The debt problems afflicting China’s real estate market deepened this week after another property developer defaulted on its bonds and the world’s most heavily indebted property group Evergrande extended a suspension of its shares into a second day without explanation. Fantasia Holdings, a mid-sized developer, that just weeks ago assured investors it had “no liquidity issue”, said in a stock exchange filing that it “did not make the payment” on Monday of a $206m bond maturing that day, triggering a formal default. The default adds to fears that a crisis at Evergrande will spread to include more of China’s property developers, which account for a large portion of the Asian high-yield bond market.

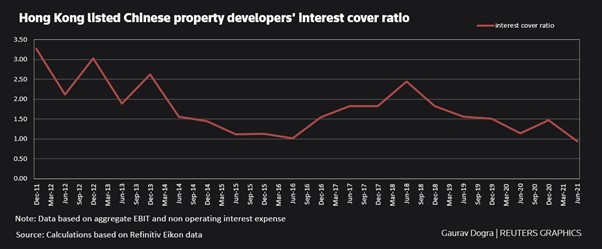

Evergrande missed an interest payment on an offshore bond on September 23, triggering a 30-day grace period before a formal default, and has yet to provide any announcement on the matter. But even before China Evergrande Group’s debt crisis sent the country’s property sector into a tailspin, Chinese property firms were struggling to earn enough to make interest payments on their debt. At the end of June, the aggregate interest coverage ratio of 21 big Hong Kong-listed Chinese real estate developers fell to 0.94, the worst in at least a decade, according to Reuters calculations based on Refinitiv data.

Hong Kong listed Chinese property developers’ interest cover ratio

In other words, China’s private property sector are now composed of ‘zombie’ companies just like 15-20% of companies in the major capitalist economies. The question now is whether the Chinese authorities are going to allow these firms to go bust. Shares in Huarong, China’s biggest bad debt manager, were suspended for months earlier this year after the company delayed its financial reports before finally unveiling a record loss in August. The delays sparked a debate over the extent to which Beijing will step in to help distressed companies.

The real estate sector faces pressure from Beijing to reduce leverage after decades of debt-driven expansion that helped fuel the country’s rapid economic growth. The government’s financial authorities have set three ‘red lines’ that financial and property companies cannot cross. Back in 2020, the People’s Bank of China and the Ministry of Housing announced that they’d drafted new financing rules for real estate companies. Developers wanting to refinance are being assessed against three thresholds: 1. a 70% ceiling on liabilities to assets, excluding advance proceeds from projects sold on contract; 2. a 100% cap on net debt to equity; 3. a cash to short-term borrowing ratio of at least one. Developers will be categorized based on how many limits they breach and their debt growth will be capped accordingly. There are now several large property companies in that situation.

The government is faced with a dilemma. If it allows Evergrande and other property companies to go bust, then millions of homes for people may not be built and the losses incurred by lenders to, and investors in, these companies could have a cascading effect across the economy. On the other hand, if the authorities bail out the companies, then the speculation could continue as the real estate sector could assume that they had government backing for all their speculative projects and they were ‘too big to fail’ – that’s so-called ‘moral hazard’; the same dilemma that faced the US authorities in 2008 when the property markets went belly up and the mortgage lenders and banks hit the dirt.

Most likely, the government will do something in between. It will ensure that the homes promised by the likes of Evergrande to 1.8m Chinese will be built by taking over the projects; already local authorities have moved in to take over local projects from Evergrande. At the same time, central government and the PBoC will allow Evergrande to default on investors and bond holders (to a degree). If those losses spill over into the financial sector, the Chinese government has plenty of financial slack to absorb the hit, as it has done in the past. For example, Evergrande’s debt of $300bn should be compared to total credit outstanding in China of $50trn, ie not very large. Moreover, if the final bill falls on the state and the state banks, reserves there can easily digest the losses.

