FFWP Admin.

Marx’s law of profitability at SOAS

by Michael Roberts

Last week I gave a lecture in the seminar series on Marxist political economy organised by the Department of Development Studies at the School of Oriental and African Studies (SOAS). The Marxist Political Economy series is a course mainly for post-graduates and has several lecturers on different aspects of Marxian economics. Course Handbook – Marxist Political Economy 2019-20 (8)

Mine was on Marx’s law of the tendency of the rate of profit to fall. Not surprisingly, the department team has noticed that I am apparently ‘obsessed’ by this law, at least according to critics of it.

Anyway, I thought it might be useful to go through my lecture in a post, with the accompanying slides referred to. So here goes. (Marx’s law of the tendency of the rate)

I started by saying that Marx considered the law of the tendency of the rate of profit to fall as “peculiar to the capitalist mode of production” along with “the progressive development of the social productivity of labour.” They go together: rising productivity and falling profitability. (Slide 2).

Indeed, Marx’s law is the direct opposite of what Thomas Piketty, author of Capital in the 21st century claimed was Marx’s view. Piketty reckoned that “Marx’s theory implicitly relies on a strict assumption of zero productivity growth over the long run” and that “Marxist analysis emphasises the falling rate of profit – a historical prediction that has turned out to be quite wrong.” Indeed, Marx’s law is ignored by mainstream economics (except for getting wrong like Piketty) and also is either ignored or rejected by so-called heterodox economics.

Moreover, even most Marxist economists consider it irrelevant or wrong for any critique of capitalism. I referenced top MEGA scholar, Michael Heinrich: “A few manuscripts from the late 1860s and 1870s suggest that Marx had doubts about the ‘law of the tendency of the rate of profit to fall’, which he no longer mentioned after 1868.“ And then the world’s most famous Marxist economist, David Harvey: “I find Heinrich’s account broadly consistent with my own long-standing scepticism about the general relevance of the law”. Indeed, it is only a minority of Marxists who consider, like Alan Freeman, that “Marx’s LTRPF remains the only credible competitor left in the contest to explain what is going wrong with capitalism.” (Slide 3).

In contrast, I argued that Marx’s law of profitability is both theoretically valid, empirically supported and relevant to the critical analysis of modern capitalism. But the law is only valid if two other laws of motion of capitalism that Marx held to are also valid. (Slide 4).

The first is the law of value. The law of value says that the value of commodities depends on the amount of human labour exerted on producing commodities, as measured by the socially necessary labour time involved. At one level, it is self-evident, “as any child knows” that nothing is produced to use or sell unless humans go to work to do it. (Slide 5).

Under the capitalist mode of production, commodities are produced for sale, in a particular social relation. The capitalist starts with money and the ownership of the means of production. With that money he/she buys the technology and raw materials to make a new product for sale and employs the workers to do so. Both that technology and workers are commodities to buy for the capitalist. But only the workers produce the new commodity for sale on the market for a new amount of money. And that end product must be worth more in labour time that invested by the capitalist and more in money than spent. There must be a profit to make it worthwhile. That profit comes from the surplus value appropriated by the capitalist over above the value paid for labour power. M- C- P- C’- M’ (Slide 6)

Marx’s theory of value reveals that more value is created only by human labour power and a surplus is extracted by the capitalist because he/she owns and controls the means of production; and that value is realised by sale in markets. The law of value is theoretically sound and indeed has been empirically supported, namely that total prices of commodities in an economy are closely correlated with total hours of labour time applied. (Slide 7)

The second law is Marx’s general law of accumulation. Competition among capitalists forces them to continue to expand their production in order to accumulate more profit or be driven out of business by others. Competition drives each individual capitalist to increase the productivity of labour ie lower their costs of production. (Slide 8)

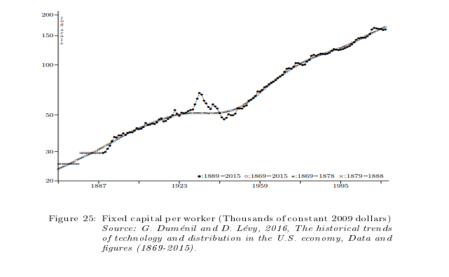

As capitalists spend more of their profits on means of production to boost the productivity of labour and reduce costs, the ratio of the value of means of production compared to the value of the labour power employed tends to rise. Marx called this ratio the organic composition of capital. It is a law in capitalist economic expansion that the organic composition of capital will rise. (Slide 9)

The law is empirically valid. (Slide 10); fixed capital per worker rises over the long term.

