I continue my campaign, along with a small band of like minds, arguing that the ups and downs of real economic growth are driven by changes in business investment. And, in a capitalist economy, that investment is driven by the level and movement in the profitability of capital and in the mass of profits generated by the workforce and appropriated by the owners of that capital. To me, this seems a simple and realistic analysis: profit rules. But this thesis is dismissed, ignored and rejected by mainstream, post-Keynesian and other ‘Marxian’ economists,

Mainstream economists reckon economic growth comes from a growing workforce and rising productivity per worker. That is true by definition, but what drives each component? According to mainstream economics, it is exogenous population growth plus the consumption and savings decisions of millions of individuals that materialise through the ‘hidden hand’ of the ‘market’ into aggregate supply and demand for goods and services. The consumer rules, growth follows.

According to the Austrian school, economic growth does come from investment. But it is the direct result of savings. The supply of savings will create investment and consumer demand through the workings of the market. Savings rule, growth follows.

According to the Keynesians, of various hues, it is consumer and investment demand that creates incomes and then savings. Demand creates supply through the workings of the market (but sometimes with the help of government). With the mainstream Keynesians, consumption by households rules; for the so-called post Keynesians, investment rules. For both, demand rules, growth follows. But for neither does profit nor profitability play a causal and central role in changing investment or consumption; on the contrary, the reverse is the case. As Keynes put it: “Nothing obviously, can restore employment which does not first restore business profits. Yet nothing, in my judgement, can restore business profits that does not first restore the volume of investment.” (Collected Writings Vol 13, p343).

In a recent discussion on the nature of Marx’s Capital and its relevance today, Prof Riccardo Bellofiore made a distinction between Marxians and Marxists. ‘Marxian’ economists are people who have taken Marxist theory forward to deal with new developments in capitalism, while ‘Marxists’ are stuck in the past of Marxist dogma and 19th century capitalism. It seems to me, however, that ‘Marxian’ economists tend to bend to the mainstream or Keynesian view that, while profit is obviously key to the nature of exploitation under capitalism, it plays no role in explaining the pace of economic growth or the regular and recurrent slumps in that output under capitalism. For an explanation of that, we must look to instability in the banking and financial system, the growth of credit (or debt), rising inequality squeezing labour’s purchasing power (‘underconsumption’), or monopoly ‘stagnation’ (a glut of profit). But don’t look to changes in the profitability of capital or the movement of profit and value created in the production and productive sectors of the economy. That’s old fashioned.

Well, I must be an old-fashioned ‘Marxist’ (well, at least, I am old). I am continuing the battle against ‘revisionism’ of ‘Marxians’ to promote Marx’s law of value and his law of profitability as an interconnected explanation of the causes of economic growth and crises under capitalism. So sometimes, it is relieving to get some support from mainstream economics.

First, Matthew Klein in the FT has a piece that points out that the conventional view of the relatively poorer rate of investment in Europe compared to the US is due to the weakness of its banks and their refusal to lend is wrong. There is no supporting evidence for this ‘credit’ cause of slow growth. In Europe, the collapse in credit is due to a lack of demand for borrowing not restrictions by banks. As the graph of Eurozone bank lending and loan demand shows, “the … demand for credit collapses out of proportion of anything bankers expressed about their willingness to lend”.

Klein goes on, “it’s difficult to look at all this and argue the problem has been the supply of credit. Something else seems to be at work.”

Paul Krugman in a blog post praised Klein’s analysis. Krugman reckoned it confirmed his long held view that the cause of the stagnation in Japan during the 1990s was not bad banking but the Keynesian ‘liquidity trap’ i.e. too high interest rates and a desire to hoard cash, not spend: “there’s little support for the bad-banks-did-it story, even though everyone repeats it. But look back at my 1998 BPEA on Japan, which is more or less where I came in. …I argued (154-158) that the nonresponse of monetary aggregates was exactly what you should expect in a liquidity trap, and that there was little evidence (174-177) that banking problems were actually central to the economy’s weakness.”

Be that as it may, we could also remind ourselves what Krugman said back about Japan. “It appears as if the slump could go on forever. A dynamic analysis makes it clear that it is a temporary phenomenon—in the model it only lasts one period, although the length of a “period” is unclear (it could be three years, or it could be 20). Even without any policy action, price adjustment or spontaneous structural change will eventually solve the problem. In the long run, Japan will work its way out of the trap, whatever the policy response”. So apparently, liquidity trap or not, Japan would recover. When it did not, Krugman pushed to break the trap with quantitative easing which reckoned would do the trick. As we know, after several bouts of QE from Japan’s monetary authorities, Japan remains stagnant, with five technical recessions since QE was introduced.

What Krugman does not refer to in his post on Europe’s banks is that Klein adds a little note from David Watts from CreditSight. Watts finds that if he runs growth in sales revenues and the level of utilisation of existing capacity for Eurozone non-financial companies against business investment, he finds there is a close correlation. In other words, what drives business investment are the level of sales and profits. Klein concludes: You don’t need any estimate of a “credit channel” (or “policy uncertainty” or “confidence”) to explain why companies boost or cut their capex. They spend when it’s profitable, and don’t when it isn’t.”

