The world’s stock markets are spiralling down. The US equity market has fallen 10% in the last month, a figure that is called a ‘correction’ in investor terminology. That’s not yet a crash or ‘bear market’, usually measured as a 20% fall. But it’s going that way.

Stock markets are diving because it seems that the big investors, banks and financial institutions globally, are worried that China is imploding and planning to devalue its currency hugely, thus driving down the rest of emerging economies, many of which are already in recession (Brazil, Russia, South Africa etc) and so will pull down the rest of world, the major advanced economies, into a global slump.

The economists of many investment banks, previously confident of economic recovery and lauding the great emerging market ‘miracle’, are now in a despond of despair. For example, analysts at the UK bank, the Royal Bank of Scotland (RBS) told clients to “sell everything” as stock markets could fall more than a fifth, while oil and other commodity prices could drop to a tenth of where they were just a year ago. RBS have noticed a ‘nasty cocktail’ of deflation in commodity prices, emerging economies in recession, capital flight by investors and rich citizens from China and other emerging economies and the prospect of higher dollar debt servicing costs as the US Federal Reserve carries out a planned hike in its policy interest rate this year.

I raised the prospect of an emerging market crisis two years ago and then again last summer and the risk that Fed hikes could induce a new economic recession globally. Now mainstream economics has caught on and is advising its clients (rich investors) to get out of the market. But exaggerated optimism has swung to its opposite. Is a global economic and financial collapse really imminent?

Most of the doom-mongers concentrate on what they see is the kernel of a global slump: China. The RBS says that “China has set off a major correction and it is going to snowball… the epicentre of global stress is China, where debt-driven expansion has reached saturation. The country now faces a surge in capital flight and needs a “dramatically lower” currency.” Albert Edwards at Societe Generale has been predicting a deflationary slump for the last five years of global economic recovery. Now he is convinced that the Chinese crisis will lead to a global slump. “The western manufacturing sector will choke under this imported deflationary tourniquet,” says Edwards.

But is this right? There is no question that the Chinese economy is in trouble. Economic growth has slowed from double-digit increases back in 2010-11 to under 7% on official estimates in 2015. Many reckon that this official figure is nonsense and, looking at the pace of electricity consumption and spending, economic growth is probably more like 4%, which in Chinese terms is almost a recession.

When the Great Recession broke, the Chinese government reacted to a serious decline in global demand for its exports by launching a major government spending programme to build bridges, cities, roads and railways. That kept the Chinese economy growing. Interest rates were slashed and local authorities were allowed to borrow in order to spend on housing and other projects. There was a major credit boom. As a result, Chinese non-financial debt rose from about 100 per cent to about 250 per cent of GDP. Total Social Financing, a broad measure of monthly credit creation, is now growing at nearly three times the rate of officially recorded money GDP growth, or more if you don’t believe the official GDP data.

The government was influenced by pro-capitalist economists in their ranks who have been continually arguing that the government must ‘open up’ the economy to foreign capital and private companies. The government should privatise the big state owned companies and banks, end capital controls and allow the Chinese yuan to become a freely fluctuating currency, it was argued. Indeed, just before the Chinese stock market and currency crash began, the government pushed for and got the Chinese yuan to be included in the IMF’s international reserve currency basket for the so-called SDR. In effect, the Chinese currency was now increasingly subject to the laws of the international currency markets and the economy was increasingly influenced by the law of value.

More debt, slower growth and an overvalued currency, now subject to speculation, has engendered a stock market crash and now rich Chinese and foreign investors are trying to get their money out of China or the yuan and convert it to dollars abroad. Capital flight, as it is called, is running at over $100bn a month, or about $1.2trn a year. Given that Chinese dollar reserves are about $3.3trn and around half of that is needed to cover imports, if capital flight continues at the current rate, Chinese dollar reserves will be exhausted in about 18 months.

The Chinese authorities have been unable to handle this financial crisis. By opening up their economy to currency and financial speculation, they created a Frankenstein that is now trying to kill them. First, they tried to weaken the yuan against the dollar to boost exports. But a weaker currency only encouraged rich Chinese and Chinese companies to switch even more into dollars, by legal and illegal methods. Then they tried to prop up the stock market with extra credit and by making state-owned banks buy stocks. But this only fuelled even more debt. Then they reversed these policies, causing a stock market crash and credit squeeze.

