Yesterday the US Federal Reserve’s monetary policy committee (FOMC) decided to keep its policy interest rate unchanged. The FOMC reckoned that global economic growth was slowing and it would be risky for the Fed to hike rates at this time because its policy rate sets the floor for all interest rates on bonds and mortgages and many of those overseas. The Fed had begun the process of hiking its policy rate last December, for the first time in nine years. That was because Fed Chair Janet Yellen was convinced that the US economy was recovering on a sustained basis. US unemployment had dropped back nearly to the level before the Great Recession and inflation had begun to rise. In other words, she thought the US economy was returning to ‘normal’ (finally after eight years!) and the Fed could also act ‘normally’ with its interest rate policy.

Then in January, economic data from around the world showed a serious falling away and there were fears that China would implode. That shocked the Fed’s committee. Now it appears divided between those like vice-chair Stanley Fischer who are worried that inflation is coming back and the Fed must act, and others on the committee who worry that if the Fed hikes too early and quickly it could cause a stock market crash and a new recession globally (see my post on that risk). The ‘doves’ won out this time and only one FOMC member voted for a hike. The FOMC now projects slower economic growth in 2016 than before (just 2%, similar to the latest projections from the UK government for Britain). It now waits for better economic news, but with bias towards more hikes later in the year.

This ‘dovish’ turn by the Fed is being adopted in spades by the other main central banks, such as the ECB and the BoJ. Indeed, both are engaged in the opposite process from the Fed, namely of cutting interest rates even into negative territory, the so-called NIRP. That’s because the Eurozone and Japanese economies remain close to stagnation and it is deflation that is the spectre haunting these economies, not inflation.

As I have explained in several previous posts, central bank monetary easing has been virtually the only policy adopted by governments around the world to try and get out of the current Long Depression. First, it was zero interest rates, then it was quantitative easing (printing money) and now it is NIRP (negative interest rate policy). And all have signally failed. Indeed, the actions of the BoJ in January and the ECB in March to introduce negative rates for banks holding cash reserves with them (designed to make banks lend and households spend their savings deposits) have not produced any positive result. On the contrary, instead of the euro and the yen falling in value, people are hoarding all their cash and these currencies have strengthened! Moreover, charging banks for holding cash at the central banks but not allowing them to cut deposit rates for their customers (as both the ECB and BoJ are doing) is destroying bank profitability. It’s been called the law of unintended consequences.

The next desperate measure on monetary policy is the idea of ‘helicopter money’, i.e. putting some of money in everybody’s bank accounts, so that they can spend it and get ‘demand’ going. Actually such printing of money for people to spend directly is similar to an income tax cut. It’s really fiscal stimulus but financed not by the issuance of government bonds, but directly by the printing of money by central banks.

This last extraordinary measure is balked at by government policy makers. That’s partly because they are not sure it will work in boosting aggregate demand as it has never been tried before. It may have unintended consequences. And it’s partly that central bank policy makers like Yellen, Draghi and Kuroda are hoping that the major economies are still going to recover without further measures. And it‘s partly because fiscal stimulus (government spending) is still frowned upon by governments because it means ‘piling on more debt’. Now the Keynesians say that there is nothing wrong with more debt. If it stimulates growth and incomes, then the debt costs can be financed and the debt eventually paid back. So growth through debt should not be resisted.

The Keynesians have advocated monetary easing for the last eight years with enthusiasm, but it has failed. Actually, as I have pointed out before, Keynes himself could have told his followers that monetary policy, even ‘unconventional’ measures like QE, would not work in a depression. Back in the early part of the 1930s depression, Keynes thought they would work. But by 1936 when he wrote his seminal General Theory of employment, money and interest, he recognised that just printing more money for banks, households and firms to spend was not doing the trick. It was necessary for governments to spend instead, run budget deficits (more spending than taxing) and borrow the extra cash, in order to employ workers directly and invest in infrastructure like bridges, roads etc to ‘pump-prime’ the capitalist economy.

And this is the cry of modern Keynesians now: more government spending, budget deficits and infrastructure investment to end ‘secular stagnation’. This is answer. Now the modern Keynesians are demanding that the ‘fiscal bogeyman’ is confronted. Barry Eichengreen wants action because “The world economy is visibly sinking, and the policymakers who are supposed to be its stewards are tying themselves in knots.” But “the problem is that monetary policy is approaching exhaustion. It is not clear that interest rates can be depressed much further”. For Eichengreen, the “solution is straightforward. It is to fix the problem of deficient demand not by attempting to further loosen monetary conditions, but by boosting public spending. Governments should borrow to invest in research, education, and infrastructure. Currently, such investments cost little, given low interest rates. Productive public investment would also enhance the returns on private investment, encouraging firms to undertake additional projects.”

