“The theories of John Maynard Keynes provide the sound intellectual framework for the views which trade unionists had always instinctively held and known to be right” (TUC, 1968, p. 85)

The ideas and theories of John Maynard Keynes still dominate the economic views and policy proposals of the leaders of the labour movement in the major capitalist economies. Keynes is seen as offering a ‘third way’ between the pro-capitalist ‘free market’ economics that dominates the universities (and among the strategic advisers of government) and the opposite of dangerously revolutionary Marxian economics. Keynes argued that, with a judicious range of policy measures, capitalism can be made to work better and can be managed so that it meets the needs of the many, without disrupting the social structure of society.

On this blog and elsewhere, I have developed a long and detailed critique of Keynesian economics. But suffice it to say now that free market economics claims that prosperity will be achieved as long as capitalists are free of any regulations (environmental, safety, health etc) and of too much taxation, while markets are kept ‘competitive’ and free of monopolies, particularly in the ‘labour market’ ie. trade unions. Then capitalists can compete freely to maximise profits and in doing so will invest in new technology to boost the productivity of labour and employ more workers, whose wages will then rise. Everybody wins.

The Keynesians retort that free market capitalism (‘laisser-faire economics’, Keynes called it) does not work because the market economy has faultlines that generate a chronic lack of ‘effective demand’. Holding down wages to boost profits means capitalists cannot sell all their production and are periodically forced into laying off workers and unemployment ensues. It is necessary for governments to intervene and raise wage levels and/or increase government spending to fill the gap in aggregate demand. Then this will create enough demand for capitalists to sell their goods and make a profit. So a judicious macro management of the market economy can work for all.

The Marxist view is that it is not question of the lack of demand or low wages or inequality in the distribution of incomes, but a problem in the profit system of production itself. The contradiction of capitalism is that, despite the efforts of capitalists, average profitability will fall over time. This causes recurrent and regular crises of production that cannot be resolved by the ‘free markets’ or Keynesian macro-economic management.

This Marxist view carries little traction among economists and leaders of the labour movement. The dominance of the Keynesian thought among the ‘left’ and in the labour movement was expressed most clearly in the UK only last week in a report by the British Trade Union Congress (TUC) on the state of the UK economy and what to do about it.

The report was authored and presented by Geoff Tily, a senior TUC economist. Tily is a long standing and enthusiastic follower of Keynes, whose work he considers as being radical and pertinent to solving the problems of the 21st century capitalism. His book ‘Keynes Betrayed’ is regarded as one of the most prominent in arguing that Keynes was a radical reformer of market economics and economies.

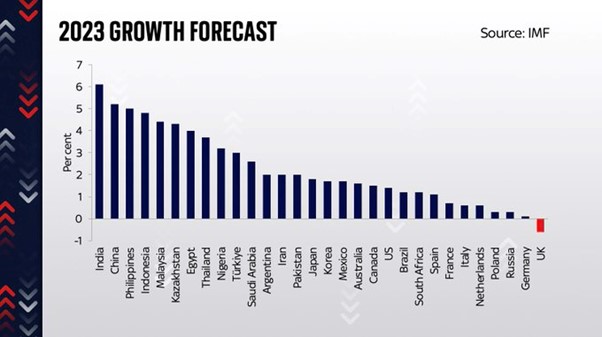

The TUC report offers a powerful account (with facts and figures) of the shocking failure of British capital. The British economy is now not only regarded as ‘the sick man of Europe’ but of the G7 and indeed of the top 30 economies in the world , at least according to the IMF, which reckons it will be the only major economy to enter a slump this year.

