by Michael Roberts

The debate among economists continues on whether the recent hike in

inflation rates in the major economies is due to a ‘supply shock’ or

‘pent-up consumer demand’; and related to that, whether the inflation

rise will be ‘transient’ or ‘permanent’.

Supply or demand? If prices rise, is it because supply is not rising

‘enough’ or demand is rising ‘too much’? That’s like the chicken and

egg argument. There is an answer to that conundrum. After all, the

chicken came first. Chickens evolved from previous species; their eggs

simply reproduce more chickens.

Similarly, I would argue that prices and price changes are determined

by changes in supply. Or more precisely by the value of and changes in

the value of commodities produced. Value determines price at the

highest level of abstraction. Demand for commodities follows from the

value produced and takes the form of money earned by workers (wages) and

appropriated by capitalists (profits).

In a capitalist economy, the price and value of an individual

commodity can diverge. Money is the representation of value but when

money is not in the form of another commodity like gold, then

non-commodity money can diverge from the value of the money commodity;

and prices do not then match the value in commodities. Prices in a

modern monetary economy are determined by the supply of value embodied

in their production and by the supply of non-commodity money. So price

inflation is supply-driven. Demand for commodities is determined by the

combined purchasing power of workers wages and capitalist profits – if

you like, these are the eggs produced by the chicken of value

production. These eggs are necessary for the production of more value

(more chickens), but they are still the result of previous chickens’

supply.

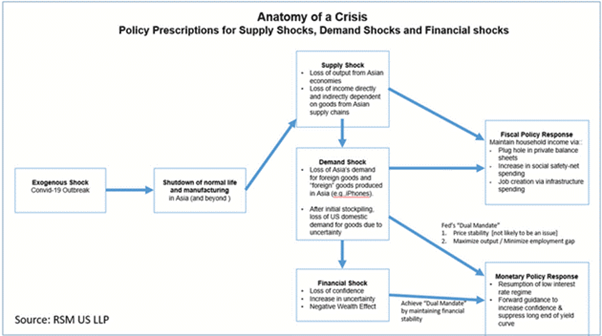

Where does this meandering on my part takes us? In my view, it helps

explain the causes of the current inflation rises. The COVID pandemic

slump was clearly a ‘supply shock’. Production collapsed with

lockdowns, workers were sent home or into hospital, transport and trade

shuddered to a halt; social activity and events were replaced by

isolation. That then reduced demand, even though in the advanced

capitalist economies, a major section of workers continued to get paid

or got government handouts.

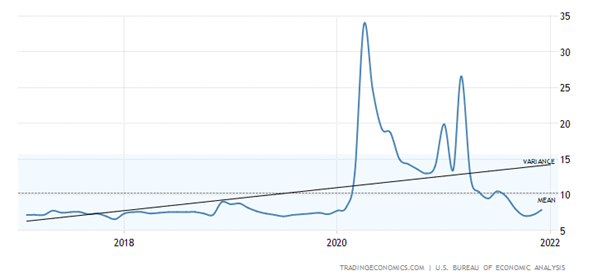

So household savings rose significantly during the slump of 2020.

US household savings as % personal disposable income

This has led some to argue that these savings are ‘pent-up demand’ released in the year of vaccinations and economic recovery in 2021 and this created ‘excessive demand’ that caused the rise in the prices of goods and services – with inflation rates not seen for over 40 years.

There is undoubtedly some truth in this explanation. But the ‘pent-up demand’ was the result of the previous supply shock and price rises have accelerated only because ‘pent-up supply’ has not followed. Also, much of the savings build-up was among the richer income groups, who could work from home and not spend much; unlike those in ‘essential’ services and transport and retail who are generally paid less and had to go to work.

Higher-income households and retirees are more likely to have increased their savings during Covid

So any increase in consumer spending is limited because those at the top of the income pyramid tend to save more than those at the bottom. Indeed, savings rates are back to ‘normal’ now.