The IMF and the OECD have joined the chorus for fiscal action. But so far, only one government is listening to this call. After its recent election victory in recession-hit Canada, the new PM Justin Trudeau has decided to run a government budget deficit in order to get out the slump that Canada has been in. Trudeau highlighted the importance of infrastructure spending and measures to bolster incomes. “My message to other government leaders is don’t fall into the trap that thinking that balancing the books” is an end in itself, he said. “It’s a means to an end.”

So the Canadian government plans to run a deficit of nearly C$30 billion ($22.3 billion) to be announced in the budget next week. But as Trudeau says, it won’t be much “There’s a limit on how much you can flow infrastructure dollars in a short time frame from a standing start.” A C$30 billion deficit would be just 1.5 percent of gross domestic product. That’s a swing of 1.4 percentage points from an expected deficit of 0.1 percent of GDP in the current year. Hardly a big deal.

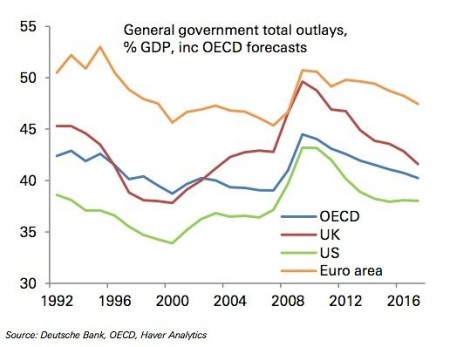

But apart from Canada, no other G7 government intends to widen its budget deficit and spend more (see graph below). Japan has run a huge deficit for the past seven years, but it is also trying to cut it back. Also, in its latest budget, the UK government reaffirmed its commitment to reducing the very high deficit reached in 2009 and turning it into a surplus by 2019, with yet another round of spending cuts.

Back in the 1930s, Keynes found to his chagrin that no government would adopt his policy of fiscal stimulus, not even US president Roosevelt with his ‘New Deal’. Roosevelt’s Treasury secretary Morgenthau was wedded to ‘balanced budgets’. So Keynes gave up in disgust. It is an irony of the post-1945 dominance of Keynesian economics up to the 1970s, that Keynes’ main policy plank was never applied by governments in the Great Depression, but only by war economies (and then by the direct control of the capitalist sector). Eichengreen says governments won’t act, and Keynes said the same in the 1930s, because they are locked into the ideology of the past and prejudices deeply rooted in history. These must be overcome “to end the current stagnation”. But is the refusal to adopt fiscal stimulus measures a product of outdated ideology, in other words, stupidity on the part of the likes of George Osborne in the UK or Wolfgang Schauble in Germany? Or is there a rational argument for avoiding running up large amount of deficits and debt by government in trying to get an economy going?

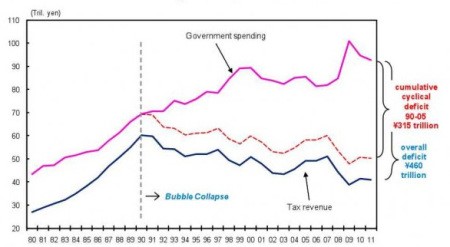

Well, yes. There are unintended consequences of fiscal spending by governments. It is supposed to boost demand and output. There has been much talk and argument about just how government spending would ‘multiply’ output. Views differ but the empirical evidence is not convincing. The experience of Japan also shows that running budget deficits and increasing government spending has done little to restore economic growth there. In the 1990s, there was considerable extra government spending and rising budget deficits (graph below), but these Keynesian prescriptions failed to revive the Japanese economy.

As I have argued in previous posts, the key to restoring economic growth is investment and that depends on profitability. In a predominantly capitalist economy, raising the profitability of capital has a much higher impact on growth (the Marxist multiplier) than government spending (the Keynesian multiplier). http://gesd.free.fr/carch12.pdf. Indeed, more government spending based on more debt or taxation can threaten the profitability of capital. A war economy removes the problem of profitability. During WW2, debt rocketed but the ‘socialisation of investment’ by governments ensured production went ahead while workers’ consumption was restricted through forced saving for the ‘war effort’. This is the extreme unintended consequence of war Keynesianism.

Even if governments heed the advice of the Keynesians and the IMF, short of war, fiscal stimulus will not succeed in restoring growth. Most policy makers in government may be resisting the calls of the Keynesians for ‘ideological reasons’, but the Keynesians are wrong anyway. The law of unintended consequences operates with fiscal as well as monetary policy.

No comments:

Post a Comment