Back last October, Professor David Harvey, presented an essay to the University of Izmir, Turkey in October. You can see a You tube screening of that presentation at https://www.youtube.com/watch?v=-ZJrNgb-iiY&spfreload=10.

Professor Harvey then drafted a paper sent to me called David Harvey, Crisis theory and the falling rate of profit; to be published in 2015 in The Great Meltdown of 2008: Systemic, Conjunctural or Policy-created?, edited by Turan Subasat (Izmir University of Economics) and John Weeks (SOAS, University of London); Publisher: Edward Elgar Publishing Limited. Here is the draft, Harvey on LTRPF.

Last December I did a reply on my blog,

https://thenextrecession.wordpress.com/2014/12/17/david-harvey-monomaniacs-and-the-rate-of-profit/

and presented my response in more depth in a paper reply-to-harvey, that Professor Harvey (from now on DH) kindly posted on his own website, http://pcp.gc.cuny.edu/.

I won’t repeat the arguments presented in DH’s paper and my reply – you can read them yourself. Suffice it to say that DH was arguing that in essence, that Marx’s law of the tendency of the rate of profit to fall (LTRPF) is not the only or even the principal cause of crises. Thus it cannot be the basis of a Marxist theory of crisis. Indeed, “there is, I believe, no single causal theory of crisis formation as many Marxists like to assert”.

It’s not monocausal

Harvey argues that we proponents of Marx’s law as the basis of a theory of crises are one-sided and monocausal in our approach because: “proponents of the law typically play down the countervailing tendencies”. Moreover, Professor Harvey pours cold water over the “array of graphs and statistical data on falling rates of profit as proof of the validity of the law”. He doubts their validity because there is plenty of evidence in the ‘business press’ that the rate of profit, or at least the mass of profit, in the US has been rising, not falling.

Professor Harvey prefers other reasons for capitalist crises than Marx’s law. There is the effect of credit, financialisation and financial markets; the devaluation of fixed constant capital in the form of obsolescence; and, above all, the limits on consumer demand imposed by the holding down of real wages relative to capitalist investment and profits. He wants us to consider alternative theories based on the “secondary circuit of capital” i.e. outside that part of the circuit to do with the production of value and surplus value and instead look at that part concerned with the distribution of that value, in particular ‘speculative overproduction’.

As I say, my reply to these arguments is outlined in my post and in my longer paper. But more recently, Professor Andrew Kliman (from here called AK), Marxist economist and author of two great books, Reclaiming Marx’s Capital and The failure of capitalist production (see my post, https://thenextrecession.wordpress.com/2011/12/08/andrew-kliman-and-the-failure-of-capitalist-production/), has entered the fray. In a two-part reply to Harvey published in the New Left Project

(http://www.newleftproject.org/index.php/site/article_comments/harvey_versus_marx_on_capitalisms_crises_part_1_getting_marx_wrong)

AK has delivered an effective and enlightening rebuttal of DH’s arguments.

As AK says “The real issue is not that anyone has advocated a mono-causal theory, but that Harvey is campaigning for what we might call an apousa-causal theory, one in which the LTFRP plays no role at all (apousa is Greek for ‘absent’). He is the one who is trying to exclude something from consideration. In light of his emphasis on capitalism’s ‘maelstrom of conflicting forces’ and its ‘multiple contradictions and crisis tendencies’, one might expect that he would urge us to consider all potential causes of crisis, excluding nothing. However, Harvey is not merely suggesting that other potential causes of crisis be considered alongside the LTFRP. He seems determined to consign it and the theory of crisis based on it to the dustbin of history.”

AK quotes Harvey “those who attribute the difficulties of contemporary capitalism to the tendency of the profit rate to fall are, judging by this evidence of labour participation, seriously mistaken. The conditions point to a vast increase and not a constriction in surplus value production and extraction.”

Then AK makes the point that I also make in my reply that “the data do indeed suggest that the mass—the absolute amount—of surplus-value or profit increased. But the issue here is what happened to the rate of profit, the amount of surplus-value or profit as a percentage of the volume of invested capital. An increase in the numerator of a ratio (rate) is not evidence that the ratio as a whole has increased. If the percentage increase in the denominator of the rate of profit, the invested capital, was greater than the percentage increase in the numerator, then the rate of profit fell. Given that Harvey does not show, and does not even suggest, that the denominator failed to increase by a greater percentage, the statistic he cites is just not evidence that the rate of profit rose”.

And as I said in my reply to DH (and DH is open about this), AK points out that DH is really just backing the view of Michael Heinrich that Marx’s law is not a law at all; that any way it is ‘indeterminate’ and was eventually dropped by Marx as the ‘most important law’ in political economy because it did not work (see my post, https://thenextrecession.wordpress.com/2013/05/19/michael-heinrich-marxs-law-and-crisis-theory/).

