Last Thursday, the US-based global tech giants reported their quarterly earnings simultaneously. On the same day, the US economy recorded the biggest quarterly contraction in national output ever (-9.5% yoy or -32.9% annualised).

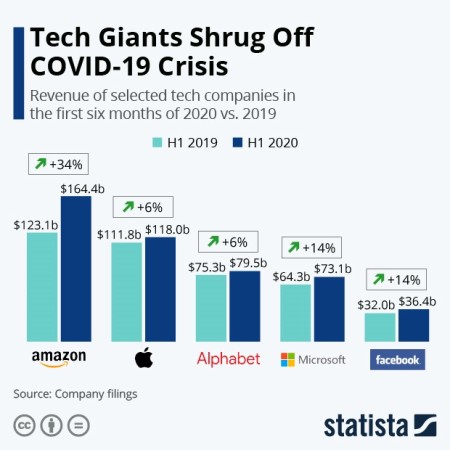

In contrast, the ‘fearsome foursome’: Alphabet (Google) – the world’s largest search engine; Amazon – the world’s largest online distributor; Apple – the world’s largest computer and mobile phone manufacturer; and Facebook – the world’s largest social media provider, posted double-digit revenue growth for the three months ended in June, raking in a combined $33.9 billion in profit in the second quarter alone. While the US and world economy have been plunged into the deepest slump since the 1930s by the lockdowns from the COVID-19 pandemic, the world’s most prominent tech companies have prospered.

Revenues are up across the tech board and the price of their shares (market cap) rose $178bn in the following day, taking their stock market value to $5trn, or 25% of US GDP. Amazon CEO Jeff Bezos saw the largest single-day increase in wealth ever recorded for any individual. In just one day, his fortune increased by $13 billion. On current trends, he is on track to become the world’s first trillionaire by 2026.

At the same time as these results came out, the fearsome foursome were ‘grilled’ by a US Congressional Committee about their nefarious practices in dealing with competitors; and their increasing ‘market power’ and ever-growing monopoly position in the most profitable sector of the US economy. The Judiciary Committee published 1300 documents that supposedly showed their attempts to crush competitors, buy them out or exclude them from markets.

Amazon’s Jeff Bezos, Apple’s Tim Cook, Google’s Sundar Pichai and Facebook’s Mark Zuckerberg

For example, Facebook chief Mark Zuckerberg mailed that he saw “acquisitions as an effective way to neutralise potential competitors”, and how many start-ups fear that if they reject a Facebook buyout he will go into “destroy mode” against them. Apparently, Google insiders worried about how to fend off competition on the way to erecting what critics called a “walled garden”. As one executive opined: “The open web we knew and loved is going away.” There is a mounting campaign to curb or break up these ‘super-star’ companies and end their monopoly market power.

But this is not new in the history of capitalism. Successful companies in new expanding fields of capitalist accumulation have grown from small to large and eventually to ‘monopoly’ positions: railways, oil, motor vehicles, finance and telecoms. In 1911, Standard Oil was broken up into 34 companies by Congress. Rockefeller ran the company as its chairman until his retirement in 1897. He remained the major shareholder and after 1911, with the dissolution of the Standard Oil trust into 34 smaller companies, he stayed as the richest person in modern history, as the initial income of these individual enterprises proved to be much bigger than that of a single larger company. Its successors such as ExxonMobil, Marathon Petroleum, Amoco, and Chevron are still among the companies with the largest revenues in the world.

In 1984, AT&T was the main ‘monopoly’ telecoms provider and so was broken up into seven regional companies. But AT&T continued to make huge profits as did its regional monopoly successors. The break-up of ‘market power’ made little difference to improving competition or productivity or, most important, labour incomes.

The ending of monopoly ‘market power’ will not turn round the low productivity of the US economy and its current collapse into a deep slump, or for that matter, reduce inequality of incomes or wealth in the US. Recent research by IMF economists found that the downward trend in the labour share of global income since the early 1990s was mainly due to ‘technological progress” as workers were replaced by labour-saving technology, particularly in so-called ‘routine occupations’. “The empirical analysis points to a dominant role of technology and global integration in this trend, although to different degrees between advanced and emerging market economies. Technological progress, reflected in the steep decline in the relative price of investment goods, has been the key driver in advanced economies, along with high exposure to routine occupations that could be automated, with global integration also playing a role, albeit a smaller one.” Rising inequality is the result of ‘normal’ capitalist accumulation and the appropriation of profit through the exploitation of labour and labour-saving technology.

And yet the concept of ‘market power’ persists in left economics as the dominant explanation of what is wrong with American capitalism and globally. Take this recent article in Jacobin by rising star economic journalist, Grace Blakeley. “Many of the world’s largest tech companies have become global oligopolies and domestic monopolies. Globalization has played a role here, of course — many domestic firms simply can’t compete with global multinationals. But these firms also use their relative size to push down wages, avoid taxes, and gouge their suppliers, as well as lobbying governments to provide them with preferential treatment.”

Blakeley argues that Amazon has become America’s largest company through ‘anti-competitive practices’ that have landed it in trouble with the European Union’s competition authorities. The working practices in its warehouses are notoriously appalling. And a study from last year revealed Amazon to be one of the world’s most “aggressive tax avoiders.” Part of the reason Amazon has to work so hard to maintain its monopoly position is that its business model relies on network effects that only obtain at a certain scale, argues Blakeley. Tech companies like Amazon make money by monopolizing and then selling the data generated from the transactions on their sites.