The TUC report describes the UK economy as in a ‘doom loop’, a term used by the current Labour spokeperson on economics, Rachel Reeves: “This government has forced our economy into a doom loop – where low growth leads to higher taxes, lower investment, squeezed wages, and the running down of public services. All of which hit growth again”, Rachel Reeves, response to Autumn Statement, 17 Nov. 2022. According to the ‘doom loop’ argument, the vast erosion of around a third of the UK economy and the arrested standard of life for workers is a consequence of the fiscal ‘austerity’ policies in place since 2010. The TUC report refers to former Marxist (now Keynesian) Paul Mason who explains the loop: “supply is deficient, but the immediate cause of this deficiency is aggregate demand. This means that policymakers over 2022 and into 2023 are intensifying contractionary policy in the face of deficient aggregate demand.“

So the failure of British capital is down to the austerity policies since 2010 of cutting government spending creating a lack of demand. What happened to British capital before 2010 is ignored. The policy answer is to reverse austerity, raise government spending and wages and then aggregate demand will rise through what is called the Keynesian multiplier and so restore economic growth. “With these mechanisms identified, the lost prosperity can be restored.”

The TUC report criticises those on the left who reckon the current crisis is due to supply constraints. Instead, “what is wrong is that existing capacity and resources are being underused and not that we just need to invest for more capacity.” The TUC report refers here to a piece by another former Marxist turned Keynesian, James Meadway, who argues that it is not a zero-sum game between expanding capacity (supply) and raising demand for existing capacity. Keynesian theory “reinforces the empirical judgement that there is vast underutilised potential that can be deployed through current as well as capital expenditures…. So the core of a left strategy today – including its programme for the environment – is redistribution.” (Meadway). I interpret this to mean that it is not necessary to replace the capitalism mode of production but just make the redistribution of income and wealth fairer and the economy will jump forwards.

The Guardian newspaper editorial described, in its paeon of praise, that the TUC report “draws heavily on the recent ‘New macroeconomics’ literature, that in turn recalls the historic contributions of J. A. Hobson (1858-1940) and J. M. Keynes (1883-1946). These emphasise the relation between a too high return to wealth and too low return to work, and theories of over-production and underconsumption. Rather than deficient supply, the underlying problem of the world economy is excessive supply in the context of deficient demand.” Really – excessive supply!

As the TUC report puts it, the problem is that the “excessive imbalance towards wealth from labour distorts economic activity through a dislocation between aggregate production and aggregate purchasing power. On the one hand, too low wages put goods and services out of the reach of workers. On the other hand, the massive resources of the wealthy do not compensate because they are relatively less interested in goods and services …. Consumption therefore falls short and overproduction is the result.”

Thus Tily presents us with an unvarnished theory of crises based on underconsumption. As he says, the logic of his argument “leads to the vital conclusion that underconsumption and overproduction are relative conceptions: production is only excessive relative to deficient purchasing power and pay. It therefore follows that a better balance between labour and capital will permit higher production in an absolute sense. The analysis has always appealed to the left, above all motivating the 1945 Labour Manifesto: over-production is not the cause of depression and unemployment; it is under-consumption that is responsible (my emphasis)”.

This crude underconsumption theory of crises was refuted by Marx 160 years ago and has been proven wrong empirically over time. It is not even strictly Keynes’ theory. But it is apparently the bedrock of the current TUC analysis. What is the cause of this chronic underconsumption? According to Tily, it is that investment cannot expand capacity if interest rates, the cost of borrowing, are too high. Keynes showed that it is high interest rates set by finance capital that weakens productive capital, not the underlying profitability of productive capital. As Tily puts it: “The focal point of his analysis and much of his practical work was securing a permanent reduction in the long-term rate of interest.” Indeed, ending the rule of finance capital altogether, “the euthanasia of the rentier” as Keynes called it.

How this was to be achieved given the expanding role of finance capital in modern economies is not made clear. Reforming the finance sector through ‘regulation’ is apparently the policy measure. Good luck with that! The TUC and Tily never advocate the public ownership of the big banks and the closure of speculative hedge funds and investment banks. Such policies are taboo.

Moreover, how do we explain why the very low interest rates that Britain has enjoyed in the last 20 years have not led to faster investment and growth in the productive sector? Tily’s answer is that “a distinction should be made between Keynes’s low interest rate polices and the manner of monetary policy over the past decade. Keynes sought low interest rates above all to strengthen fixed capital investment, and he envisaged domestic action in the context of capital control on the international domain. Low interest rate policies today are in the context of an utterly deregulated global regime. Rather than foster domestic production, low rates have been recycled to earn high reward on more speculative terrain.”

