In its latest economic report, the IMF came to two important conclusions about the state of world capitalism in 2015 (http://www.imf.org/exter…/…/ft/survey/so/2015/NEW040715A.htm).

First, it reckons that global capitalism will remain in a depression. The IMF says that “a large share of the output loss since the crisis can now be seen as permanent, and policies are thus unlikely to return investment fully to its pre-crisis trend”. While potential growth in advanced economies will tick up in the next five years, it will remain well below levels before the financial crisis. Emerging nations will see their potential growth decline over the same period.

In advanced economies, real GDP growth that maximises potential capacity will ‘accelerate’ to an average of just 1.6% over the next five years, compared with 1.3% from 2008 to 2014. But this growth will remain weaker than the 2.3% pace from 2001 to 2007. The IMF economists failed to mention that this 1.6% a year growth was about half the post-war 20th century average. Growth in so-called emerging economies will also drop down.

The second conclusion was that the reason for this slower and crawling growth rate was that there had been a collapse in investment and this collapse was concentrated in the capitalist business sector. Yes, the collapse in the housing bubble in many advanced economies was one reason for the drop in private sector investment, but the collapse in business investment was much greater and long lasting.

The IMF found that business investment in the advanced economies was 13% lower in from 2008-2014 than it expected back in spring 2007 before the Great Recession. For the US, the gap was even bigger at 16% and 18% for Japan. How wrong can you get?

Recently, the Bank for International Settlements (BIS) latched onto the same point – that the Great Recession and the subsequent weak and slow recovery in the major economies was a product of the collapse in business investment, i.e. the fault of capitalism, http://www.bis.org/publ/qtrpdf/r_qt1503g.htm

As the BIS put it: “Business investment is not just a key determinant of long-term growth, but also a highly cyclical component of aggregate demand. It is therefore a major contributor to business cycle fluctuations. This has been in evidence over the past decade. The collapse in investment in 2008 accounted for a large part of the contraction in aggregate demand that led many advanced economies to experience their worst recession in decades. Across advanced economies, private non-residential investment fell by 10-25%”.

But what caused this fall in investment and why is it not recovering sufficiently to restore trend real GDP growth in the major economies? Well, the IMF comes up with a brilliant answer: it’s lack of demand. Capitalist companies are not investing enough because there is a lack of demand for their products. But this answer begs the question: why is there a lack of demand? And it also fails to recognise that the biggest component in the fluctuation in aggregate demand since 2007 has been investment. After all, investment is part of aggregate demand, as the BIS points out.

The IMF’s Keynesian answer is no answer at all but simply a tautology: there is no growth because there is no demand! As usual, the Keynesians have got their causal sequence back to front, see my post, https://thenextrecession.wordpress.com/2013/10/19/the-fallacy-of-causation-and-corporate-profits/.

At least the BIS attempts to look for a cause that is not circular reasoning. The BIS found that “the uncertainty about the economic outlook and expected profits play a key role in driving investment, while the effect of financing conditions is apparently small.” The BIS dismisses the consensus idea that the cause of low growth and poor investment is the lack of cheap financing from the banks or the lack of central bank injections of credit. We have quantitative easing coming out of ears, with the latest burst coming from the ECB bond purchasing plan worth €1.8trn, or 3% of global GDP over the next 18 months.

Instead, the BIS looks for what it calls “seemingly more plausible, explanation for slow growth in capital formation”, namely “a lack of profitable investment opportunities”. According to the BIS, companies are finding that the returns from expanding their capital stock “won’t exceed the risk-adjusted cost of capital or the returns they may get from more liquid financial assets.” So they won’t commit the bulk of their profits into tangible productive investment. “Even if they are relatively confident about future demand conditions, firms may be reluctant to invest if they believe that the returns on additional capital will be low.” Exactly.

Ironically, the BIS reckons that, whereas investment in the stock market was more profitable for companies than investing in productive assets in the period before the Great Recession, the reverse is the case now. The profitability of capital stock has not risen, it’s just that the stock market is now so expensive that the likely return against stock prices has fallen. And returns on bonds have slumped.

Even so, it seems that companies and financial institutions prefer to hold ‘safe assets’ like government bonds rather than invest in production. So we now have the ridiculous phenomenon of government bonds being bought in the bond market at negative yields i.e’.bought at prices so high that the interest paid on the bond will not match the extra cost of the bond during its lifetime. And this applies now not just to very safe German bonds but even to Spanish and Irish bonds, economies just coming out of major debt crises.