And the rising market power of a small number of larger firms has actually reduced productivity. “This concentration has also constrained investment and wage growth as these firms simply don’t have to compete for labour, nor are they forced to innovate in order to outcompete their rivals.”

Much of what Blakeley says here is true. Undoubtedly, much of the mega profits of the likes of Apple, Microsoft, Netflix, Amazon, Facebook are due to their control over patents, financial strength (cheap credit) and buying up potential competitors. Indeed, take the latest case. Microsoft is now in talks to purchase TikTok, which is owned by China’s ByteDance, with the aim of weakening this latest big rival to the super star companies. But the market power or monopoly explanation goes too far. Technological innovations also explain the success of these big companies.

Marx considered that there were two forms of rent that could appear in a capitalist economy. The first was ‘absolute rent’ where the monopoly ownership of an asset (land) could mean the extraction of a share of surplus value from the capitalist process without investment in labour and machinery to produce commodities. But the second form Marx called ‘differential rent’. This arose from the ability of some capitalist producers to sell at a cost below that of more inefficient producers and so extract a surplus profit – as long as the low cost producers could stop others adopting even lower cost techniques by blocking entry to the market, employing large economies of scale in funding, controlling patents and making cartel deals. This differential rent could be achieved in agriculture by better yielding land (nature) but in modern capitalism, it would be through a form of ‘technological rent’; ie monopolising technical innovation.

The history of capitalism is one where the concentration and centralisation of capital increases, but competition continues to bring about the movement of surplus value between capitals (within a national economy and globally). The substitution of new products for old ones will in the long run reduce or eliminate monopoly advantage. The monopolistic world of GE and the motor manufacturers did not last once new technology bred new sectors for capital accumulation. The oil giants are also now under threat from new technology. The world of Apple will not last forever.

Moreover, by its very nature, capitalism, based on ‘many capitals’ in competition, cannot tolerate any ‘eternal’ monopoly, a ‘permanent’ surplus profit deducted from the sum total of profits which is divided among the capitalist class as a whole. The endless battle to increase profit and the share of the market means monopolies are continually under threat from new rivals, new technologies and international competitors.

It’s certainly true that accumulation of capital takes the form of increased concentration and centralisation of capital over time. Monopolistic tendencies are inherent, as Marx argued in Volume One of Capital 150 years ago. However, ‘market power’ may have delivered rental profits to some very large companies in the US, but rents to the few are a deduction from the profits of the many. Monopolies redistribute profit to themselves in the form of ‘rent’ but do not create profit.

Kathleen Kahle and Rene Stulz found that slightly more than 100 firms earned about half of the total profit made by US public firms in 1975. By 2015, just 30 did. Now the top 100 firms have 84% of all earnings of these companies, 78% of all cash reserves and 66% of all assets. The top 200 companies by earnings raked in more than all listed firms, combined! Indeed, the aggregate earnings of the 3,500 or so other listed companies is negative – so much for most US companies being awash with profits and cash.

Profits are not the result of the degree of monopoly or rent seeking, as neo-classical and Keynesian/Kalecki theories argue, but the result of the exploitation of labour. Marx’s law of profitability is still central to a capitalist economy. Just before the COVID-19 pandemic hit the world economy, the major capitalist economies were already heading into a new recession, the first since the Great Recession of the 2008-9. The profitability of capital was near all-time lows; up to 20% of US and European companies were making only enough profit to cover the interest on their debt, with none to spare for new investment. Real GDP growth rates had dropped to their lowest rates since 2009 and business investment was stagnating. A global recession was coming; and it had little to do with the ‘market power’ of the FAANGs sucking up all the profits; much more to do with the inability of capital to exploit labour enough.

But that is something mainstream economics (both neoclassical and Keynesian) never wants to consider. For the mainstream, if profits are high, then it’s ‘monopoly power’ that does it, not the increased exploitation of labour. And it’s monopoly power that is keeping investment growth low, not low overall profitability. But if the ‘market power’ argument is accepted over a Marxian analysis of capital, then it implies that all that needs to be done is to weaken ‘market power’; or break up the monopolies and restore ‘competition’, not end the capitalist mode of production.

In her Jacobin article, Blakeley perceptively concludes that “The only real way to tackle these inequities is to democratize the ownership of the means of production, and begin to hand the key decisions in our economy back to the people.” Yes, but I’m not sure what she means specifically: workers on the boards – German style?; shares for employees?; regulation? All those measures have failed in the past to ‘hand key decisions back to the people’. In the article, Blakeley advocates a wealth tax. But such a tax would do little to ‘democratize ownership of the means of production’.

The real solution to the market power of the likes of Apple, Microsoft, Amazon, Facebook, Google, Netflix etc is to bring them into public ownership to be run by democratically elected boards and managers drawn from the workers in these companies, consumer bodies, trade unions and government. The fearsome foursome’s rule would then be ended. The billions they ‘own’ through their shares would be lost to them overnight. The nefarious practices of these companies would then be stopped and the social media scandals ended. And most important, the key services that these companies provide (as the pandemic has revealed only too well) can then be supplied (at low cost without adverts!) to meet social needs, not deliver mega profits.

No comments:

Post a Comment