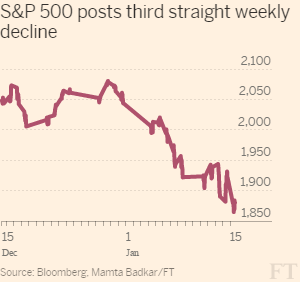

On Friday, US stock markets fell to their lowest level since August 2015 in its third consecutive weekly decline.

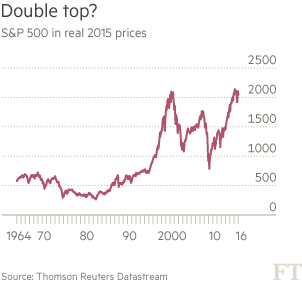

In many previous posts, I have argued that stock markets are really still in a long-term secular ‘bear market’ of decline. Stock market values follow the profitability of capital and, as I have argued in other posts, the profitability of US capital has not yet reached the bottom of its current downwave that, in my view, began in 1997, with various upturns (2001-6, 2009-13). If that is correct, then the US stock market (and others as well) have yet to reach the bottom of this secular bear market that began in 2000 with the dot.com hi-tech bubble bust.

This latest stock market collapse has taken place within weeks of the decision of the US Federal Reserve’s monetary policy committee (FOMC) deciding for the first time for nearly ten years to raise its policy rate that sets the floor on interest rates in the US and abroad. At the time, Fed chief Janet Yellen said that the US economy “is on a path of sustainable improvement.” and“we are confident in the US economy”, even if borrowing rates rise.

As I commented at the time “This was ironic because just before the Fed hiked its interest rate, the figures for US industrial production in November came up and they showed the worst fall since December 2009 at the end of the Great Recession.” Since then we have had further poor data on the US economy with weak retail sales and industrial production for December, suggesting that US real GDP growth in the last quarter of 2015 was likely to be as low as just 1%.

Stock markets falling and the US economy slowing, with the rest of the world stagnating and China apparently imploding: this is putting egg on the face of Janet Yellen, as the UK Guardian’s economic correspondent put it, Larry Elliott.

I have argued that there was a serious danger that the US Fed would repeat the mistake it made in 1937 during the last Great Depression of the 1930s. Then it concluded that the US economy had sufficiently recovered to enable it to start raising interest rates. Within a year, the economy was back in a severe recession that it did not recover from until America entered the world war in 1941.

So should the Fed be hiking interest rates at this time? This question was debated at the recent annual meeting of the American Economics Association (ASSA 2016) by the great and the good of mainstream economics. There were two sorts of the responses to this question from mainstream economics.

The first was to ignore the fact of the weak global and US economic recovery or argue that it didn’t matter. At the main debate on the issue among leading luminaries of the mainstream, Martin Feldstein, former economics advisor to Bush, reckoned that the US economy was recovering well with unemployment down and incomes rising. So there was nothing to worry about.

John Taylor, leading economist from Stanford University, took a different tack. Yes, the US economy was very weak but this was the fault of economic and monetary policies of the current US administration and the Federal Reserve. What was needed was to reduce regulation of the banks and large companies so they can grow and for the Fed to end its cheap money policy. Let’s just get back to business as usual and things will be fine. Taylor appeared oblivious to the fact that it was the failure to regulate the banks and financial system or to stop the introduction of speculative financial instruments that contributed to the global financial crash in the first place!

But the main response of the other debaters at the mainstream meeting was to conclude that we just don’t know why the economic recovery was so weak and now seems to be faltering. Vice chair of the Fed, Stanley Fischer, offered several possible reasons, but said he did not know which was right. Fischer was worried that the ‘equilibrium rate of interest’, (now called R*) where savings and investment are matched with full employment and moderate inflation looked very low, as inflation was near zero. This was another way of saying that the equilibrium rate could be ‘zero bound’ and thus the economy was in some form of ‘secular stagnation’, as argued by Keynesians like Larry Summers.

But Olivier Blanchard, former chief economist of the IMF, ever the optimist, offered Fischer a positive answer. Actually, the US economic recovery was beginning to look normal, after all. You see, the infamous Phillips curve of the 1970s, namely that when unemployment fell, inflation would rise, was still operating weakly. So as labour markets tightened, inflation would rise and the Fed would be justified in raising its policy rate as it had started to do.

I’ve discussed before this ‘equilibrium rate of interest’ idea (drawn from the work of neoclassical monetarist, Knut Wicksell). Both Keynes and Marx looked, not to a concept of a ‘natural rate of interest’ but to the relation between the interest rate for holding or lending money to the profitability (or return) on productive capital. Indeed, so did Wicksell. According to Wicksell, the natural rate is “never high or low in itself, but only in relation to the profit which people can make with the money in their hands, and this, of course, varies. In good times, when trade is brisk, the rate of profit is high, and, what is of great consequence, is generally expected to remain high; in periods of depression it is low, and expected to remain low.” But there was no mention of this relation between R* and the profitability of capital from the likes of Fischer or Blanchard at ASSA.

