Much quicker than I expected, the new Greek government and the Euro leaders are coming to a major face-off. The Syriza government have made it clear that it will not agree to another Troika-style fiscal austerity and neo-liberal ‘structural reform’ programme in return for loans to pay back debt coming due (money to be paid to the IMF and hedge funds). Instead it wants debt relief, or ‘haircut’, or at least a new debt regime that reduces the burden of debt servicing to the minimum so that there is enough room for the government to spend to help the poor, the unemployed and bankrupt small businesses rather than Europe’s banks and oligarchs.

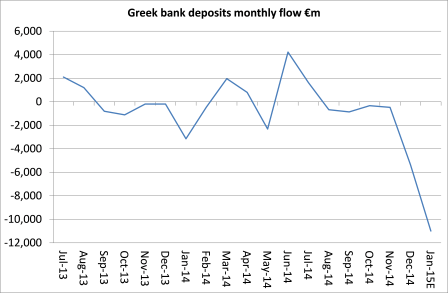

So far, the ECB and the Euro leaders are talking tough and saying that they will concede little or nothing to Syriza. On the contrary, the talk is of cutting off any further funding of Greek banks through the Eurosystem just as Greek banks see their customer deposits disappear abroad as rich Greeks and corporation spirit their money out of the country. The ECB has already blocked normal credit facilities to Greek banks. And now Greek bank deposits are starting to fall at an accelerating pace.

On Wednesday, the Euro finance ministers meet to decide what if anything they can offer the Greeks to help and the Euro leaders themselves will meet to discuss any final package.

The chances of the Greeks being forced out of the Eurozone has risen significantly because the most that the Euro leaders will offer will be an extension of the maturity of the existing EU loans to Greece (now totalling €217bn), so that repayments are spread out over a longer period and a reduction in the interest charged on those loans. But even these concessions are only likely to be offered if Greece agrees to more ‘structural reforms’ i.e. deregulating labour markets, privatising state companies and opening up markets to overseas capital.

Syriza is pledged to block these, although it will pursue (with more vigour) the tax obligations of the rich and oligarchs who avoided tax with the connivance of the previous Conservative government.

If Syriza accepts this limited offer from the Euro leaders, it will provide some ‘fiscal space’, because the cost of the EU loans has been reduced and interest payments on these loans have been postponed until 2022. So servicing costs will fall to below 2% of GDP this year. And if the maturity of these loans is extended even more, then the public debt to GDP burden, now standing at 175% of GDP, will fall by 20% points, because it will reduce interest payments by 0.5% of GDP a year, money that can be spent by the government elsewhere.

But of course, such concessions are way short of what the Greeks need to turn poverty, unemployment and investment around even if the Euro leaders offer to spend extra funds on infrastructure projects in Greece. And the concessions will still be conditional on Greece agreeing to a new Troika-type programme by any other name.

The Greeks want the Euro leaders to agree to a ‘bridging loan’ for a few months while they negotiate an agreement. But if the Euro leaders refuse that and there is no agreement this week, then the ECB governing council may well decide to cut off credit to Greek banks. The Greek banks are bust. Up to 40% of loans the banks have issued to households and companies in Greece have gone sour, or are ‘non-performing’, as bankers call it. Greek banks do not have enough capital and reserves to cover these loans if they have to be ‘written off’ and the ECB, responsible for bank governance in the Eurozone, may well insist on this soon.

And with deposits disappearing, Greek banks are now relying totally for their operations on Emergency Lending Assistance (ELA) from the National Bank of Greece (NBG). This is credit from the central bank to keep the banks going, subject to monitoring and restriction by the ECB.

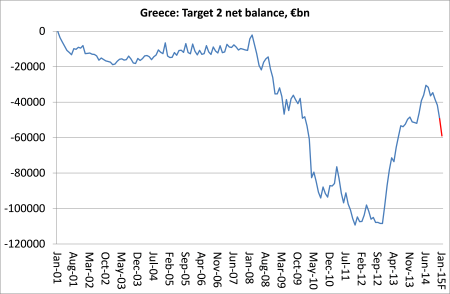

The NGB finds this money by printing it and therefore in effect is receiving credit from the rest of the Eurozone under what are called Target 2 operations. Greek Target 2 liabilities, what the NBG owes to the rest of Eurosystem, have now risen to €60bn from a low of €35bn last autumn. During the height of the Euro/Greek crisis back in 2012, ELA reached €112bn. But it won’t be long before that level is reached again.