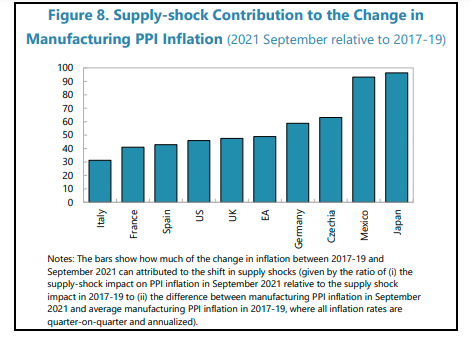

IMF economists have just released a paper that aims to measure the relative contributions of supply and demand to rising inflation in 2021. Globally, the economists reckon that “close to half of that upward swing (in inflation) came from the change in the supply shock component, which had mostly exerted downward pressure on manufactured-goods prices in the pre-pandemic years. The share attributable to supply shocks varies across individual countries; it is estimated at about half for the euro area, 60 percent for Germany and 45–50 percent in the United States and the United Kingdom, and about 40 percent for France and Italy”. Note the impact of supply shocks in Mexico and Japan.

I would argue

that this supply-side ‘shock’ is really a continuation of the slowdown

in industrial output, international trade, business investment and real

GDP growth that had already happened in 2019 before the pandemic broke.

That was happening because the profitability of capitalist investment

in the major economies had dropped to near historic lows, and as readers of this blog know, it is profitability that ultimately drives investment and growth in capitalist economies.

If rising inflation is being driven by a weak supply-side rather than

an excessively strong demand side, monetary policy won’t work.

Monetary policy supposedly works by trying to raise or lower ‘aggregate

demand’, to use the Keynesian category. If spending is growing too fast

for production to meet it and so generating inflation, higher interest

rates supposedly dampen the willingness of companies and households to

consume or invest by increasing the cost of borrowing. But even if this

theory were correct (and the evidence does not support it much), it

does not apply when prices are rising because supply chains have broken,

energy prices are increasing or there are labour shortages. As Andrew

Bailey, governor of the Bank of England, said: “Monetary policy will

not increase the supply of semiconductor chips, it will not increase

the amount of wind (no, really), and nor will it produce more HGV

drivers.”

Nevertheless, the monetary authorities and mainstream Keynesian

economists continue to emphasise ‘excessive demand’ as the main cause of

inflation. The hardline monetarists thus call for sharp rises in

interest rates to curb demand while the Keynesians worry about wage-push

inflation as rising wages ‘force’ companies to raise prices. As FT columnist and Keynesian Martin Wolf puts it “What

[central bankers] have to do is prevent a wage-price spiral, which

would destabilise inflation expectations. Monetary policy must be tight

enough to achieve this. In other words, it must create/preserve some

slack in the labour market.” In other words, the task must be

create unemployment to reduce the bargaining power of workers. Full

employment and wage increases are to be opposed. Wolf and BoE governor

Bailey claim this is to stop runaway inflation. In reality, it is to

preserve profitability.

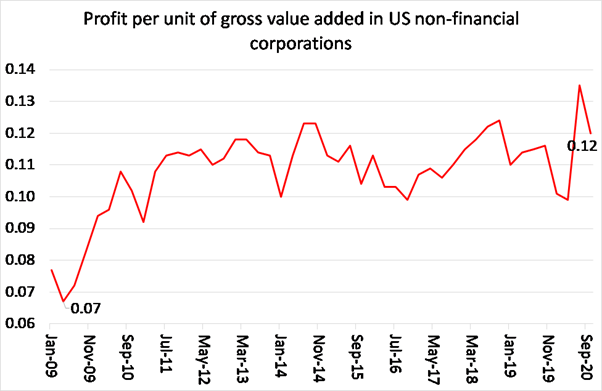

As I have shown in previous posts, there

is no evidence that wage rises lead to higher inflation. We are back

to the chicken and the egg. Rising inflation (chicken) forces workers

to seek higher wages (egg). Indeed, over the last 20 years until the

year of the COVID, US real weekly wages rose just 0.4% a year on

average, less even that the average annual real GDP growth of around

2%+. It’s the share of GDP growth going to profits that rose (as Marx

argued way back in 1865).

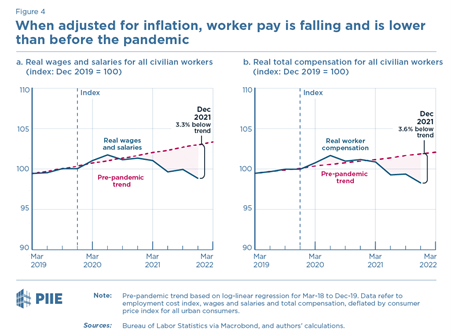

Throughout the recovery period from the pandemic slump, it is prices that have outstripped wage rises. As former White House economist, Jason Furman has shown, during the pandemic, US real wages (even after including benefits) have been falling and are now well below the pre-pandemic level.