Another view is that of Austrian school of economics that argues that the easy money policy of the Fed and other central banks, including the use of quantitative easing (QE), i.e. ‘printing money’, has only fuelled the stock market and bond boom that is now bursting and distorted the allocation of investment into productive sectors. This malinvestment must be quashed with a strong dose of monetary tightening to get interest back into line with the Wicksellian ‘natural equilibrium’.

This Austrian view has been promoted by the economists of the international central bankers association, the Bank of International Settlements (BIS). The BIS economists reject the Keynesian view of ‘secular stagnation’ that must be overcome by more monetary and fiscal stimulus. That is just making things worse, in their view. They have done several studies to argue that what causes crises is excessive credit leading to malinvestment and financial bubbles that burst. Their latest study of recessions in 22 rich countries dating back to the late 1960s claims just this. It’s not a lack of demand that ‘causes’ economic crises under capitalism as Keynesians like Paul Krugman, Larry Summers or Brad DeLong argue, but malinvestment in the supply-side of the economy caused by too much debt.

Returning to Wicksell, the BIS economists reckon that if real interest rates (that’s after inflation is deducted) are held too low (i.e. below the ‘natural rate’ that equates savings and investment in the ‘real economy’), then credit bubbles and malinvestment ensue. And rates are too low. They are way into negative territory, not seen since the first post-war international slump of 1974-5.

The BIS reckons the Fed is right to hike interest rates, but what is wrong is that they have taken too long to do so. Now the economy will have to go through ‘cold turkey’ or ‘creative destruction’ (to use the phrase of early 20th century Austrian economist, Joseph Schumpeter) to clear the system of excessive credit and unproductive investment. In other words, another slump.

In a way, nothing has changed in the debates of the 1930s between the Keynesians who blame a lack of demand for the depression (with no real explanation of why demand slumped) and the Austerians (Austrians and monetarists like Milton Friedman) who blame excessive credit and the interference of central banks and governments in the ‘natural’ workings of the market.

Once again I have to trot out my hobby-horse on the debate within mainstream economics on whether the cause of the Great Recession and subsequent depression can be laid at the door of the lack of demand (Keynesian) or too much debt (Austrian). Neither theory has a place for the profitability of capital in an economy that yet has a mode for production based on making a profit!

Yes, in a slump, there is a lack of demand (capitalists cut investment and households stop spending). But that is a description of a slump, not an explanation. Yes, too much debt can provoke a financial crisis and weigh down on future investment. But why and when does debt or credit, a necessary part of capital accumulation, become ‘too much’?

The Marxist answer, in my view, is that debt becomes too much when it can no longer be serviced because the profits from productive investment become insufficient to sustain it. And demand becomes inadequate when the profits from investment drop so much that capital stops employing labour and closes down companies and reduces the utilisation of plant and equipment.

Another irony of the debate within the mainstream at ASSA was a session by the so-called Real Business Cycle (RBC) theorists, a school of neoclassical macroeconomists, who deny that crises are due to a lack of demand or a liquidity trap, where even zero interest rates do not revive an economy, as Keynesians argue. Steve Williamson of the Federal Reserve Bank of St Louis, along with others, presented a paper in which they argued that the concept of secular stagnation caused by a liquidity trap and that the equilibrium rate of interest was very low, was nonsense.

These RBC theorists reckoned that low interest rates were not an indicator that the US economy was in stagnation and so hiking them would not cause a new recession. Don’t look at interest rates, they said, look at the profitability of corporate capital. That is what matters. And that is at its highest for 30 years.

“While many authors have documented the low and declining returns on government debt, these returns bear little resemblance to the returns on productive capital: The latter is a direct measure and a much better indicator of adequate private investment opportunities and has been rising for the past five years. Summers (2014) and others have articulated the secular stagnation hypothesis based on insufficient aggregate demand: The evidence on investment strongly suggests otherwise. Indeed, the private sector has undertaken large capital outlays since the end of the recession. The takeaway here is that the current recovery is not an example of secular stagnation. The evidence on investment and returns on productive capital shatter the essential components of the secular stagnation hypothesis.”

In my view, the RBC theorists are right that “the returns on productive capital” are a much better indicator of the state of the economy than interest rates and the unproductive debate on what is the right rate of interest. But they are wrong in arguing that all is fine because profitability has never been higher. As this blog and other Marxist authors have shown, US and global profitability is not at its highest but near its lows since 1945. And this is especially the case with the profitability of productive assets (ie excluding finance and real estate).

Yes, there was a recovery of profitability in the neo-liberal period after the early 1980s, but it was limited and came to an end by the end of century. The last 15 years or so has been a profitability downwave (with short rallies). It is because of this downwave (and excessive debt that has accompanied it) that capitalism has failed to get out of the long depression. The current stock market collapse is an indicator of this and perhaps heralds the next leg down in the global economy, whether the Fed hikes again in 2016 or not.

No comments:

Post a Comment