Ex-Federal Reserve Chair Ben Bernanke has recently become an adviser to Citadel, a hedge fund management company and to PIMCO, the world’s largest bond fund. This will make Ben Bernanke a very rich man, instead of just a rich one. Up to now he has been perhaps earning a mere $1m a year in base salary, plus income from book rights and even more from speaking fees. But now he will be into hundreds of millions.

The revolving door between public office and working for large financial institutions is the way of the world under modern global capitalism. No wonder, the Fed, the IMF, the World Bank, the ECB etc, supposedly independent institutions, operate to ensure the well-being of the top financial firms and continually forecast the success of capitalist economies. Actually, strictly speaking, the US Federal Reserve is not independent as it was set up and is still ‘owned’ by the major Wall Street banks. So along with the money, the likes of Ben Bernanke, Hank Paulson, Tim Geithner, Alan Greenspan flit between Wall Street and Washington DC seamlessly because it puts them at the centre of the action: setting the financial strategy of the largest imperial power and influencing the course of world financial markets.

Thus finance capital sucks into its grasp all the bright and clever people, not to do ‘public service’ for the majority of Americans or elsewhere, but to deliver the objectives of capital, with rich reward in doing so.

American politicians and media continually refer to the “middle-class” in their comments and reports when they really mean what we used to call the “working-class”. The working class ‘were’ people who worked in factories, offices and stores and did not have professional qualifications to become lawyers, doctors, managers and other business people – the latter being the original term for the middle-class. The dropping of the term, ‘working-class’, was deliberate. It was to hide the class nature of modern capitalism between those who own the means of production or who plan the strategy of capital like Ben Bernanke and those who sell their labour for a living with no power over their own destiny. It was also to convince working people that there was no longer any inequality or class division in modern society. We are all middle class now.

But this ideological smokescreen is starting to work less effectively in masking reality. While the financial elite in America and Europe continue to prosper in this post-Great Recession world, the average American or European households are struggling. In the last 25 years, the annual income of the median US household is still just under $52,000. And since the financial crisis hit six years ago, the economic ‘recovery’ has yet to translate into higher incomes for this ‘typical’ American family. After adjusting for inflation, US median household income is still 8% lower than it was before the recession, 9% lower than at its peak in 1999 and essentially unchanged since the end of the Reagan administration in 1992.

Take the generation born in 1970. In early adulthood, these Americans out-earned their parents, those born in 1950. But their gains stalled in the 2000s, when they were in their 30s. Now in their 40s, their earnings have fallen behind those of their parents at the same stage in their lives

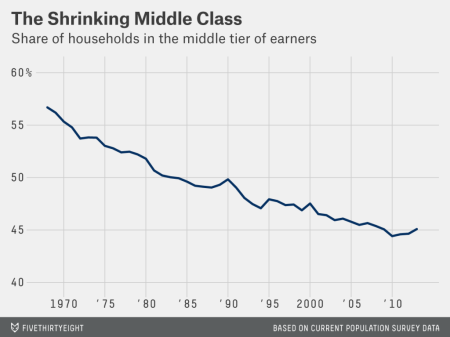

And focusing on median income does not show the wide disparity in incomes that produces that median. In 1970, 55% of US income was earned by households in the middle 60% of the income distribution. More than half of households were in the “middle tier” of households (those earning between two-thirds and twice the median income). In 2013, both numbers had fallen to about 45%. In a 2012 report, Pew researchers called the 2000s “the lost decade of the middle class.”

US society, after the short period of equality from the 1950s to the 1970s, has been polarising in just the way that Marx envisaged between an extreme rich elite, centred around the ownership and management of large corporations, mainly in finance, and the rest of us. In a recent unpublished paper, Simon Mohun, emeritus professor at QMC, London, carefully analysed US personal income data on a class basis (ClassStructure1918to2011wmf (1)).

Mohun found that managers who have sufficient non-labour income that they do not need to work were no more than 2% of income earners, having shrunk from 4% in the 1920s. This is the real capitalist-managerial class. The 1%, or even more accurately, the top 0.1% of households, rule. The next layer, like Ben Bernanke, live off them and plan strategy for them (just 2% now). The next layer work for and support them (this is about 14% – the real middle class and this section has been declining). Then there is the rest of us.

For more on the nature of inequality in modern capitalist economies, see my book, Essays on Inequality,

Createspace https://www.createspace.com/5078983

or Kindle version for US:

http://www.amazon.com/dp/B00RES373S

and UK

http://www.amazon.co.uk/s/?field-keywords=Essays%20on%20inequality%20%28Essays%20on%20modern%20economies%20Book%201%29&node=341677031.

No comments:

Post a Comment