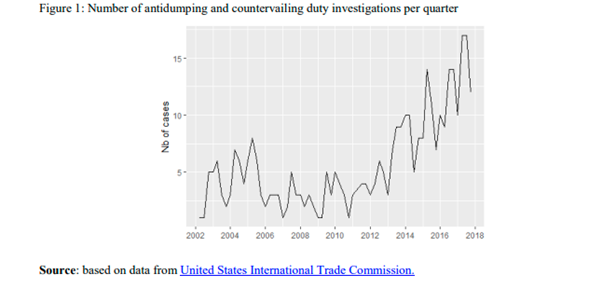

The response has been an intensification of protectionist measures (rising tariffs etc); control of trade, particularly in technology and attempts to reverse globalization into ‘reshoring’ or ‘friendshoring’ capital that previously went to all parts of the globe.

As Lagarde put it: “governments are legislating to increase supply security, notably through the Inflation Reduction Act in the United States and the strategic autonomy agenda in Europe. But that could, in turn, accelerate fragmentation as firms also adjust in anticipation. Indeed, in the wake of the Russian invasion of Ukraine, the share of global firms planning to regionalise their supply chain almost doubled – to around 45% – compared with a year earlier.”

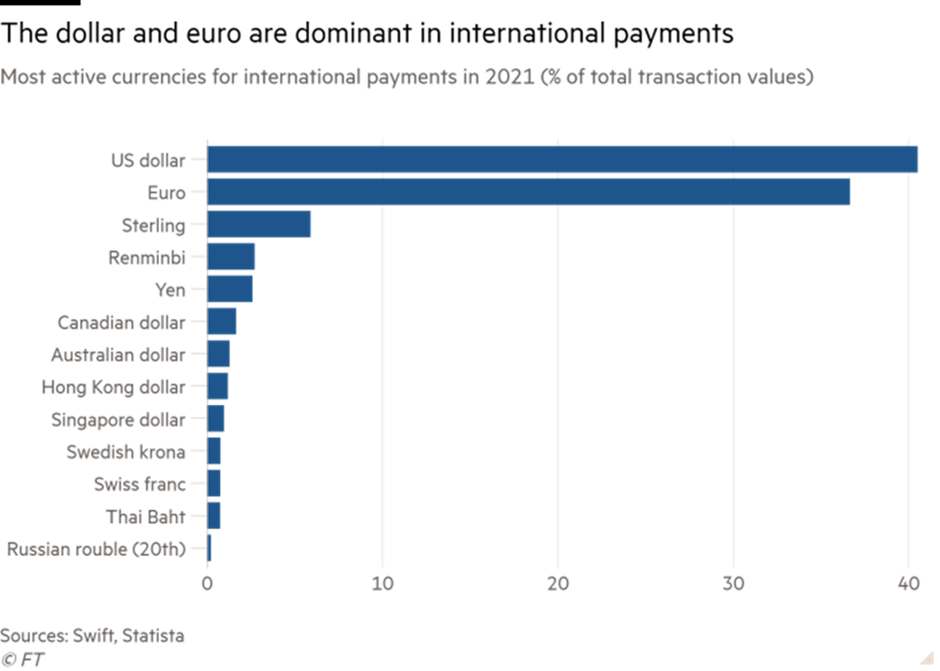

Do these developments mean that the imperialist bloc is losing control of the extraction of surplus value from the working people of the world? In particular, is the US dollar’s role as the emperor of currencies under threat from other currencies in trade and investment? Lagarde commented: “Anecdotal evidence, including official statements, suggests that some countries intend to increase their use of alternatives to major traditional currencies for invoicing international trade, such as the Chinese renminbi or the Indian rupee. We are also seeing increased accumulation of gold as an alternative reserve asset, possibly driven by countries with closer geopolitical ties to China and Russia.”

It’s undoubtedly true that the imposition of economic sanctions on Russia employed by the imperialist governments – banning of energy imports; seizing FX reserves; closing international banking settlement systems – has accelerated the move away from holding the dollar and euro. However, Lagarde added the caveat that this trend is still way short of dramatically changing the global financial order. “These developments do not point to any imminent loss of dominance for the US dollar or the euro. So far, the data do not show substantial changes in the use of international currencies. But they do suggest that international currency status should no longer be taken for granted.”

Lagarde is right. As I have shown in previous posts, that although the US and the EU have lost ground in the share of world production, trade and even currency transactions and reserves, there is still a long way to go before declaring a ‘fragmented’ world economy in that sense.

The US dollar (and to a lesser extent the euro) remains dominant in international payments. The US dollar is not being gradually replaced by the euro, or the yen, or even the Chinese renminbi, but by a batch of minor currencies.

According to the IMF, the share of reserves held in US dollars by central banks has dropped by 12 percentage points since the turn of the century, from 71 percent in 1999 to 59 percent in 2021. But this fall has been matched by a rise in the share of what the IMF calls ‘non-traditional reserve currencies’, defined as currencies other than the ‘big four’ of the US dollar, euro, Japanese yen and British pound sterling, namely such as the Australian dollar, Canadian dollar, Chinese renminbi, Korean won, Singapore dollar, and Swedish krona. All this suggests is that the shift in international currency strength after the Ukraine war will not be into some West-East bloc, as most argue, but instead towards a fragmentation of currency reserves.

