by Michael Roberts

Three of the major central banks met and raised their policy interest

rates yet again in the so-called ‘fight against inflation’.

Interest-rate levels are now at 15-year highs. But the financial

markets took the comments of the central bankers as signalling that

their policies were working and inflation was falling. And it would

fall sufficiently for the central banks to stop raising rates soon and

so avoid an economic slump.

This is wishful thinking. The bank chiefs made much of the apparently less worse levels of economic activity in recent real GDP data. But this again is wishful thinking or white-washing.

The IMF is now predicting no slump this year and raised its growth forecasts (slightly). It now reckons global growth in 2023 will be 2.9% from a previous forecast of 2.7%, but that’s still well below the 3.4% the IMF estimated for 2022. And the new forecast for 2023 is really based on a pick-up in growth in China and India, with two countries providing more than 50% of global expansion this year. The major capitalist economies are not expected to manage more than 1% or so.

Nevertheless, the IMF chief economist pushed out the boat of optimism. Pierre-Olivier Gourinchas, IMF chief economist, said 2023 “could well represent a turning point”, with economic conditions improving in subsequent years. “We are well away from any [sign of] global recession,” Gourinchas said, striking a sharp contrast with remarks by managing director Kristalina Georgieva last month that recession would hit more than a third of the global economy.

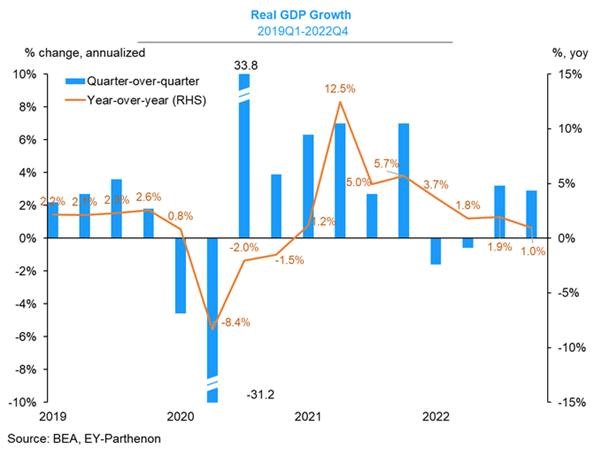

The US reported an annualised growth rate of 2.9% in Q4 2022 and and that led to a chorus of economists firmly dismissing a slump this year. But this annualised measure is misleading. In Q4 2022 US GDP was up only 1% compared to Q4 2021. More significant, inventories (ie stockpiling goods) contributed over half that 2.9% annual rate in Q4. Sales to Americans (consumers and producers) were virtually flat, while business investment rose at under a 2% rate. Real spending by consumers was relatively strong at 2.1% but that depended on previous fiscal handouts from government in the last year being spent. US real GDP growth has slowed from 5.4% yoy in Q4 2021 to just 1.0% yoy in Q4 2022. The US economy is moving towards a recession.

US real GDP growth has finally returned to its pre-pandemic trend rate but only after three years of recession and below trend growth. And now it could turn down again.

It’s similar story for the Eurozone. The Eurozone economy grew just 0.1% in Q4 2022 and if the ludicrous 13% GDP growth figure recorded for Ireland is discounted, Eurozone output fell by 0.1%. The reason the Irish GDP growth rate is so high is because it includes the booking of multi-national corporate profits in Ireland as a tax haven.

Indeed, major EZ economies like Germany and Italy contracted in Q4, while France just escaped contraction. And outside the Eurozone, both Sweden and the UK contracted.

As for the UK, the economy is heading down fast. The economy contracted in Q3 2022 and was probably flat in Q4. But even the BoE admits contraction is likely this quarter and beyond. Indeed, according to the IMF, there is only one economy out of 30 it reviewed that will have a slump this year – and that is the UK.

It’s true that headline inflation is coming down in most economies as food and energy prices which drove the rates up last year have begun to fall back – although they are still much higher than at the beginning of 2021. It is worth remembering that falling inflation does not mean that prices have fallen – just that the rate of increase has slowed. Indeed, in the US, prices have risen 15% in the last two years, while wage increases have been half that rate.

One measure of the impact on average households in the major economies is the so-called misery index. This an aggregation of the unemployment rate and the inflation rate – the twin devils for working people. Official unemployment rates have stayed near post-war lows (I won’t discuss now the validity of this data) but the huge rise in inflation rates has taken the misery index to highs not seen for 35 years.

Headline inflation rates may be falling but what is called core inflation remains ‘sticky’. Core inflation rates exclude food and energy prices and they show little sign of dropping much.

This is what worries central banks. And what it also shows is that interest-rate hikes have little effect on reducing inflation, which rose because of food and energy prices, something central banks cannot control and are now falling for reasons nothing to do with central banks. Instead, central bank rate hikes are increasing the cost of borrowing to spend for households and invest for companies. Indeed, as ECB chief Lagarde said at her press conference, monetary tightening was being ‘very efficient’ in squeezing the real economy. As I have argued in a previous post, profits are now being squeezed as price inflation abates. And rising interest rates are squeezing companies at the other end.

Sure, if consumer spending and business investment slumps, then core inflation will eventually fall, but only as economies drop into recession. Even then, the major economies may enter a slump in production and a rise in unemployment this year, but still have inflation rates well above the levels of two years ago – the worst of all possible worlds.

No comments:

Post a Comment