George Osborne, Britain’s finance minister, delivered his so-called autumn statement (in December!) today. This covers the current state of public finances and plans for future tax and spending measures.

The Conservative-led coalition faces an election next May and its main pledge when it came into office in May 2010 was to ‘balance the budget’ and reduce government debt. After the huge bank bailout and the impact of the Great Recession of 2008-9 on tax revenues and welfare spending, the government deficit stood at over 10% of GDP and gross government debt had rocketed to over 75% of GDP.

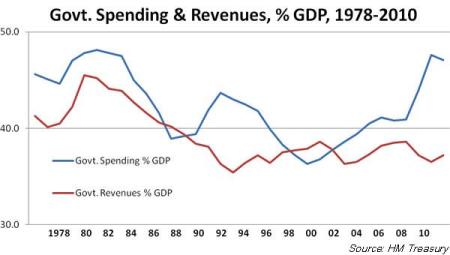

The government blamed this on the profligacy of the previous Labour government. This was nonsense, of course. Labour had run relatively small deficits, has reduced government spending as a share of GDP and debt was low until the global banking crash.

And the Conservatives would have done exactly the same as Labour in bailing out the City of London with more borrowing.

The Conservatives are obsessed with the government deficit and debt – getting them down has been their measure of ‘prosperity’. But even on this measure, they have failed. Osborne made much of the reduction in the deficit ‘by half’ by April 2015. But back in 2010, he forecast that he would balance the budget by April 2016. He has now announced that this target will not be achieved until April 2019.

And to meet this target, even assuming that Britain continues to grow at 2-3% over the next four years, the government will have to impose a massive round of public spending cuts on welfare benefits and services. It will also have to raise taxes, although it claims that it can cut income tax again during the life of the next government (although that promise is pushed back to 2019).

And the deficit is one thing. Government debt is still rising in real terms. Debt is over £160 billion more than forecast back in 2010 and is now well over 90% of GDP on a gross basis and is not expected to peak on the best forecasts until 2019.

The government has failed because the UK economy has not grown in income anywhere near as much as the government forecast back 2010. Osborne forecast real GDP growth would average about 2.7% a year; instead it has averaged up to this year only 1.3%, half the rate. At the same time, although unemployment has come down, most of the new jobs have been part-time, low-paid and self employment (see my post,

http://thenextrecession.wordpress.com/2014/07/18/uk-cost-of-living-crisis-contin).

This has meant that real incomes (ie after inflation) have fallen by the largest amount since the Great Depression of the 1930s.

As a result, tax revenues have nowhere matched that expected by the government. So the budget forecasts have proved woefully wrong. Revenues from income tax and national insurance during the most recent 12-month period have grown at an annual rate of only 1.8% compared with the budget forecast of 5%.

The government stood back from imposing too severe a reduction in the budget deficit after 2012, for fear that the economy would drop back into a new slump – and it nearly did.

But that just means, in its obsession with the deficit, that if the Conservatives win the election in May, they will launch a new round of austerity measures.

Maybe a new round of austerity won’t happen because the Conservativces won’t win next May. But all three major parties are committed to more spending cuts in bowing to the God of ‘fiscal probity’. “All parties support balancing the current budget in the next Parliament. Deficit spending is clearly still deemed to be politically untenable in the UK.” Gavyn Davies, FT.

Compared to the Chancellor’s plan, Labour would permit extra borrowing to finance investment (1.5% of GDP) and would allow themselves longer to attain balance for the current budget. But they would still impose austerity to the tune of half the amount of the Conseravtives.

Behind the obsession with deficits and debt lies the real agenda. It is two-fold: to reduce the size of the public sector and destroy any vestiges of the ‘welfare state’, opening up public goods and services to deliver profits to the capitalist sector. The other aim is lower the burden of tax on and increase the subsidies to the capitalist sector over the long term to boost profitability.