Both G Carchedi and I (http://gesd.free.fr/mrhtprof.pdf) and AK in recent papers (http://gesd.free.fr/klimanh13.pdf) have dealt with Heinrich’s arguments. But of course, that has not ended that attack on the relevance of the LTRPF as the underlying causal explanation of recurrent crises under capitalism. Indeed, only recently, Saso Furlan, a Marxist student from the Slovenian Institute of Labour Studies and a prominent member of the Initiative for Democratic Socialism party that recently won seats in the Slovenian parliament, has written an article accepting Heinrich’s position in full (http://drustvenaanaliza.blogspot.de/2015/03/on-law-of-tendency-of-rate-of-profit-to.html?m=1).

The battle of metaphors

DH has now replied to AK’s rebuttal of his arguments in a new paper, Capital’s Nature: A Response To Andrew Kliman

(http://www.newleftproject.org/index.php/site/article_comments/capitals_naturea_response_to_andrew_kliman).

In a very eloquent response, full of interesting observations, DH takes up the metaphor used by AK and, of course, used by Marx himself on several occasions, that the Marxist theory of value and the LTRPF is really like Newton’s law of gravity. The law of gravity means that on earth objects will tend to fall to the ground. Of course, such a fall can be delayed by wind, or by constructions, etc, but the tendency is there and explains the ultimate movement of objects.

As AK puts it “If I appeal to the universal law of gravitation in order to explain why apples have a tendency to fall off trees, without mentioning other factors that can make them fall, like the blowing of the wind, or counteracting factors like air resistance, I am not assuming that these other things do not exist. Much less am I constructing a mono-causal model that excludes them and which is therefore severely restricted in applicability.”

Marx’s metaphor is, DH admits, a “clever and beguiling metaphor”. The metaphor shows that “capital can never escape the tendency for profit rates to fall. It is inherent in capital’s nature, even as the conditions under which the law operates vary widely. The competitive search for relative surplus value ultimately undermines and destroys the capacity to produce and realize that surplus value. This is the primary contradiction of capital around which a host of secondary contradictions (e.g. those embedded in the credit system or deriving from insufficient aggregate demand) cluster. No amount of tinkering with the secondary contradictions (e.g. financial reform or basic income redistributions) can abolish the tendency for profit rates to fall and crises to form. Only a revolutionary politics that addresses this primary contradiction will suffice.”

Indeed. But DH does not like this Marxist metaphor. After all, metaphors have their limitations and often are exhausted by reality. He wants us to consider others, some of which Marx also used. DH reckons the one that impresses him most is “that of capital as an organic whole sustained by the internally differentiated circulatory flows of value that absorb from capital’s milieu the energies of human labor as well as the raw materials to be found in capital’s social and natural environment.”

DH quotes from the introduction to the Grundrisse to support his alternative metaphor: “The conclusion we reach is not that production, distribution, exchange and consumption are identical, but that they all form the members of a totality, distinctions within a unity….A definite production thus determines a definite consumption, distribution and exchange as well as definite relations between these different moments. Admittedly, however, in its one-sided form, production is itself determined by the other moments. For example if the market, i.e. the sphere of exchange, expands, the production grows in quantity and the divisions between its different branches becomes deeper. A change in distribution changes production, e.g. concentration of capital, different distribution of the population between town and country, etc. Finally, the needs of consumption determine production. Mutual interaction takes place between the different moments. This is the case with every organic whole.”

Using this quote, DH wants us to think that Marx saw crises as a result of ‘mutual interaction’ between different parts of the circuit of capital: production is determined by ‘other moments’. Thus the causal sequence is not ‘mono-causal’ or one-way: from the profitability of capital to investment and production and then consumption, but is one of ‘mutual interaction’.

But if we look closely at the quote, we can see that this is not the correct interpretation. Marx says “a definite production thus determines a definite consumption, distribution and exchange as well as definite relations between these different moments”. Only in a “one-sided form” is production determined by other moments. Production leads and sets off a chain reaction that feeds back on production in a crisis.

But DH likes the ‘organic whole’ metaphor because he reckons it shows that crises under capitalism are multi-causal: “In the same way that the human body can fall sick and die for all sorts of different reasons other than sheer old age, so there are multiple points of stress and potential failure within the organic whole of capital. A failure at one point, moreover, typically engenders a failure elsewhere.”

The trouble with his metaphor of a human body that gets sick, in contrast with Marx’s metaphor of gravity, is that DH replaces a clear causal sequence from profitability to crises that can be tested and measured with a view of a vague variety of contingent forces within the organic whole that move one way or another depending on the interplay of multiple but correlated contradictions. There is no explanation of where these crises come from.

