Part 1

Last May, at the Marxist Muss conference in Berlin, I debated with Professor Michael Heinrich on whether Marx had a coherent theory of crises under capitalism that could be tested empirically. Heinrich’s view, best expressed in an article he had written for Monthly Review Press in 2014, was that Marx did not have a coherent theory of crisis and, anyway, it cannot be tested as we only have official capitalist statistics. For something to read during this ‘Xmas week’, here is a revised version of my speech in that debate. The first part deals with the question of whether Marx had a coherent theory of crises or not.

Why do we care about the theory of crises?

Those active in the struggles of labour against capital internationally may wonder why some like me spend so much time turning over the ideas of Marx and others on why capitalism has regular and recurrent slumps and financial crashes. We know they do, so let’s just get on with ending capitalism through struggle and put aside the minutae of theory.

Well, there is good reason to understand the theory, because good theory leads to better practice. Yes, we know that capitalism has regular and often deep economic crises. These cause huge damage to people’s livelihoods and stop human social organisation moving towards a world of abundance and out of scarcity and toil. And crises are indications of the contradictory and wasteful nature of the capitalist mode of production.

Before capitalism, crises were products of scarcity, famine and natural disasters. Now they are products of a profit-making money economy; they are man-made and yet appear to be out of the control of man; a fetishism. Above all, crises show that capitalism is a failing system despite the great strides in the productivity of labour that this mode of production has generated in the last 200 years or so. It will have to be replaced if humankind is to progress or even survive as a species. So it matters.

Did Marx have a coherent theory of crisis?

What is it? It is a matter of intense debate among Marxists. There are various interpretations. Crises of capitalist production are due ‘underconsumption’, a lack of spending by workers who do not have enough to spend; or due to ‘disproportion’, the anarchy of capitalist production means that production in various sectors can get out of line with others and production can just outstrip demand; or it’s the lack of profitability in an economic system that depends on profit being made for private owners in order for investment and production to take place. In my view, the latter argument is the one that is both the best interpretation of Marx’s theory and also the one that is logical and fits the facts.

Some argue that Marx did not have a coherent theory of economic crises, and that was especially the case with Marx’s law of profitability. The argument goes that a reading of Marx’s works: Capital, Theories of Surplus Value and the Grundrisse, shows that Marx’s law of the tendency of the rate of profit to fall is inconsistent and illogical.

For example, the law argues that the value of means of production (machinery, offices and other equipment) will, over time, rise relative to the value of labour power (the cost of employing a labour force) – a rising organic composition of capital, Marx called it. As value (and profit) is only created by the power of labour, then the value produced by labour power will, over time, decline relative to the cost of investing in means of production and labour power. The rate of profit will tend to fall.

But some Marxist critics say that this assumes that rate of surplus value (profit relative to the cost of employing labour power) will be static or rise less than the organic composition of capital. And there is no logical reason to assume this – indeed, the very rise in the organic composition will involve a rise in the rate of surplus value (to raise productivity), so the law is really indeterminate. We don’t know whether it will lead to a fall or a rise in the rate of profit.

But this is to misunderstand the law and how Marx posed it. The law ‘as such’ is that a rising organic composition of capital will rise and, assuming the rate of surplus value is static, the rate of profit will fall. But this is only a ‘tendency’ because there are ‘ countertendencies’, including a rising rate of surplus value, the cheapening of the value of means of production, wages being forced below the value of the labour power, foreign trade and fictitious profits from financial speculation. But these are ‘countertendencies’, not part of the ‘law as such’ precisely because they will not overcome the law (the tendency) over time.

As Marx said: “They do not abolish the general law. But they cause that law to act rather as a tendency, as a law whose absolute action is checked, retarded and weakened by counteracting circumstances.… the latter do not do away with the law but impair its effect. The law acts a tendency. And it is only under certain circumstances and only after long periods that its effects become strikingly pronounced.”

Marx argues that the law is based on two realistic assumptions: 1) the law of value operates, namely that value (and surplus-value) is only created by living labour and 2) capitalist accumulation leads to a rising organic composition of capital. These assumptions (or ‘priors’ in modern statistical language) are not only realistic: they are self-evident.

First, the law of value. The production of what Marx called ‘use values’ (things and services we need) is necessary to create value. But even a child can see that nothing is produced unless living labour acts. “Every child knows a nation which ceased to work, I will not say for a year, but even for a few weeks, would perish.”, Marx to Kugelmann July 11, 1868.

The rising organic composition of capital is also self-evident. From hand tools to factories, machinery, space stations, there is a huge increase in labour productivity under capitalism as a result of mechanisation. Yes that creates new jobs for living labour but it is essentially a labour-shedding process. While each unit of a new means of production might contain less value (due to the lower price of production of that technology) than a unit of an older means of production, usually the old is replaced by new and different means of production, or by a new system of means of production that contains more total value than the value of the means of production they have replaced.