But there is a dual nature to the accumulation process under capitalism. On the one hand, there is a tendency to increased unemployment from technology shedding labour. On the other hand, new technology creates new jobs. Everything then depends on the momentum of the industrial cycle: “the general movement of wages is exclusively regulated by the expansion and contraction of the industrial reserve army and this corresponds to the periodic alternations of the industrial cycle”.

Marx (Slide 11) Accumulation can drive down labour’s share in new value but also lower the price of future investment. (Slide 12).

In sum, the organic composition of capital (C/V) rises over time. This means increased centralisation and concentration of capital. Rising C/V creates a reserve army of labour and technological unemployment. The size of reserve army will vary cyclically with the strength of accumulation. This law can be empirically verified and has been in many studies. (Slide 13)

This brings us the main message of the lecture. The first two laws of motion lead to the third law: the law of the tendency of the rate of profit to fall. The first law says that only labour creates value. The second says that capitalists will accumulate more capital over time and this will take the form of a faster rise in the value of the means of production over the value of labour power i.e. a rising organic composition of capital. (Slide 14) For Marx, the third law of profitability is “in every respect the most important law of modern political economy and the most essential for understanding the most difficult relations. It is the most important law from the historical standpoint. It is a law, which despite its simplicity, has never before been grasped and even less consciously articulated.” (Slide 15)

The law has a simple formula (Slide 16). The capitalist starts with money to invest in:

Means of production (fixed capital) and raw materials (circulating capital) = constant capital (c)

Labour force to produce the commodities paid in wages. But the labour force produces more value than it is paid in wages; so it is called variable capital (v).

The labour force produces commodities that contain surplus value over and above its own value in wages paid = surplus value (s)

The rate of profit is thus S/(C+V). If we divide this formula by the value of labour power (V), we get s/v//c/v+1. In other words, the rate of profit falls if C/V rises faster than S/V and vice versa. (Slide 17)

Marx argues that rising C/V is the tendency which will generally rule and operate over time and rising S/V is a countertendency (induced by the tendency) that can curb, or slow or occasionally reverse the tendency. If the tendency prevails, the rate of profit will fall – and most of the time it does. That is Marx’s law. (Slide 18)

This law has been subject to criticism from the start when it was first revealed in the 1890s in Volume Three of Capital. (Slide 19)

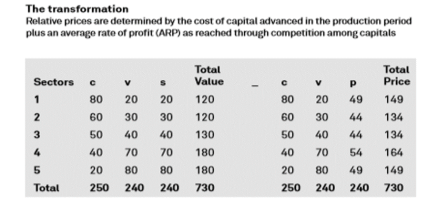

There are two main critiques. The first is the so-called ‘transformation problem’. In Volume Three, Marx shows how the values of commodities as expressed in socially necessary labour time are modified in competition for sale of those commodities. There is price for the commodity in the market, but different producers have different efficiencies – some produce the commodity for sale in less labour time than others. And they do so because they invest more in labour-saving technology as expressed in a higher organic composition of capital. Through competition in the market, a production price is established. At that production price, the more efficient producers make more profit. They do so because in the market there is a transfer of value from the less efficient to the more efficient and profitability tend to an average across the economy.

Values are turned into prices of production by this competitive process. Market prices will oscillate around production prices, which are also continually changing due to changes in technology and the organic composition of capitals. But in Marx’s transformation, total value in the economy (in labour time) is still equal to total price of production (which is value modified by average profitability) and total surplus value is equal to total profit. So value, the labour time exerted, is still the basis of prices in a capitalist economy. (Slide 20)

Marx’s transformation of values into prices was rejected and attacked by many Marxists. Bortkiewicz argued that the inputs in values (c+v) on the value side of Marx’s table are really prices of production. In Marx’s formula, the value of the inputs before the equalization differ from the prices of production for the same commodities after the equalization of profit rates. But surely, says Bortkiewicz, the same commodities must be bought and sold as prices of production and not as values. So Marx’s formula is incorrect and indeterminate. But if we ‘correct’ Marx’s transformation using simultaneous equations, total value no longer equals total price and/or total surplus value does not equal total profit. So there is a logical inconsistency in Marx’s solution. Value in labour time is no longer proven as the basis of prices. (Slide 21)