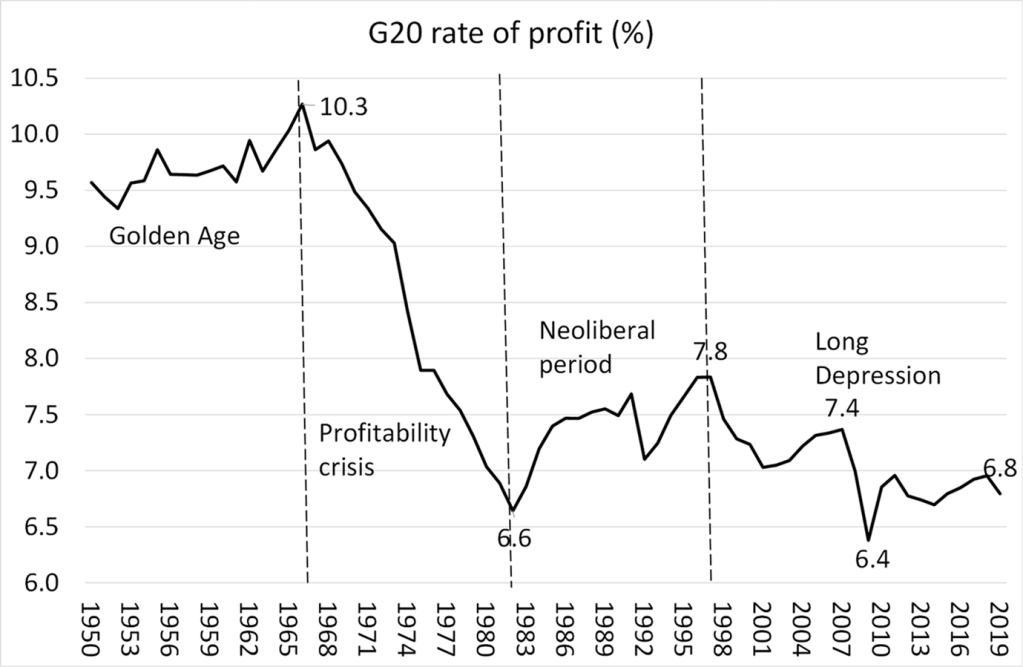

This fragmentation worries Lagarde, as a key representative of the US-EU global hegemony. She proposed: “insofar as geopolitics leads to a fragmentation of the global economy into competing blocs, this calls for greater policy cohesion. Not compromising independence, but recognizing interdependence between policies, and how each can best achieve their objective if aligned behind a strategic goal.” What does she mean? She means that the major powers must work together with similar fiscal and monetary measures to ensure that ‘fragmentation’ fails and the existing order is sustained. But that is going to be very difficult in a world economy that is slowing in real GDP and investment growth, and above all, where the profitability of capital remains around all-time lows.

The US dollar and its hegemony is not under threat yet because “50-60% of foreign-held US short-term assets are in the hands of governments with strong ties to the United States – meaning they are unlikely to be divested for geopolitical reasons.” (Lagarde). And it’s even the case that ‘anti-US’ China remains heavily committed in its FX reserves to the US dollar. China publicly reported that it reduced the dollar share of its reserves from 79% to 58% between 2005 and 2014. But China doesn’t appear to have changed the dollar share of its reserves in the last ten years.

Moreover, multilateral institutions that could be an alternative to the existing IMF and World Bank (controlled by the imperialist economies) are still tiny and weak. For example, there is the New Development Bank set up in 2015 by the so-called BRICS (Brazil, Russia, India, China and South Africa). The NDB has now appointed Brazil’s former leftist President Dilma Roussef as head, based in Shanghai.

There is much noise that the NDB can provide an opposite pole of credit to the imperialist institutions of the IMF and World Bank. But there is a long way to go in doing that. One ex-official of South African Reserve bank (SARB) commented: “the idea that Brics initiatives, of which the most prominent thus far has been the NDB, will supplant Western-dominated multilateral financial institutions is a pipe dream.” For a start, the BRICS are very diverse in population, GDP per head, geographically and in trade composition. And the ruling elites in these countries are often at loggerheads (China v India; Brazil v Russia).

As Patrick Bond put it recently: “The “talk left, walk right” of BRICS’ role in global finance is seen not only in its vigorous financial support for the International Monetary Fund during the 2010s, but more recently in the decision by the BRICS New Development Bank – supposedly an alternative to the World Bank – to declare a freeze on its Russian portfolio in early March, since otherwise it would not have retained its Western credit rating of AA+. ” And Russia is a 20% equity holder in NDB.

But back to Lagarde: “the single most important factor influencing international currency usage is the “strength of fundamentals.” In other words, on the one hand, the trend of weakening economies in the imperialist bloc facing very slow growth and slumps during the rest of his decade; and on the other, continued expansion of China and even India. This means that the heavy military and financial dominance of the US and its allies stands on the chicken legs of relatively poor productivity, investment and profitability. That’s a recipe for global fragmentation and conflict.

No comments:

Post a Comment