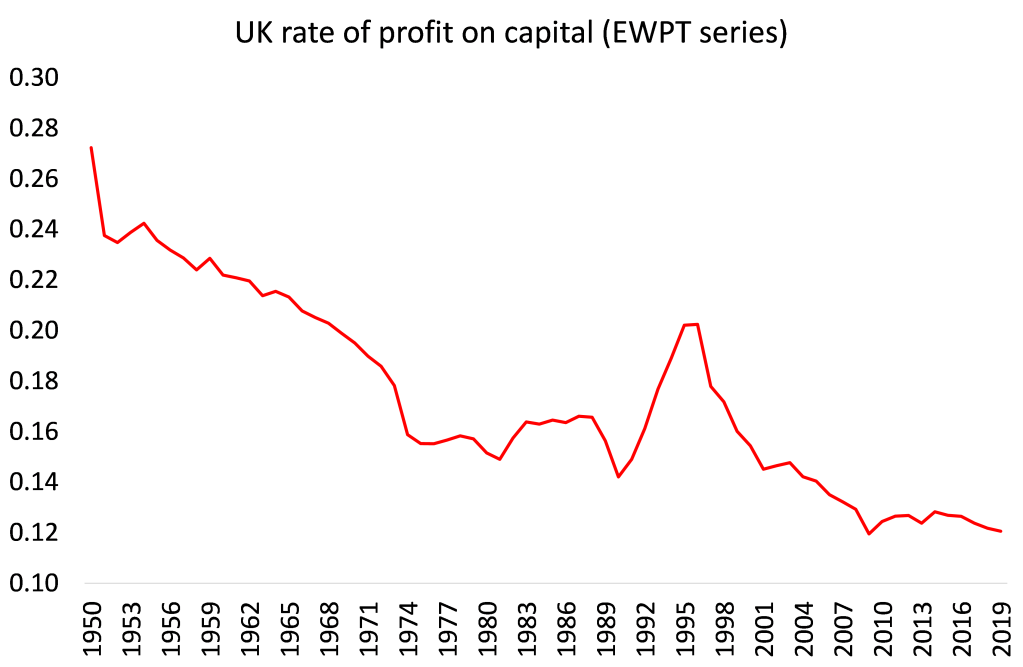

Maybe so, but that still begs the question : why this time has cheap credit been ploughed by banks and big business into financial speculation and not into productive investment (as, according to Tily, it was in the Golden Age)? The reason surely is that now it is more profitable to do the former than to do the latter. In the golden age after WW2, profitability was high in the productive sectors and the financial sector was not dominant. It is the fall in profitability that has led to the switch to financial speculation.

Interestingly, Tily slightly retreats from his view that it is Keynes’ theory on interest rates rather than profitability that provides the explanation of crises, when he admits that “on theoretical grounds the (supply-side) idea of a falling rate of profit may still be persuasive and regarded as vindicated by productivity outcomes on a long horizon.”

And Tily goes on to admit that Keynes was no radical reformer as he claims, being strongly opposed to Marxian economics. “Keynes was on the record making stupid remarks, for example in his (1925) ‘A short view of Russia’: “How can I adopt a creed which, preferring the mud to the fish, exalts the boorish proletariat above the bourgeois and intelligentsia who, with whatever faults, are the quality in life and surely carry the seeds of all human advancement?” (CW IX, p. 258) Indeed, Keynes refused to support the Labour party in the 1930s, siding with the Liberals because Labour was “a class party and the class is not my class. The class war will find me on the side of the educated bourgeoisie.”

As for supporting wage increases to solve crises, Keynes was not so keen on boosting wages as a solution to a slump. “in general, an increase in employment can only occur to the accompaniment of a decline in the rate of real wages. Thus, I am not disputing this vital fact which the classical economists have (rightly) asserted as indefeasible.” Indeed, Keynes in his later years increasingly emphasised the correctness of ‘free market economics, what he called ‘classical economy’. “I do not suppose that the (neo) classical medicine will work by itself or that we can depend on it. We need quicker and less painful aids. But in the long run, these expedients will work better and we shall need them less, if the classical medicine is also at work. And if we reject the medicine from our systems altogether, we may just drift on from expedient to expedient and never get really fit again.” Keynes 1940.

