The imminent triumph of Donald Trump as the Republican candidate in the upcoming US presidential election is really worrying mainstream economists. Adair Turner was head of the UK’s financial regulation authority where he was a great success in stopping UK banks engaging in reckless speculation (joke!). He is a former vice-chairman of Merrill Lynch Europe and lectures at the London School of Economics.

He has now published a book, Between Debt and the Devil, in which he argues that to get the global economy going, central banks and governments must opt for ‘helicopter money’ i.e. central banks should credit every household bank account with several thousand dollars, euros or pounds, so that they can directly spend the cash and restore aggregate demand, boost output and encourage companies to invest for higher growth.

You can read his basic arguments and proposals here from a paper he presented last November at a special IMF conference in Washington. IMF- The Case For Monetary Finance – Adair Turner IMF Jacques Polak Nov 2015.pdf

I have discussed before the nature of helicopter money and its likely success in meeting Adair Turner’s aspirations – not much is the short answer. But nevertheless, action is needed by the ruling economic authorities, says Turner, because political extremism, as represented by Trump and other extreme left and right parties in Europe is an “inevitable consequence of a breakdown in capitalism”. At a conference on market economies in London, Turner said “I think it’s a huge issue for those of us who believe in a free-market economy and that free-market capitalism delivers for everybody. The blunt fact is that it is breaking down.” He did not say exactly when it ever worked for the majority.

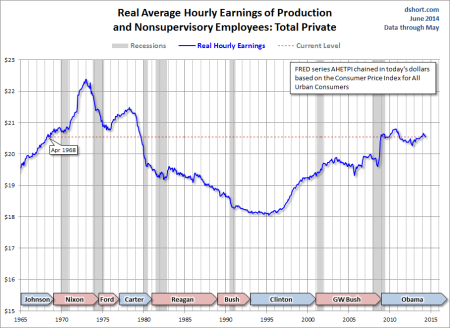

He pointed out that wage-earners on the lower end of the scale “have seen no increase in the US for 25-30 years” and in the Eurozone, wages “are significantly below where they were before the 2008 financial crisis”, he added. This was the driver of the loss of votes for the acceptable centre parties of capitalism in the major economies (and the rise of the ‘no vote’ party – I would add).

Capitalism’s failure to recover in the ‘normal’ way after the global slump of 2009 has led to a weakening of sensible rational mainstream policies. And “these things can become circular, and there’s a process of political uncertainty that creates worries about financial risk which leads to lower levels of investment,” Turner said. “The Trump development is the inevitable consequence of a system” that used to provide benefits for everyone (except that it has not for two generations in the US), but that doesn’t any more.

Keynesian Mark Thoma is a macroeconomist and econometrician and a Professor of Economics at the Department of Economics of the University of Oregon. Thoma is best known as a regular columnist for The Fiscal Times through his blog “Economist’s View”, which Paul Krugman called “the best place by far to keep up with the latest in economic discourse”.

Thoma is also worried. He reckons that “Capitalism is the best economic system yet invented for producing economic growth and satisfying the diverse desires of millions and millions of people. The key to its success is the ability to respond quickly to changes in economic conditions.” But it seems that capitalism comes with a cost: namely although the capitalist economic system is great, its politicians are not: “the failure of our political system to protect the people who pay the price of capitalism’s dynamism, a failure that has fuelled the economic insecurity, that’s helping the rise of Donald Trump and Bernie Sanders.”

You see, according to Thoma, capitalism allows new technology to thrive, but such technology is disruptive to many “it produces winners and losers. When new technology is adopted, some people who did nothing worse than pick the wrong industry to work in will lose their jobs, while others will see their incomes rise, sometimes spectacularly if the new technology serves an important, unfilled need.”

And globalization, although good, has also been disruptive. “Opening markets to international trade also produces winners and losers as markets adjust to the specialization of production across countries. International trade benefits consumers by making cheaper goods available, but it hurts people employed in industries producing goods that can be made at lower cost in other countries.”

Usually, Thoma reckons, the gains from new technology, free trade and global capital flows outweigh any losses for the majority (he does not show why), but apparently right now that is not happening. You see,“in reality, the gains haven’t been transferred from winners to losers. Instead, the gains have gone largely to the winners — often those at the top of the income distribution, which is an important factor behind the increasing income inequality the U.S. has experienced in the last few decades.”

Why this could have happened Thomas does not say, but in order to save capitalism, the best economic system ever, it seems that we need to interfere with the market and the process of capitalist production itself – a contradictory conclusion. What’s the answer? Well, we need better social insurance programs to redistribute income from the rich to the worse off. But the politicians of the right in the US and elsewhere won’t back such measures; indeed, they impose even worse policies: like tax cuts for the rich and reductions in welfare for the poor and vulnerable. “The result has been ever-growing unrest, the perception (perhaps reality, Thoma?)that the system is rigged against the working class and the populist movements the country is seeing today.”

However, Thoma does not give up on the system. If only the politicians would come to their senses. “We don’t have to abandon capitalism. Sharing the gains from America’s dynamic, flexible economy more widely won’t kill the goose that lays our golden — but unequally distributed — eggs.” Thus the problem is not the capitalist mode of production for private profit but the distribution of that production. You could ask Professor Thoma, if the former might not lead to the latter?

It should be the aim of mainstream economists to explain to the rich and powerful that if they carry on as they are, then they will provoke more “populist upswings” (which are bad news) and future changes to the system could be “more drastic and unpredictable” (god forbid).

So the answer for the likes of Turner and Thoma is to appeal to the rich to be more reasonable or the ‘great unwashed’ could become very unreasonable. Sounds like a plan (not).

No comments:

Post a Comment