Researchers at the Dallas Fed agree. They found that “real wages have been falling over the last six months… even if they got (as indeed they did) real wage gains earlier in the expansion.”

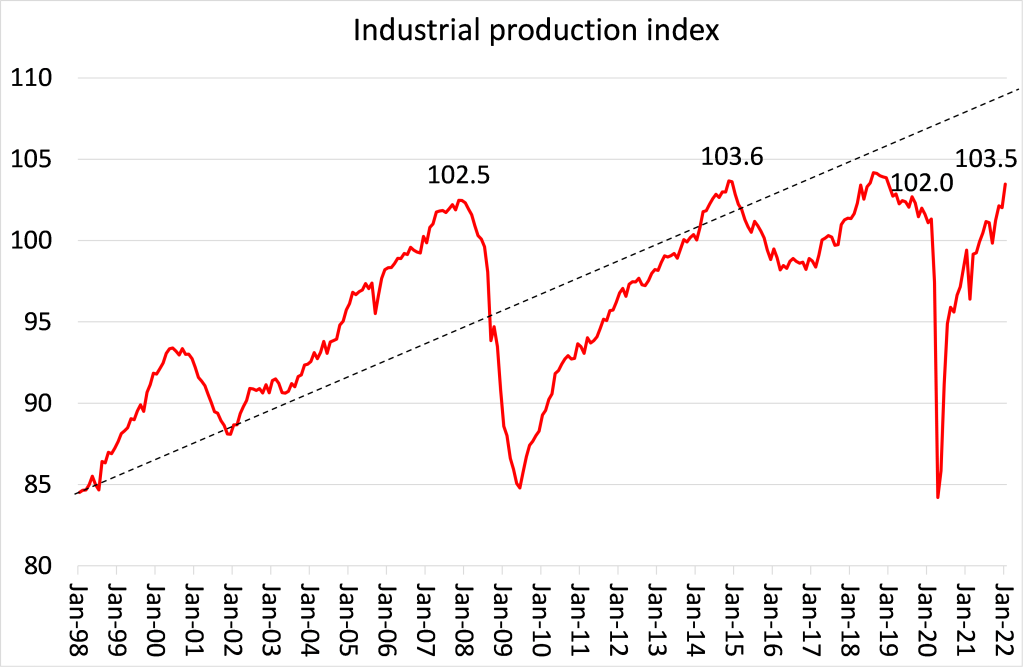

There are two other indicators that rising inflation rates are really due to supply ‘bottlenecks’ and not ‘excessive demand. First, industrial production (IP). In the US, the fastest recovering major economy, industrial output has jumped back in 2021 from the deep contraction of 2020. But the IP index is still no higher than seven years ago and only marginally higher than just before the Great Recession in 2008. The productive sectors of the US economy have been stagnating.

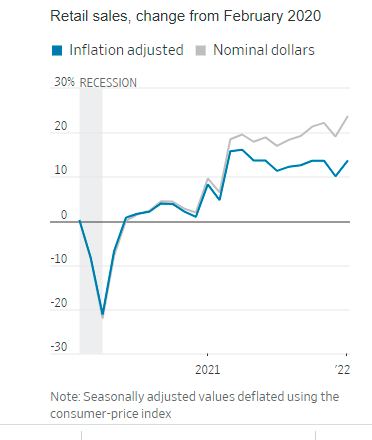

Then there is retail sales, supposedly a measure of consumer demand ,although retail sales cover only about 40% total consumer spending (leaving out spending on health, utilities and transport etc). The latest monthly figure for US retail sales was heralded as showing a dramatic boom in consumer spending. But when you account for inflation in food, energy and other retail goods, real spending was falling through 2021.

If rising inflation is really an indicator of weak supply and not strong demand, it means that monetary policy tightening (and the Fed is now planning sharp rises in its policy rate starting next month), will not curb inflation without pushing the US economy into stagnation or slump. There is a danger that the US economy is heading for a ‘Volcker moment’, when the Fed chief of the later 1970s hiked interest rates into double-digits to crush high inflation. That triggered a stock market ‘correction’ and the deep post-war recession of 1980-2. Just as now, profitability was at a post-war low, so the sharp rise in the cost of borrowing just led to a collapse in investment and eventually production.

Maybe the Fed will ‘chicken out’ of a Volcker move. If so, with supply remaining weak relative to demand, we can expect inflation rates to stay higher for longer

No comments:

Post a Comment