The Bank of England chief economist, Andy Haldane, has often been ‘off message’ when it comes to an analysis of the global financial crash, the banking system and economic policy. Back in 2013, he argued that about the value of the financial sector to an economy. “In what sense is increased risk-taking by banks a value-added service for the economy at large?” He answers, “In short, it is not.” And this is the chief economist of the Bank of England speaking.

Now he has stepped out of line with the prevailing view that the BoE should be hiking rates to follow any move by the Fed. Indeed he reckons the Bank of England should consider cutting rates to the bone and doing even more than applying quantitative easing (QE) ie printing money to increase the amount of credit in banks.

Why? Well, Haldane says that the crises in Greece and now China are not chance events or “lightning bolts from the blue. Rather, they are part of a connected sequence of financial disturbances that have hit the global economic and financial system over the past decade..” Indeed, “recent events form the latest leg of what might be called a three-part crisis trilogy. Part one of that trilogy was the ‘Anglo-Saxon’ crisis of 2008-09. Part two was the ‘euro-area’ crisis of 2011-12. And we may now be entering the early stages of part three of the trilogy, the ‘emerging market’ crisis of 2015 onwards.”

Haldane throws some doubt about the efficacy of QE in restoring the progress of the major capitalist economies since 2009. It may have worked for the UK, he says: “QE appears to have had a reasonably powerful and timely”. However, “existing empirical studies point to wide margins of error around QE ready-reckoners ..The key micro-economic point is that these uncertainties are inherently greater for QE than interest rates.” In other words, we don’t really know if QE works; cutting interest rates works better.

That doubt was reinforced recently by Stephen Williamson,vice-president of the Federal Reserve Bank of St Louis and the US top expert on monetary policy. He has just issued a study in which he concludes : “There is no work, to my knowledge, that establishes a link from QE to the ultimate goals of the Fed – inflation and real economic activity. Indeed casual evidence suggests that QE has been ineffective.”

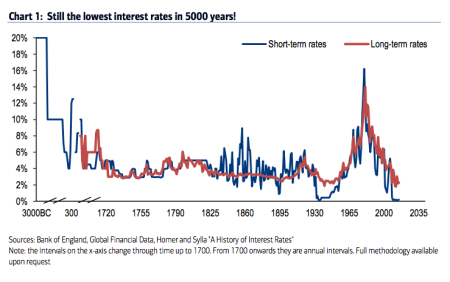

The problem is that interest rates are already close to zero and are going to stay there, ‘zero bound’, to use the jargon.

So Haldane proposes that central banks needed to apply even more innovative techniques to support the weak global capitalist economy. “If global real interest rates are persistently lower, central banks may then need to think imaginatively about how to deal on a more durable basis with the technological constraint imposed by the zero lower bound on interest rates.” Haldane proposes that perhaps governments should consider abolishing cash (notes and coins). This would stop people putting money under mattresses. Then central banks could adopt ‘negative’ interest rates. In other words, people would be charged for holding deposits in banks. With these measures, people would be forced to spend, invest or speculate, so boosting ‘demand’ in the ‘real economy’. In a way, this would a ‘permanent QE’: “part of the monetary policy armoury during normal as well as crisis times – a monetary instrument for all seasons.”

One problem with all these ‘innovations’ is that ‘conventional QE’ has proved not only ineffective in boosting the ‘real economy’, it is also downright biased towards more inequality of wealth and income. As Frances Coppola pointed out in a recent blog post: “In 2013, the Bank of England admitted that the principal beneficiaries were asset holders, particularly those in the top 5% of the income distribution. By pushing up a range of asset prices, asset purchases have boosted the value of households’ financial wealth held outside pension funds, but holdings are heavily skewed with the top 5% of households holding 40% of these assets. Rich people, in other words.”

Would the plan of the economic advisers to Britain’s new Labour opposition leader, Jeremy Corbyn, be any better? This is the idea of a People’s ‘Quantitative Easing’ (QE) programme. Instead of the Bank of England buying government and corporate bonds and printing money to do so (the current QE), the Corbyn proposal is that the BoE would buy bonds and other assets directly from local councils, regional agencies etc so that they can invest the money in projects for more housing, schools and services. “People’s QE is fundamentally different. [It] does have the Bank of England print new money, which is identical to the process that is used by ordinary banks when they lend to business, but it gives that money to people like housing authorities, to local councils, to a green investment bank to build houses, to schools, to build hospitals.” says Richard Murphy, Corbyn’s adviser.

But, as others have pointed out, ‘People’s QE’ is really no more than what the European Central Bank is doing now in its QE programme, namely buying the bonds issued by the European Investment Bank which will invest money in long-term projects (as it sees fit) around Europe. This will have limited and very slow effect.

Haldane, Corbyn and other QE exponents do not mention what has come to be called ‘helicopter money’. This was the idea of former Federal Reserve chair, Ben Bernanke, when he raised the idea that his mentor, the right-wing pro-market economist Milton Friedman, proposed for dealing with recessions. Central banks should just drop printed money from helicopters over the cities of America to boost directly the demand for goods and services, thus by-passing the banks. Bernanke never applied this idea when Fed Chair, but it is occasionally it is raised by various economists only to be put back in its box. It just sounds too radical and wild.

Actually, it is not. As Keynesian Simon Wren-Lewis points out, helicopter money is really another form of government spending. If the central banks prints cheques and/or puts a monthly sum into the bank accounts of everybody, in effect, it is boosting bank deposits of households and companies in just the same way as if the government cut taxes or handed out increased benefits. The government would eventually have to foot the bill for the central bank largesse. And again, ‘helicopter money’ would probably add to inequality of incomes and wealth as it would indiscriminately go to the rich as well as poor. Indeed, as Wren-Lewis says, “If governments undertake fiscal stimulus in a recession such that helicopter money is no longer necessary”

All these schemes and ideas are really a (desperate) response to the failure of ‘unconventional’ monetary policy practised by central banks and governments, namely QE. And they are a reaction to the unwillingness of neo-liberal governments to run budget deficits, Keynesian style, to stimulate economic activity. Of course, as I have argued, fiscal stimulation would also be pretty ineffective as long as the dominant capitalist sector is unwilling to invest more despite tax cuts or ‘corporate welfare’ subsidies. And that remains the case in most top capitalist economies.

No comments:

Post a Comment