The simple answer is best. Recently, the Bank for International Settlements (BIS) latched onto the same point—that the Great Recession and the subsequent weak and slow recovery in the major economies was a product of the collapse in business investment. As the BIS put it: “Business investment is not just a key determinant of long-term growth, but also a highly cyclical component of aggregate demand. It is therefore a major contributor to business cycle fluctuations. This has been in evidence over the past decade. The collapse in investment in 2008 accounted for a large part of the contraction in aggregate demand that led many advanced economies to experience their worst recession in decades. Across advanced economies, private non-residential investment fell by 10-25 percent.” And the BIS went on: “the uncertainty about the economic outlook and expected profits play a key role in driving investment, while the effect of financing conditions is apparently small.”

So the bank dismisses the consensus idea that the cause of low growth and poor investment is the lack of cheap financing from banks or the lack of central bank injections of credit, just as Klein finds. Instead, the BIS looks for what it calls a “seemingly more plausible explanation for slow growth in capital formation,” namely, “a lack of profitable investment opportunities.” Companies are finding that the returns from expanding their capital stock “won’t exceed the risk-adjusted cost of capital or the returns they may get from more liquid financial assets.” So they won’t commit the bulk of their profits into tangible productive investment. “Even if they are relatively confident about future demand conditions, firms may be reluctant to invest if they believe that the returns on additional capital will be low.”

And now to back the BIS analysis up and give us old-fashioned ‘Marxists’ some Xmas cheer (sorry too early), there is a new analysis by mainstream economists Kothari, Lewellen and Warner from three American business schools, called The behavior of corporate investment. The authors find a close causal correlation between the movement in US business investment and business profitability.AggregateInvestment

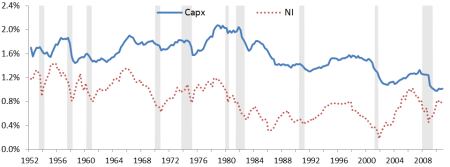

In the graph below, the authors show the return on total assets of US non-financial companies (measured as after-tax profits as a percentage of assets – red dotted line); and the rate of fixed investment against total assets (blue line). What does it show? That the US non-financial corporate rate of profit fell secularly from the 1950s, reaching a low in the mid-1980s and then consolidating or rising a little after that.

Quarterly fixed investment (Capx) and after-tax profits (NI) scaled by lagged total assets for nonfinancial corporations from 1952–2010. Data come from the Federal Reserve’s seasonally-adjusted Flow of Funds accounts. Shaded regions indicate NBER recessions.

Those who are regular readers of this blog will not be surprised at that finding. But the graph also shows that business investment (as a share of assets) has declined in tandem with profitability. Again, this confirms the work of ‘Marxist’ economists like Kliman, Jones and Tapia Granados, among others.

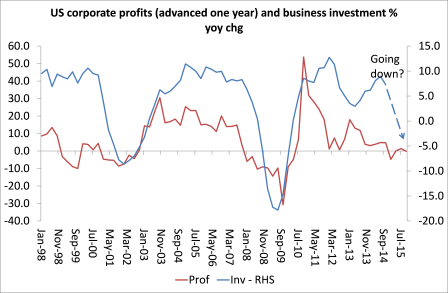

The three mainstream authors of the paper find that “investment growth is highly predictable, up to 1½ years in advance, using past profits and stock returns but has little connection to interest rates, credit spreads, or stock volatility. Indeed, profits and stock returns swamp the predictive power of other variables proposed in the literature.” And that “Profits show a clear business-cycle pattern and a clear correlation with investment.” The data show that investment grows rapidly following high profits and stock returns—consistent with virtually any model of corporate investment—but can take up to a year and a half to fully adjust. This was exactly the conclusion that I have reached in my own study and jointly with G Carchedi (http://gesd.free.fr/robcarch13.pdf). See my graph below.

The authors find that “investment growth is closely linked to recent profit growth and stock returns but only weakly related to changes in interest rates, stock volatility, and the default spread. We find no evidence that investment drops following a spike in aggregate uncertainty, contrary to the predictions of many models with irreversible investment. We also find no evidence that investment growth slows after a rise in short-term or long-term interest rates, contrary to the idea that Federal-Reserve-driven movements in interest rates have a first-order impact on corporate investment.” So all the alternative explanations of crises offered by monetarists, Keynesians and post-Keynesians have no empirical backing.

The authors also measured the predictive causal correlation between changes in profits, GDP and investment and the Great Recession. They found that “if investment maintained its historical connection to profit growth, investment was predicted to drop by 14.7%, roughly two-thirds the actual decline of 23.0%.” This two-thirds figure is almost exactly what I found for the period 2000 to 2013. I found that the correlation between changes in the rate of profit and investment was 64%; second, the correlation between the mass of profit and investment was 76%; and third, the correlation between the rate of profit (lagged one year) and the mass of profit was also 76%.

Finally, the authors found that “at least three-quarters of the investment decline can be thought of as a historically typical drop given the behavior of profits and GDP at the end of 2008. Problems in the credit markets may have played a role, but the impact on corporate investment is arguably small relative to a decline in investment opportunities following the 2008 recession and financial crisis.”

You can’t beat old fashioned ‘Marxist’ economics.

DON’T FORGET TO FOLLOW MY FACEBOOK SITE WITH DAILY ENTRIES AT:

https://www.facebook.com/Michael-Roberts-blog-925340197491022/?ref=aymt_homepage_panel

No comments:

Post a Comment