The seeming incompetence of the Chinese authorities and the continued capital flight have now convinced many Western capitalist economists that China will suffer a ‘hard landing’ or economic slump, capitalist-style, and this will add to already diving emerging economies and drive the world into slump.

But does a collapse in the Chinese stock market and fall in the value of the yuan mean an economic slump in China? China is not a ‘normal’ capitalist economy. The power of the state remains dominant in industry, in the financial sector and in investment. Yes, the Chinese authorities have opened the economy to the forces of capitalist value, particularly in trade and capital flows, and in so doing have made China much more vulnerable to crises. This is something that I forecast back in 2012: “if the capitalist road is adopted and the law of value becomes dominant, it will expose the Chinese people to chronic economic instability (booms and slumps), insecurity of employment and income and greater inequalities.” And this has been the result of Chinese leaders succumbing to the pressures of the World Bank and others to ‘liberalise’ the financial sector and become part of the international financial ‘community’.

Yes, the world is slowing down. The Long Depression, as I have described it, is still operating. Only last week, the World Bank pointed out that developing economies grew just 3.7 per cent in 2015, the slowest since 2001 and two percentage points below the average 6.3 per cent growth during the boom years between 2000 and 2008. And IMF chief Christine Lagarde reckoned that developing countries face ‘new reality’ of lower growth. “Growth rates are down, and cyclical and structural forces have undermined the traditional growth paradigm. On current forecasts, the emerging world will converge to advanced-economy income levels at less than two-thirds the pace we had predicted just a decade ago. This is cause for concern.” A 1 per cent slowdown in emerging markets would cause already weak growth in advanced countries to slow by about 0.2 percentage points, Ms Lagarde said.

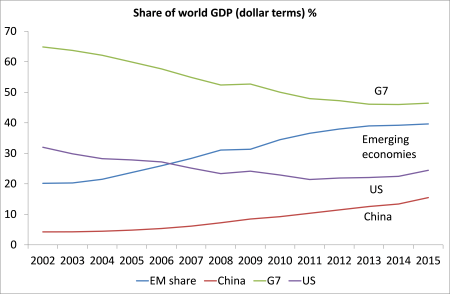

But will the slowdown in China and the slumps in major emerging economies bring down the world? The argument for that to happen is based partly on the claim that emerging economies are now the drivers of the world economy. Emerging economies are 57% of world GDP and have outstripped the advanced capitalist economies, according to IMF figures. But this is a wild exaggeration because the IMF uses what is called a purchasing power parity (PPP) measure. This measures what you can spend or invest in local currency in any country. That exaggerates the national output of emerging economies compared to measuring GDP in dollars as is necessary in world trade and investment.

In dollar terms, emerging economies have only 40% of world GDP. Sure, that share has doubled since 2002, but it is still the case that just the top seven major capitalist economies have a greater share than all the emerging economies, with 46%. And in the last two years, that share has stabilised. While China’s share of world dollar GDP has rocketed from just 4% in 2002 to 15% now, it is still much smaller than the share of world GDP for the US. That has fallen from 32% in 2002 to 24% now.

These figures show the tremendous expansion of the Chinese economy. But they also show that the US remains the pivotal economy for a global capitalist crisis, particularly as it dominates in financial and technology sectors. In 1998, the emerging economies had a major economic and financial crisis but it did not lead to a global slump. In 2008, the US had a biggest slump in its economic post-war history and it led to a global recession, the Great Recession. In my view, this weighting still applies.

I have discussed the prospects of a new US economic recession in several previous posts. What matters is not the level of interest rates, whether they are too high or too low relative to some ‘equilbrium natural rate of interest’ that US mainstream economists are now arguing about (more on that in a future post), but what is happening to corporate profits and investment. Investment drives employment and incomes and thus economic growth.

I have presented evidence from my research and from others that the profitability of capital and corporate profits generally lead business investment with a lag of 12-18 months, up and down. Currently global corporate profits (a weighted average of US, UK, Germany, Japan and China) have turned negative and US corporate profits are now also falling (on a year on year basis). That suggests that business investment, which has been expanding at about a 5% rate in the US, will start to drop too within a year or so. If that happens, then the US will likely head into recession. But it won’t be China or emerging economies that will be decisive.

No comments:

Post a Comment