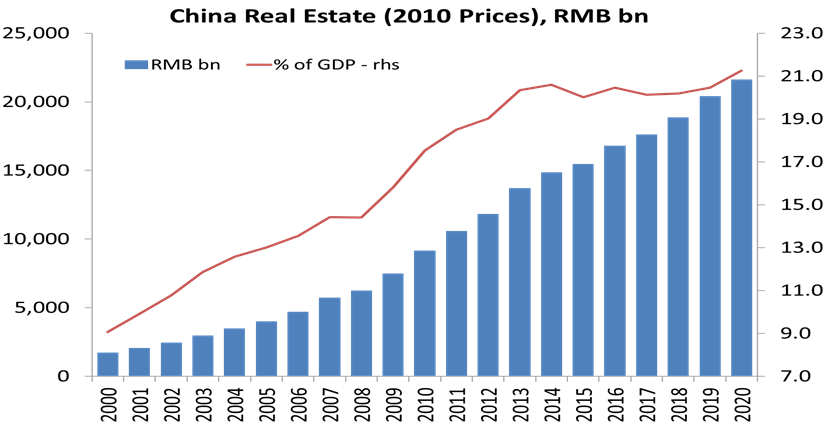

The real problem is that in the last ten years (and even before) the Chinese leaders have allowed a massive expansion of unproductive and speculative investment by the capitalist sector of the economy. In the drive to build enough houses and infrastructure for the sharply rising urban population, the central and local governments left the job to private developers. Instead of building houses for rent, they opted for the ‘free market’ solution of private developers building for sale. Evergrande-like development in China wasn’t just capitalism doing its thing. It was capitalism facilitated by government officials for their own purposes. Beijing wanted houses and local officials wanted revenue. The housing projects helped deliver both. The result was a huge rise in house prices in the major cities and a massive expansion of debt. Indeed, the real estate sector has now reached over 20% of China’s GDP.

This growth in real estate and other unproductive activities in finance and consumer media has been driving China’s official annual growth rate. As the productive sector of industry, manufacturing, hi-tech communications, etc grew more slowly, the authorities fooled themselves into claiming that real GDP growth targets of 6-8% a year were being met but this was increasingly because of the real estate market. Of course, homes need to be built, but as President Xi put it belatedly, “homes are for living in, not for speculation.”

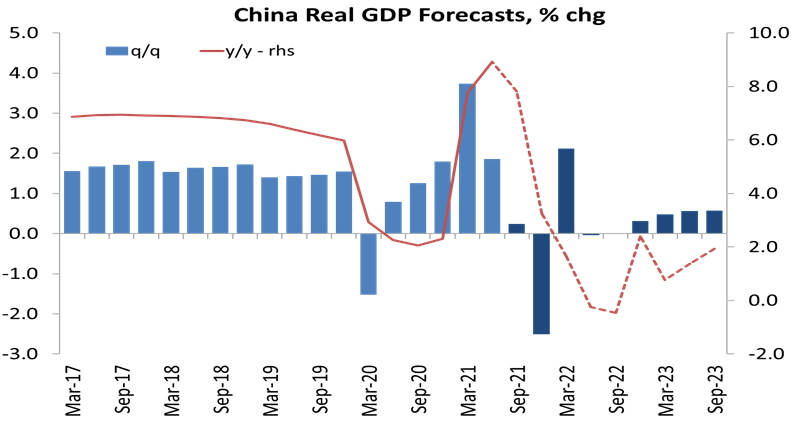

There is no getting away from the fact that there will be an immediate hit to growth from Evergrande and the associated spill-overs. China’s recovery from the pandemic slump had already been faltering, partly because of new COVID variant eruptions that caused mini lockdowns, but mainly because investment and trade growth is being limited by the patchy recovery in the major capitalist economies. So China will be lucky to hit a 2% rate for the remainder of this year.

More worryingly, even if a more disorderly spiral across the property market can be averted, the end of the credit-fuelled real estate model (or even a tempering of it) will mean lower growth. That’s the issue. The ‘Western China experts’ are convinced, either that China is finally going to have a financial implosion (something forecast nearly every year for the last 20 years); or that the economy will fall into a low growth path of 2-3% a year, hardly higher than the ‘mature’ capitalist economies.

One reason presented is that the working population is declining (indeed, it is reported that China’s fertility rate is now below that of Japan) to the point where the population could be halved by the end of the century. Another reason popular with the experts is that China’s investment-driven, export-led model for growth is over. Instead of investment, China should now rely on boosting consumption for the masses, as in the US and most of the G7 – and that means reducing the size of the state through privatisations and opening up the economy to even more ‘consumer markets’. Moreover, exports may no longer make much of a contribution to China’s growth rate because of the trade and technology barriers being erected by the US and its allies to isolate and curb China’s progress. The Chinese government is aware of this. That is why the Xi leadership talks of a ‘dual circulation’ development model, where trade and investment abroad is combined with production for the huge domestic market.