I have attempted to explain before why companies in the major economies are not raising their capital expenditures to levels and growth rates seen before the Great Recession, let alone in the 1990s, see https://thenextrecession.wordpress.com/2013/12/04/cash-hoarding-profitability-and-debt/

The profitability of capital has got to be high enough both to justify riskier hi-tech investment and to cover a much higher debt burden (even if current servicing costs are low). As I said in my previous post: “The capitalist sector of the major economies has been increasingly hoarding cash rather than investing over the last 20 years or so. It is not investing so much because profitability is perceived as being too low to justify investment in riskier hi-tech and R&D projects, and because there are better and safer returns to be had in buying shares, taking dividends or even just holding cash. Also many companies are still burdened by high debt even if the cost of servicing it remains low; the worry is that if interest rates rise or companies take on more debt, it will become unserviceable.”

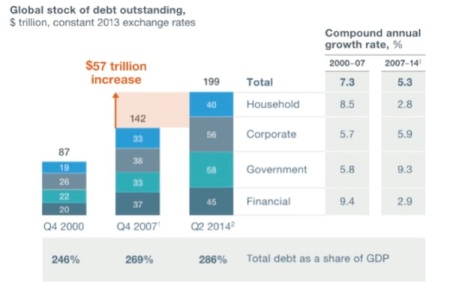

The impact of high debt (especially corporate debt) on investment and growth has a long literature and remains controversial (see my many posts on this, https://thenextrecession.wordpress.com/2014/09/30/debt-deleveraging-and-depression/). But it seems that increasingly confirmed that “high debt levels, whether in the public or private sector, have historically placed a drag on growth and raised the risk of financial crises that spark deep economic recessions.” (The McKinsey Institute, “Debt and (not much) Deleveraging”). As McKinsey put it in their latest debt report: “Seven years after the bursting of a global credit bubble resulted in the worst financial crisis since the Great Depression, debt continues to grow. In fact, rather than reducing indebtedness, or deleveraging, all major economies today have higher levels of borrowing relative to GDP than they did in 2007. Global debt in these years has grown by $57 trillion, raising the ratio of debt to GDP by 17 percentage points (see chart below). That poses new risks to financial stability and may undermine global economic growth.” (https://thenextrecession.files.wordpress.com/2015/02/mckinsey-debt-not-much-deleveraging-040215.pdf).

By the way, my emphasis on the role of credit, debt or ‘fictitious capital’ in the current crisis lends the lie to charges of being a ‘mono-causal’ law of profitability Marxist that I am currently accused of (see https://thenextrecession.wordpress.com/2015/04/02/david-harvey-on-monocauses-multicauses-and-metaphors/).

Now even Paul Krugman, who in the past has reckoned that rising debt is not a problem is prepared to admit its role only today http://krugman.blogs.nytimes.com/2015/04/07/the-fiscal-future-ii-not-enough-debt/. When arch-Keynesian Brad de Long reckoned that what the US economy needs is not less debt but more debt, Krugman noted that “Unfortunately, the biggest debt accumulations have come in economies that have much lower growth — mainly demography in Japan, productivity collapse in Italy.” , although Krugman reckons that low growth leads to high debt, not vice versa.

Moreover, it is an illusion that corporations are awash with cash at least in relation to their debts, see https://thenextrecession.wordpress.com/2014/03/24/awash-with-cash/.

If it is the case that the reason for the continuing Long Depression in the major economies (defined as below trend growth and below trend investment) is low profitability and still excessive debt, then the situation does not look set to improve. According to JP Morgan the investment bank, usually a super optimist about capitalist economic recovery, US corporate profit margins, i.e. the share going to profit for each unit of production, have been at a record highs, but now they are beginning to fall. “The share of business net value added going to capital, or net operating surplus, has edged down modestly since peaking in 2012. However, the share going to profits, which is essentially net operating surplus less interest payments, has been about unchanged since 2012. Adjusted corporate profits declined at a 5.5% annual rate in 4Q14, the latest available data point. However…we believe the natural progression of the business cycle will begin gradually squeezing business (and profit) margins.”

The recent fall in oil prices and the strengthening of the dollar is really hitting US corporate profits. Bank America now reckons that average earnings per share for S&P 500 companies will fall this year for the first time since 2009. And readers of my blog will know that GLOBAL corporate profits are now in negative territory. https://thenextrecession.wordpress.com/2015/03/27/profit-warning/.

But low profitability as a major cause of low investment is studiously ignored by the IMF in its report.

No comments:

Post a Comment