The reply to this critique is that Marx’s transformation is temporal. The Bortkiewicz critique removes the temporal aspect completely. Let us say that production starts at t1 and goes to t2. The output produced during t1-t2 is then sold at t2, the end point of t1-t2. Then t2 becomes also the initial point of the next production period, t2-t3. The output of t1-t2 has become the input of t2-t3. It exits one period and it enters with the same value in the next period. Instead, the Bortkiewicz critique holds to the absurd notion that the output of one period is the input of the same period. That’s what simultaneous equations do; remove time. (Slide 22)

The second critique of Marx’s law is that is that new technology would never be introduced by a capitalist if it did not raise profitability. Indeed, Marx says in Volume Three of Capital that “No capitalist ever voluntarily introduces a new method of production, no matter how much more productive it may be, and how much it may increase the rate of surplus-value, so long as it reduces the rate of profit.” So Okishio says that “A profit-maximising individual capitalist will only adopt a new technique of production if it reduces the production cost per unit or increases profits per unit at going prices. So capitalist accumulation must lead to a rise in the rate of profit, not a tendency to fall – otherwise why would any capitalist invest in new technology?” (Slide 23)

The reply to that is this argument is a fallacy of composition – to use the Keynesian term of logic. Yes, the first capitalist to introduce a new technology will gain extra profit – at the expense of the other capitalists who have not. The second capitalist will then introduce it and also gain some profitability (but not as much as the first did) at the expense of the other less efficient ones. But once all capitalists adopt the technology, the extra profitability for introducing it will have dissipated. And because the organic composition of capital (C/V) is likely to have risen, the rate of profit across all producers will have fallen compared to before. As Marx says: ”Competition makes it general and subject to the general law. There follows a fall in the rate of profit — perhaps first in this sphere of production, and eventually it achieves a balance with the rest — which is, therefore, wholly independent of the will of the capitalist.” (Slide 24)

And there is one more retort to the critics of the law. It is empirically supported. Over decades, there has been a secular decline in the profitability of capital across all the major economies – if you like, the world rate of profit has fallen – but not in a straight line, because there have been periods where the counteracting factors to the tendency have been stronger. But over the history of modern capitalism, the rate of profit has fallen. (Slide 25)

Marx’s law is not only secular (namely a long-term tendency for profitability to fall). The law also helps explain the cyclical recurrence of booms and slumps in capitalist production and investment. (Slide 26) The operation of counter-tendencies transforms the breakdown into a temporary crisis, so that the accumulation process is not something continuous, but takes the form of periodic cycles. (Slide 27)

The rate of profit can be falling but the total or mass of profit in the economy can be rising. Indeed, that will be the usual situation as capitalists expand investment and production to increase profits as the profitability of each new unit of investment begins to drop. This is what Marx called the double-edge law of profit. (Slide 28) So the mass of profit can and will rise as the rate of profit falls, keeping capitalist investment and production going. But as the rate of profit falls, eventually the increase in the mass of profit will decline to the point of what Marx called ‘absolute over-accumulation’, the tipping point for crises.

Thus Marx’s law of profitability provides an underlying explanation of the cycle of boom and slump that occurs periodically in capitalism. (Slide 29)

In sum:

The law of value: only labour creates value.

The law of accumulation: the means of production will rise to drive up the productivity of labour and to dominate over labour.

The law of profitability: the first two laws create a contradiction between rising productivity of labour and falling profitability for capital. This can only be reconciled by recurring crises of production and investment; and, in the long term, by the replacement of capitalism. (Slide 30).

That was the lecture. Questions from the seminar attendees were many and perceptive. Here are a few.

Are there no other factors that cause crises in capitalism apart from profitability?

What is the difference between the organic composition of capital and the technical composition of capital that Marx refers to?

Does not the law suggest that there is no economic policy within capitalism that can stop recurring crises?

If so, do the crises go on forever or will it come to a total breakdown at certain point?

I’ll leave the reader to consider these answers, if there are any answers.

No comments:

Post a Comment