This is what Keynes said in his last years: “If our central controls succeed in establishing an aggregate volume of output corresponding to full employment as nearly as is practicable, the classical theory comes into its own again from this point onwards.” So once full employment is achieved, we can dispense with planning and ‘socialised investment’ and return to free markets and mainstream neoclassical economics and policy: “the result of filling in the gaps in the classical theory is not to dispose of the ‘Manchester System’ (‘free’ markets – MR), but to indicate the nature of the environment which the free play of economic forces requires if it is to realise the full potentialities of production.”

When arch free marketeer Friedrich Hayek published his book, The Road to Serfdom, which preached that state control would end ‘democracy’ and the freedom of the market economy, Keynes wrote to Hayek: “morally and philosophically I find myself in agreement with virtually the whole of it; and not only in agreement with it, but in a deeply moved agreement.”!

As he concluded: “For the most part, I think that Capitalism, wisely managed, can probably be made more efficient for attaining economic ends than any alternative system yet in sight, but that in itself it is in many ways extremely objectionable. Our problem is to work out a social organisation which shall be as efficient as possible without offending our notions of a satisfactory way of life.” The profit motive must remain: “The loss of profit may be due to all sorts of causes, but short of going over to communism there is no possibility of curing unemployment except by restoring to employers a proper margin of profit.” As Keynes argued that “Economic prosperity is…dependent on a political and social atmosphere which is congenial to the average businessman.” These are hardly comments of a radical reformer.

Tily and the batch of Keynesian economists who spoke at the presentation of the TUC report always refer back to the golden days of the 1960s when supposedly Keynesian policies were working and a prosperous economy was being achieved through management of the economy. But this is a myth. The 1970s saw rising unemployment and inflation, alongside falling profitability of capital. How was that possible if Keynesian policies were so successful?

In contrast to Keynes, Marx said that the key to understanding the capitalist mode of production lay in the nature of production to sell commodities on a market for profit. Profit was the key. Now capitalists have to use some of that profit to pay interest on loans or rent on property and, if these ‘rentiers’ (bankers and landowners) squeezed the profit-holding capitalist too far, sure, they could cause a crisis in investment. But even if interest rates are low or zero and even if rents are low or zero, there would still be crises, slumps and depressions. Why? Because rent and interest and profit come from surplus value, not the other way round.

Keynes and Tily say the crisis comes about through a lack of ‘effective demand’, namely an unaccountable fall in investment and consumption and this causes profits and wages to fall. Marx says: let’s start with profits. If profits fall, then capitalists would stop investing, lay off workers and wages would drop and consumption would fall. Then there would be a lack of effective demand, as Keynesians like to put it, but this would not be due to a drop in ‘animal spirits’, or ‘confidence’ (we often hear that phrase from economists, ‘a lack of confidence’), or even due to ‘too high’ interest rates, but because profits are down. The problem lies in the nature of capitalist production, not in the finance sector alone.

Policies designed to reduce interest rates, or even get some government spending going, namely Keynesian policies, would not avoid these slumps or even get recovery going. Indeed, more spending on welfare and unemployment benefits could drive up taxes and extra borrowing could drive up interest rates. And more government investment that replaced or encroached on private sector investment could be damaging to the profitability of capital. So Keynesian policies could even delay economic recovery.

Indeed, the austerity policies of most governments are not as insane as Keynesians think. Austerity policies are perfectly rational: they follow from the need to drive down costs, particularly wage costs, but also taxation and interest costs, and the need to weaken the labour movement so that profits can be raised. It is a perfectly rational policy from the point of view of capital, which is why Keynesian policies were never introduced to any degree in the 1930s.

Marx’s analysis shows that the capitalist system is not just suffering from a ‘technical malfunction’ in its financial sector (due to high interest rates), but has inherent contradictions in the production sector, namely the barrier to growth caused by capital itself. What flows from this is that the capitalist system cannot be reformed or corrected in order to achieve sustained economic growth without booms and slumps – it must be replaced. That is the ultimate policy action for the left.

1 comment:

even Keynes is too far left for the current crop of oligarchs

Post a Comment