As I argued in a previous post: “Gross investment has averaged over 47% of GDP since 2009. But real GDP growth has been slowing. So China’s productivity return on new investment (or the productivity of capital input) is declining. Back in 2006, before the global crisis, it took 2.9 units of investment to increase real GDP by 1 unit. In 2014, it now takes 6.6 units. China needs to return to its long-term average TFP [total factor productivity] rate of over 2.5% a year to sustain 7% real GDP growth.” In previous posts, I have attacked the arguments of the Western experts that China is about to have a financial crash like the 2008 one in the major capitalist economies; or that its growth rate will shrink to near nothing because of the failings of its state-led economic model.

Growth in real GDP depends on two factors: growth in the size of the workforce; and growth in the productivity of existing workforce. If the former slows or even falls, then a fast enough growth in productivity can compensate or even overcome the former. Productivity growth depends primarily on more capital investment in technology; better technology that saves labour time and a better trained workforce that can deliver more in less time. The problem for China from hereon is that its capitalist sector has been allowed to expand (in a “disorderly” fashion, says Xi) to the point where the contradictions of capitalist production are beginning to damage China’s formerly spectacular rise.

Indeed Xi’s call for ‘common prosperity’ is

a recognition that the capitalist sector so fostered by the Chinese

leaders (and from which they obtain much personal gain) has got so out

of hand that it threatens the stability of Communist Party control.

Take billionaire Jack Ma’s comment before he was ‘re-educated’ by the

authorities: “‘Chinese consumption is not driven by the government

but by entrepreneurship, and the market,’… In the past 20 years, the

government was so strong. Now, they are getting weak. It’s our

opportunity; it’s our show time, to see how the market economy,

entrepreneurship, can develop real consumption.’”

—The Guardian, 25 July 2019

The profitability of the capitalist sector has been falling for some time, just as it has the major capitalist economies. So Chinese capitalists have looked for higher profits in unproductive sectors like real estate, consumer finance and media – that’s where the billionaires are found. These sectors are now blowing up in the faces of the Chinese leaders.

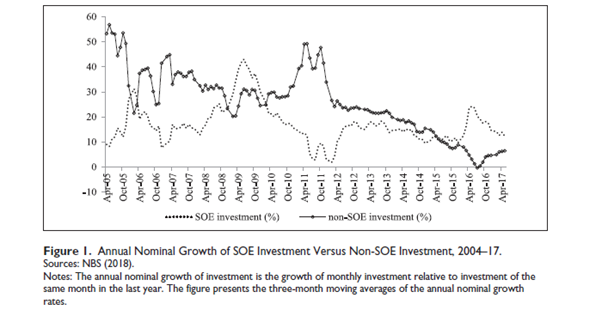

State sector investment has always been more stable than private investment in China. China survived, even thrived, during the Great Recession, not because of a Keynesian-style government spending boost to the private sector as some economists, both in the West and in China argued, but because of direct state investment. This played a crucial role in maintaining aggregate demand, preventing recessions, and reducing uncertainty for all investors. When investment in the capitalist sector slows down as it does as profit growth slows or falls, in China the state sector steps in. SOE investment grew particularly fast over 2008–09 and 2015–16 when the growth of non-SOE investment slowed down. As David Kotz showed in a recent paper: “Most of the current studies ignore the role of SOEs in stabilizing economic growth and promoting technical progress. We argue that SOEs are playing a pro-growth role in several ways. SOEs stabilize growth in economic downturns by carrying out massive investments. SOEs promote major technical innovations by investing in riskier areas of technical progress. Also, SOEs adopt a high-road approach to treating workers, which will be favorable to the transition toward a more sustainable economic model. Our empirical analysis indicates that SOEs in China have promoted long-run growth and offset the adverse effect of economic downturns.”

What is needed is not a further expansion of consumer sectors by opening them up to ‘free markets’, but instead state-led investment into technology to boost productivity growth. And that state sector investment can be directed towards environmental goals and away from uncontrolled expansion in carbon-emitting fossil fuel industries. As Richard Smith has put it: “The Chinese don’t need a higher standard of living based on endless consumerism. They need a better mode of life: clean unpolluted air, water and soil, safe and nutritious food, comprehensive public health care, safe, quality housing, a public transportation system centred on urban bicycles and public transit instead of cars and ring roads.”Rising personal consumption and wage growth will follow such investment, as it always does.

But that means it is time for the Chinese government to make a turn back towards state investment and planning of housing, technology and public services and involve China’s highly educated industrial and urbanised workers in that planning. Unfortunately, China’s leaders do not want any shift towards the latter, so the danger of long-term economic slowdown will remain.

No comments:

Post a Comment