That is why the ECB governing council, if it knows that no agreement has been reached between the Greeks and the Euro leaders on the debt issue, may well decide that it cannot allow the NBG to go on printing money to bail out Greek banks.

If there is a two-thirds vote on restricting or stopping the NBG providing ELA, and the NBG sticks to the ECB instruction, then the game is up. Greek banks will run out of money and go bust, defaulting on their debts and there will be a run on the banks. Greece will have been kicked out of the Eurosystem of banking and, in effect, out of the Eurozone.

That will quickly lead to Greek government introducing capital controls to stop money leaving the country and then refusing to repay its debts, not immediately but between March and June when payments become due. The cost of default will be huge. The Greek government owes €273bn to the IMF, the ECB and the EU governments. Target 2 liabilities may well rise to over €160bn. And the Greek banks and corporations owe in euros nearly another €100bn to foreigners.

If the Greeks are thrown out of the euro and they will have to opt for a new currency. They would only be able to use the euro as Greek currency if they are prepared to accept a massive credit squeeze and deeper economic slump. If they opt to introduce a new currency, it will probably be worth only 50% of the euro. Greek banks, corporations and government will have to default by at least that amount. That means losses of about €200bn that governments, banks and corporations in the rest of Europe will have absorb, or about 2% of Eurozone GDP. Estimates put the loss to Germany alone of a Greek default at about €75bn.

That can be absorbed, at least on paper, without a meltdown in Europe of banks or government bonds, especially now that the Eurozone has got special stability fund to handle any bank or government crises.

The question is whether Angela Merkel and the German government would prefer to take the hit from default rather than concede Greek demands for debt relief and fiscal spending without any Troika-type conditions. The Germans do not want to show that their fiscal probity can be breached by a ‘profligate’ Greece led by a ‘rabidly leftist’ government. And they do not want the likes of Portugal, Spain or Italy to get similar ideas (the conservative Spanish government is backing the Germans on this. So they may opt for Grexit if the Greeks do not back down.

On the other hand, Grexit could lead to the unravelling of the whole Euro project if it confirms to an increasingly sceptical electorate that the Euro project is not a union of equals but really a Franco-German imperialist project (which it broadly is, of course). The precedent would be set that member states could leave or be thrown out and Euroscepticism would get renewed strength. That’s the choice for the Germans, while Syriza must choose whether to accept new fiscal and structural conditions and monitoring for any debt relief. The face-off begins Wednesday.

ADDENDUM

The Greek government has just spelt out a new compromise deal for discussion with the EU on Wednesday. The government’s proposal is in four parts, according to a Finance Ministry source. The first foresees that 30 percent of the Troika memorandum be scrapped and replaced with 10 new reforms which Greek officials are to agree with the Organization for Economic Cooperation and Development. The second sub-proposal entails Greece’s primary surplus target of 3 percent of GDP for this year being reduced to 1.49 percent. Thirdly, authorities want to reduce Greek debt through a swap plan. And finally, Greece’s “humanitarian crisis” is to be eased using measures set out in the government’s policy program which was unveiled by Prime Minister Alexis Tsipras on Sunday night. According to Finance Minister Yanis Varoufakis, the government did not want “to tear up the (Troika) memorandum nor to enforce it faithfully.”!

As regards financing, ministry sources said Greece wants to secure the 1.9 billion euros in profits from the Greek bonds held by the Eurosystem and will seek to issue T-bills, some 8 billion euros above the 15-billion-euro limit which Greece has exceeded. Authorities are also keen to raise the threshold for emergency liquidity assistance from the European Central Bank. A further portion of a pending 7.2-billion-euro loan tranche could also be drawn if required, the sources said, essentially reversing the previous insistence by the government that it does not want the money. Another proposal foresees some 11 billion euros in leftover funding from the recapitalization of Greek banks being used to help Greek lenders deal with nonperforming loans.

This is a big step down from the Syriza government as they search for some ‘fiscal space’ to meet some of the promises they made to the electorate. Two questions: will the EU leaders buy it and will the Greek electorate swallow it?

No comments:

Post a Comment