As Marx explains in the Grundrisse: “What becomes cheaper is the individual machine and its component parts, but a system of machinery also develops; the tool is not simply replaced by a single machine but by a whole system… Despite the cheapening of individual elements, the price of the whole aggregate increases enormously”. As Marx put it: ‘It would be possible to write quite a history of the inventions made since 1830, for the sole purpose of supplying capital with weapons against the revolts of the working class.’ (Marx, 1967a, p. 436).

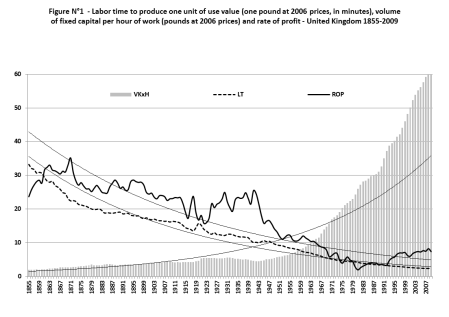

Higher productivity is not the aim of capitalist investment; it is higher profit. And to achieve that, capital needs higher productivity and labour-shedding new means of production. Was Marx right that capitalist investment leads to a higher organic composition of capital over time? He sure was. Look at this graph.

It shows a steady rise in the value of means of production (machinery etc) relative to the value of labour (measured in labour time) in the US since 1947. It also shows rising productivity (the labour time taken to produce one unit of things or services – LT). This is for the UK since 1855, as measured by Esteban Maito). So we have a rising organic composition of capital (VKxH) and a rising productivity of labour (falling LT) and a decline in the rate of profit over time (ROP). This is Marx’s law as such.

There are counter-tendencies but they do not overcome the tendency, the law as such, indefinitely. Why? Well, first, there is a limit to the rate of surplus value (24 hours) and there is no limit to the expansion of the organic composition of capital. Second, there is a ‘social limit’ to a rise in the rate of surplus value, namely labour (workers’ struggles) and society (social legislation and custom) set a minimum ‘social’ living standard and hours of work etc. This is the essence of class struggle under capitalism.

Did Marx drop his law of profitability as a theory of crises?

In a letter to Engels as late as 1868, over ten years after he first developed the law, Marx said that the law “was one of the greatest triumphs over the asses bridge of all previous economics”.?

But many Marxist critics reckon that Marx dropped this law as relevant as he did not seem to refer to the law after he expounded it in the late 1860s and looked more at the role of credit in crises (as Keynes and modern heterodox economists now do). Moreover, Engels, in editing Marx’s manuscripts after his death into Volumes 2 and 3 of Capital, made far too much of Marx’s law; indeed distorting Marx’s views on this.

Back in 1978, Jerrold Seigel had a look at the manuscripts. Yes, Engels made significant editorial changes to Marx’s writing on the law as in capital Volume 3. He divided it into three chapters 13-15; 13 was ‘the law’; 14 was ‘counteracting influences’ and 15 described the ‘internal contradictions’ (the combination of the tendency and countertendencies). Engels shifted some of the text into Chapter 13 on the ‘law as such’ when in Marx’s manuscript they came after the counteracting factors in Chapter 14. But in doing so, Engels does not overemphasise the importance of the law – on the contrary, Engels actually makes it appear that Marx balances the countertendencies in equal measure with the law as such, when the original order of the text reemphasises the law after talking about counter-influences. So, as Seigel puts it: “Engels made Marx’s confidence in the actual operation of the profit law seem weaker than Marx’s manuscript indicates it to be.” (Seigel, Marx’s Fate: The Shape of a Life, Princeton, Princeton University Press, 1978, p339 and note 26).

Fred Moseley and Regina Roth recently introduced a new translation into English of Marx’s four drafts for Volume 3 by Ben Fowkes, where Marx’s law of profitability is developed and shows how Engels edited those drafts for Capital (Moseley intro on Marx’s writings). Moseley concludes that the much maligned Engels did a solid job of interpreting Marx’s drafts and there was no real distortion. “One can, therefore, surmise that Engels’ interventions were made on the basis that he wished to make Marx’s statements appear sharper and thus more useful for contemporary political and societal debate, for instance, in the third chapter, on the tendency of the rate of profit to fall.”

From 1870, Engels had moved from Manchester to London. So Marx and he met together as a matter of routine, usually daily. Discussions could go on into the small hours. Marx’s house lay little more than 10 minutes walk away … and there was always the Mother Redcap or the Grafton Arms. As late as 1875, Marx was playing with calculations of the rate of surplus value and the rate of profit. If Marx had really dropped the law as his most important contribution to understanding the contradictions of capitalism, would he not have mentioned it to Engels?

In the second part of this blog post, I shall look at the empirical support for Marx’s law of profitability as a theory of crises under capitalism.

No comments:

Post a Comment