DH tries to contrast his metaphor of a “chaotic mishmash of possible causes for breakdown and crises that I typically invoke without any necessary directionality of change with the mechanical certainties of that Newtonian world in which the clock was wound up at the outset through the extractions of absolute surplus value only to gradually be wound down under the competitive impetus to create relative surplus value. As the ratio of capital to labour employed shifts ineluctably in the former’s favor so the profit rate trends down. To me, this mechanical model appears too deterministic, too unidirectional and too teleological to fit how I see and experience capital evolving as an organic whole”.

But DH invokes chaos because he does not see Marx’s law as a dialectical law, i.e. because he does not see the tendency and the countertendencies. Thus he cannot discern any theory of crisis. So we have no idea what is going on. Every crisis is different with different causes and so “the job of the Marxist diagnostician is to figure out what ails capital this time around” – without reference to any previous crisis. And we can’t do any better than this because what causes illness in a human body can change with time e.g. genes mutate, environments change and diets and healthcare vary etc

Not in my lifetime!

DH also resurrects the old argument that even if the LTRPF is relevant to crises under capitalism, it is really only relevant to a long term apocalyptic end or breakdown. “Yes indeed the sun will eventually run out of gas and given the second law of thermodynamics energy will dissipate. But there is nothing to stop the increasing concentration and, in the earth’s case, storing of energies in one part of the universe for a time so that species as well as whole civilizations can be constructed through increasing order.” But “in the here and now the second law of thermodynamics means very little to us at the macro-level struggling to reproduce in our little corner of the universe, even as it is a universal feature of the world in which we live (and has lots of localized uses in closed systems such as in steam engines)”.

This metaphor that Marx’s law only operates at the same level as the laws of physics that predict that the sun (like other stars) will eventually burnt out in a billion or more years, so that it is irrelevant to crises in human life times is pinched from Rosa Luxemburg, who adopted an underconsumptionist theory of crises (as does DH in some places – see mattick on harvey).

Luxemburg addressed a ‘mono-causal’ LTRPF supporter of her day in ironic tone, as follows “there is still some time to pass before capitalism collapses because of the falling rate of profit, roughly until the sun burns out!” Rosa Luxemburg Anti-Critique, p. 76n.

In quoting Luxemburg’s remark in his book, Imperialism and the accumulation of capital, M Bukharin commented “It would be ridiculous to demand that the process should reach its logical conclusion. The objective tendency of capitalist development towards this end is quite sufficient. Long before the ‘end’, this tendency (LTRPF – MR) will sharpen the struggle for any possibility to gain an additional profit to such an extent, and will be accompanied by such a centralization of capital and sharpening of social relations, that the epoch of a low rate of profit will become the epoch of catastrophes.”

Bukharin goes on to point out that Luxemburg’s alternative theory of crisis based on too much surplus value that cannot be realized except through expansion into the third world also meant that “not only can one not draw any revolutionary conclusions from Rosa’s theory but, on the contrary, conclusions that make revolution appear impossible for a long time.” https://www.marxists.org/archive/bukharin/works/1924/impacck/ch05.htm

Where’s the evidence?

DH offers no evidence to test his ‘multi-causal chaos’ theory of crises while proponents of the LTRPF as the underlying causal driver of recurrent crises can and do just that. AK provides powerful evidence in the second part of his reply to DH. And I and others like G Carchedi, Esteban Maito, Alan Freeman, Tapia Granados and more have also generated empirical evidence to test and confirm or falsify Marx’s law. The result is that Marx’s LTRPF does fit the facts as the best explanation of recurrent crises.

As AK explains in his second part, we can decompose the movement in the rate of profit to see if it matches the assumptions of the law in reality. Thus Marx’s law says that the rate of profit will fall if the organic composition of capital rises faster than the rate of surplus value. Marx’s law says that if the rate of surplus value rises faster than the organic composition of capital, then the rate of profit will rise. But this latter countertendency is just that – it will be weaker than the tendency for the organic composition of capital (OCC) to rise. So over time (and not time as long as it takes the sun to burn out!), the rate of profit will fall.

The evidence presented by AK and others for the US is conclusive on this. Here is some more evidence from my calculations on the latest data on the US rate of profit (see my post, https://thenextrecession.wordpress.com/2015/03/27/profit-warning/).

So there is a secular decline in the US rate of profit from 1946 to 2014. The rate of profit did fall well before the sun burnt out. The reason is clear. Between 1946 and 2014, the organic composition of capital rose 47%, while the rate of surplus value actually fell 8%, so the rate of profit fell 29%. In the neo-liberal period after 1982, the rate of profit fell only very slightly, because the ‘countertendency’ of a rising rate of surplus value was nearly enough to match the rise in the organic composition of capital.

