We share this article from BloombergBusinessWeek Trump doesn't say too much about this. It also reflects some of the friction between sectors of the big bourgeois on this issue. There is serious differences between the tech sector and the energy sector for example. Bloomberg had a scathing article on Wilbur Ross in its last issue. Some of us around this blog were involved in a campaign against Ross and BP in Northern Indiana some years ago over the issue of taxes as they had convinced both Democrats and Republicans in the Indiana State Legislature to lower their taxes (Ross owned Ross Steel) at the expense of homepwners. We had a car caravan through three towns, a rally outide the BP refinery and ended at Whiting Town Hall

Ross is a real piece of work and is now Commerce Secretary.

Trump Trade Friction Overlooks America's Huge Surplus in Services

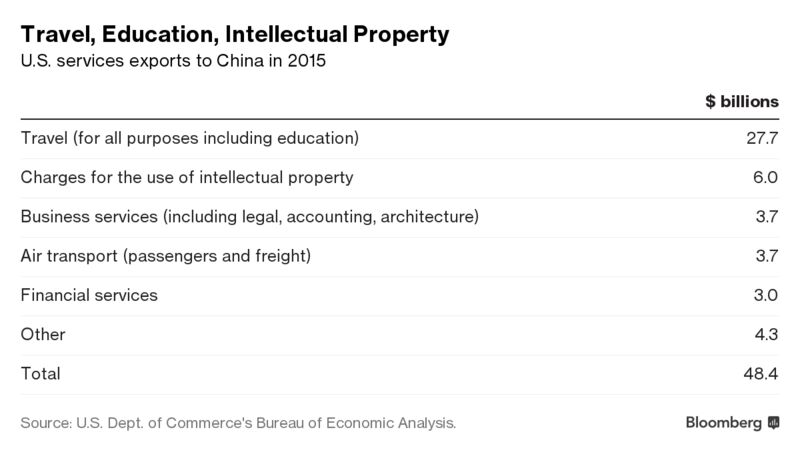

Intellectual property is a big export earner for the U.S.

by Jiyeun Lee

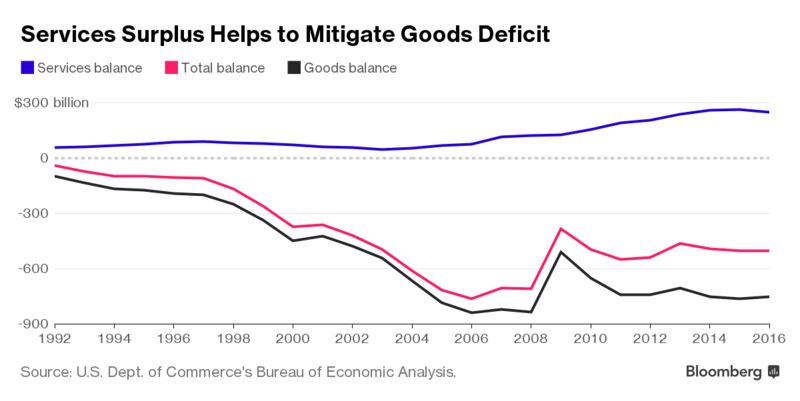

One thing that’s often missed in President Donald Trump’s complaints about the U.S. trade deficit is America’s $248 billion surplus in exports of services like education, banking and software.

While the services surplus is dwarfed by the goods deficit, it has doubled over the past decade and is an area where the U.S. could potentially keep making gains, given its highly skilled and educated workforce.

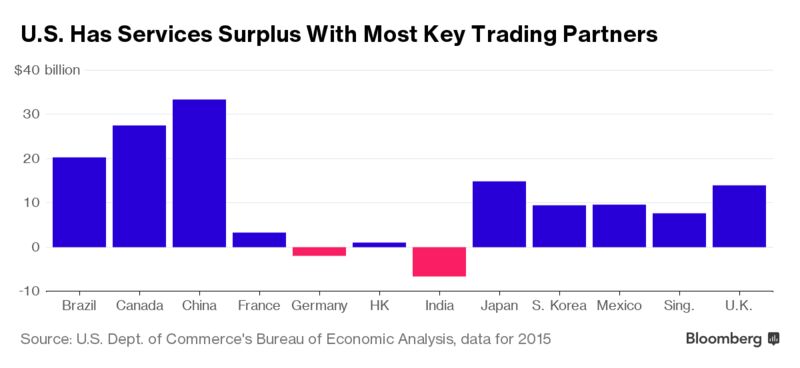

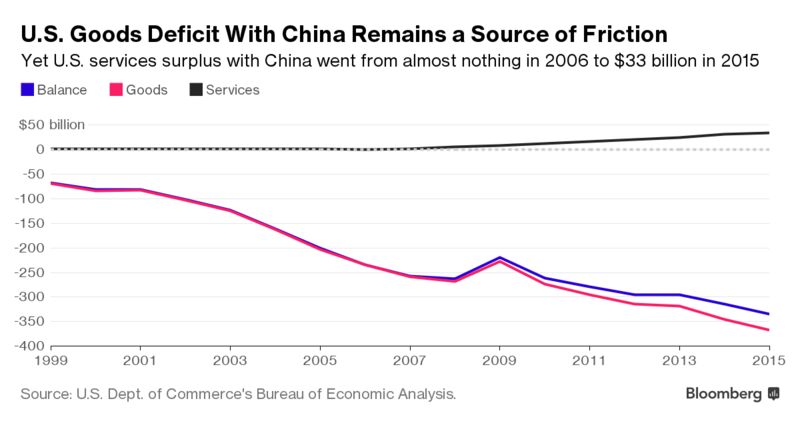

One risk is that an "America First" policy on goods could undercut the growing appetite of other nations for U.S. services. Countries like China, Japan and Mexico, which are under the spotlight for their massive surpluses in goods sales to the U.S., also have a large services deficit with the world's biggest economy.

This position reflects the global supply chain, where multinational companies channel manufacturing production to places like Asia to take advantage of things like lower wages, according to Louis Kuijs, head of Asia economics at Oxford Economics.

Trump’s efforts to bring back manufacturing may not be easy, as the supply chains have become sophisticated and created labor forces with specific skills that may not be easy to replicate, according to Kuijs.

Natixis’ Garcia Herrero said the Trans-Pacific Partnership, which Trump has rejected, would have benefited American services exports, and areas of key strength for the U.S. like Silicon Valley.

Their arguments hold little sway with the U.S. administration, and this doesn’t look likely to change any time soon.

Steve Bannon, chief strategist for the Trump admininistration, said at recent conference that the withdrawal from the TPP was "one of the most pivotal moments in modern American history." The government is working on new bilateral trading relationships that position the U.S. as a "fair trading nation" and start to bring jobs home, he said.

No comments:

Post a Comment