This hidden agenda is sometimes exposed. Only this week, a Conservative MP called for huge cuts. “The Chancellor could make a £20 billion start by culling Whitehall’s sprawling bureaucracy, enforcing public sector pay settlements, freezing benefits, reducing the welfare cap, scaling back middle-class welfare and looking again at the state pension.” Dominic Raab, Conservative MP for Esher and Walton.

Note the attack on the state pension. This has been sacrosanct up to now. But the Conservatives are now preparing to dismantle it, using the argument that the young should not have to pay for the old and that’s unfair. The right-wing Economist magazine took up this call: “Britain’s fiscal problems are partly the result of over-generous spending on the old. They should pay off some of the debts instead of passing them all on to the young.”

But apparently it is not unfair for the poor to pay for the rich. In the UK the bottom 10% of income earners pay more in all taxes as a percentage of their income than the top 10%. The government could switch its priorities on spending from defence, subsidies to industry, lowering corporation tax, more tax cuts for the rich to boosting public investment, services and welfare. Despite its headline noise on a few infrastructure projects (rail, flood protection etc), it is doing no such thing.

Faster growth would soon deal with any deficit anyway. In terms of real annual GDP growth, the OBR estimates that a 0.1% point increase would do as much over the four years from 2015-16 for the deficit as roughly £3 billion of spending cuts. The trouble is that the UK economy may be growing at 3% a year currently, but nobody expects that to last. The Office for Budget Responsibility has actually revised down its forecasts for growth after this year for every year up to 2019. Even Osborne admitted that the “warning lights” are flashing over the health of the global economy, and Britain “cannot be immune”.

Yes, any new downturn in the world economy would soon push the UK economy back into recession too. Osborne raises only that risk to a booming UK economy (the fastest in the G7 this year). But there are serious domestic risks too. Most of the contribution to the ‘boom’ of 2014 is coming from the unproductive sectors of the economy (housing – prices rising at 12% a year; and financial services as the City of London ploughs on).

Manufacturing output is still struggling and despite a huge devaluation of the pound back in 2010, UK exports have failed to get anywhere near the government’s expectations.

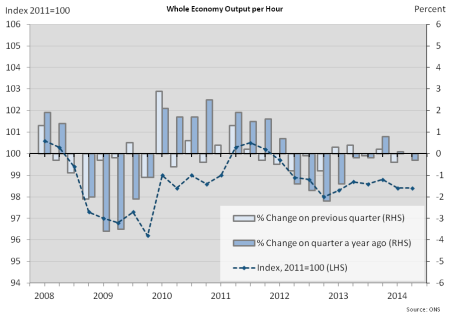

Productivity growth remains appalling.

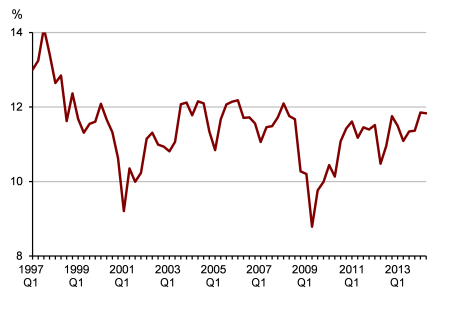

That’s mainly because the business sector is unwilling to invest in new technology or skilled labour at good rates of pay. Investment to GDP in most major capitalist economies has been falling. But it is particularly low in the UK.

And that is because profitability in the corporate sector, although improving a little after all the austerity measures so far, is still below levels seen in the late 1990s or even 2005.

After six years, the UK economy has only just got back to where it was before the Great Recession.

But the economy is standing on the chicken legs of a credit-fuelled property and services boom, sustained, ironically, by cheap labour provided by hard-working, young immigrants from Europe and elsewhere.

The Conservative government aims to cut back that immigration and impose a new and severe round of public spending cuts, while big business stands by with its arms folded. The economy will falter, especially if there is new world economic downturn, and the government’s targets on public finances will fall short, just as they have done up to now in this parliament.

No comments:

Post a Comment