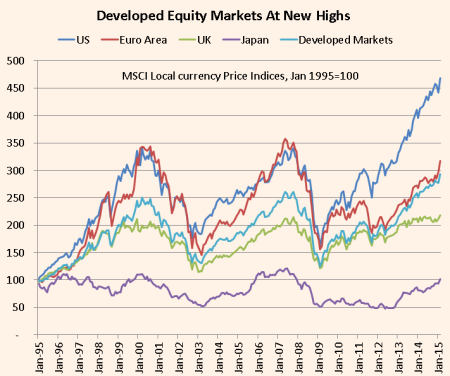

At the end of February, the S&P 500 stock index closed at a record high and the Nasdaq Composite (an index of hi-tech companies) briefly rose above 5000, the level last achieved in the dot.com bubble back in 2000.

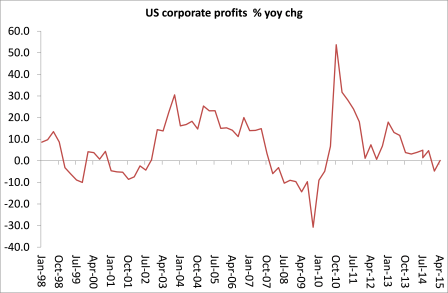

But we may well be near the end of this stock market bonanza, six years after the S&P embarked on a bull run, resulting in a rally of 250%, including the reinvestment of dividends. Profits for US companies are expected to decline over two consecutive quarters for the first time in six years. Not since the aftermath of the financial crisis have S&P 500 companies recorded two straight quarters of falling profits on a year-over-year basis.

The profits of the S&P 500 multinational companies with significant global operations are now being pressured by a record high dollar, which results in lower foreign revenues. And energy companies have been hit hard by significant reductions in their earnings as oil prices have halved since the summer. Deflation in energy and fuel prices may help consumers a little, but it is real bad news for the profitability of energy multinationals.

Analysts are forecasting a decline of 4.6% in Q1 2015 S&P 500 earnings compared with the same period a year ago, with those for the second quarter are seen falling 1.5%. That would represent the first back to back quarterly decline since the second and third quarters of 2009 at the depth of the Great Recession.

And it is not just energy companies. Utilities, materials, telecom services, consumer staples and information technology corporations are forecast to record negative year-over-year earnings growth for the first quarter. And since the early 1990s, the only times that earnings per share have fallen in the US have been at the onset of recessions, in 2000 to 2002 and 2007 to 2009.

And it’s not just earnings of the top companies that are set to decline. Profits for the whole US corporate sector have now stopped rising.

Increasingly, the stock market has been supported simply by an injection of billions in credit by the Federal Reserve. Financial firms and non-financial corporate have been flush with cash that they have raised from the issuance of corporate bonds at extremely low rates of interest. This cash has then been invested in the stock market and in paying out dividends and buying back stock, so encouraging others to buy stocks. Only a small proportion has been used to invest in new technology and more labour

(https://thenextrecession.wordpress.com/2014/03/24/awash-with-cash/).

And profits have also been artificially sustained by significant cuts in corporation tax and other exemptions from tax. For example, Warren Buffett’s investment company, Berkshire Hathaway has been able to defer $62bn in taxes, that’s eight years of taxes, because the company has bought capital intensive businesses like railways and power utilities. That has given the company even more funds to invest in the stock market. Berkshire’s Energy unit receives tax credits for renewable power generation — reporting $258m of wind energy tax credits in 2014, and $913m of investment tax credits in 2012 and 2013 for opening new solar power plants. This is interest-free borrowing made possible by the taxpayer because of the business-friendly government.

But as I have argued in previous posts

https://thenextrecession.wordpress.com/2014/08/01/the-risk-of-another-1937/),

the days of low interest borrowing and investment speculation are about to come an end. It seems that the Federal Reserve is going to start raising the floor on interest rates this summer, leading to rising mortgage and corporate bond rates. That could spark a significant drop in stock market prices and even kick off a new recession.

Back in 1937 during the Great Depression, it appeared to the US authorities that the slump was over and it was time to ‘normalise’ interest rates. On doing so, the economy promptly dropped back into a new recession that was only overcome when the US entered the world war in 1941. The reality was that the profitability of capital and investment had not really recovered and raising the cost of borrowing tipped the economy back

But why would the Fed do this if there is such a danger? Precisely because it wants to cool a speculative stock and bond market and, most important, avoid a sharp rise in wages that could squeeze profits as the labour market tightens.

If the Fed does move later this year, it could start to expose just how much fictitious capital (as Marx called stock and bond investment) has built up in the US and other economies and see it go up in smoke.

No comments:

Post a Comment