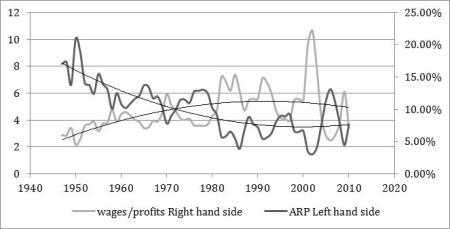

G Carchedi in an unpublished paper looked at just the productive sector of the US economy. He found that, from 1947 to 2010, the rate of exploitation actually fell, which shows the limits of growing exploitation as a counter-tendency. And the rate of profit (ARP) fell. In the graph below, the wages to profits ratio (W/P) – the opposite of the rate of surplus value – rises up to 1985 and then reverses (modestly). And the rate of profit consolidates.

The rate of profit and ratio of wages to profits (W/P)

The increase in the rate of profit from the mid-1980s was really just a slowing down of its secular fall. And the decrease in W/P since the mid-1980s (increase in the rate of exploitation) is actually a slowing down of its secular increase, i.e. of a decrease in the rate of exploitation. This shows that, given the persistent increase in the OCC, (i.e. given the persistent fall in surplus value relative to the capital invested) over the long run, the rate of exploitation cannot but decrease.

LTRPF and crises

But does a falling rate of profit lead to crises as Marx argued and we mono-causals also reckon? Well, again the evidence is strong. Indeed, I know of no Marxist economist, except perhaps DH, who does not doubt that it was a crisis of profitability in the 1970s in the major economies that led to the first simultaneous international slump in 1974-5 and the double-dip recession of 1980-2. And that includes those economists like Gerard Dumenil, Michel Husson, Sam Gindin etc who reckon that the LTRPF had nothing to do with the Great Recession. It even includes the so-called post-Keynesian economists who reckon that the slumps of the 1970s and 1980s were ‘profit-led’ (ie wage share rose and drove down profits), although this school now reckons the current crisis is ‘wage-led’ (i.e. wages are too low for effective demand). See my post, https://thenextrecession.wordpress.com/2014/03/11/is-inequality-the-cause-of-capitalist-crises/.

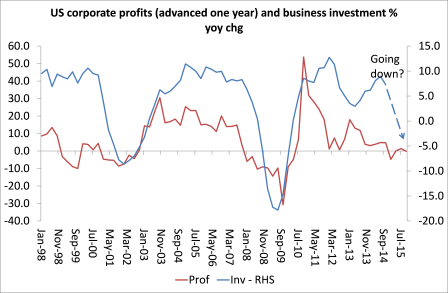

And we can refute the argument that the ‘underlying’ cause of the Great Recession was not a crisis in profitability but something else. Tapia Granados has shown that profits have led investment and thus growth up and down: “available empirical data for 251 quarters of the U.S. economy… supports the hypothesis of causality in the direction of profits determining investment and, in this way, leading the economy toward boom or bust.”

https://thenextrecession.files.wordpress.com/2013/04/does_investment_call_the_tune_may_2012__forthcoming_rpe_.pdf

And I have also shown how changes in the mass of profit will be followed (not led) by changes in investment.

DH recognizes the need to look for empirical evidence that might lead to an alternative explanation for crises than that of the LTRPF. He notes that “One of my favorites, for example, is to look carefully at how investments in the fixed capital and consumption fund of the built environment both absorb surplus capital and ultimately become the locus of a crash (as happened in 2008 and as is now threatened in China). This corresponds, as I pointed out, to Marx’s comment that “the cycle of interconnected turnovers embracing a number of years, in which capital is held fast by its fixed constituent part, furnishes a material basis for the periodic crises.” And he goes on to say: “Why, then, are we not investigating this with the same intensity and tenacity as is devoted to the falling rate of profit?”

Well. some of us have done just that. In various papers I have looked at the connection between the time of the turnover of fixed capital and the regularity of cyclical crises. I argued in my book, The Great Recession, that the 13-16 year period for a change in the direction of the rate of profit does correlate with the age of US fixed assets. Esteban Maito and Peter Jones have also considered in detail the role of the turnover of capital in recent papers.

It’s a pinball wizard!

DH concludes that “I would claim my organic metaphor for understanding capital’s nature works far better for understanding what is happening to us in the here and now.” Well, let’s raise another metaphor: that of a pinball machine. The ball could represent the accumulation of capital. It whizzes round hitting various obstacles in a chain reaction. They light up, representing various crises, each slightly different. One crisis bounces onto another (from housing to stocks to banks etc), as in Harvey’s metaphor. But the pinball machine’s raison d’etre is that its level slopes down so that gravity takes over; that is the essence of its working. The ball is always tending to drop to the bottom and even intervention by levers from the outside (government action) cannot stop that tendency which eventually overrides the obstacles and levers and the ball drops into the hole at the bottom. Accumulation stops.

Of course, metaphors have their limits but, I think, this one works well to understand the ‘here and now’ of capitalism.

No comments:

Post a Comment