President Trump’s economic team have release their plans for the federal budget over the next ten years. It is a combination of wildly optimistic economic growth forecasts, vicious cutbacks in public services and environmental measures; and significant cuts in corporate taxes and personal taxes for the rich.

But what is exercising mainstream economists are the schoolboy errors in the budget logic. The budget assumes a $2trn increase in revenue coming from fast economic growth to balance the budget by 2027. But at the same time this economic growth is supposed to pay for $2trn in tax cuts so that there is no loss in revenue. But if you cut revenue with tax cuts of $2trn, you cannot restore the revenue by growth AND also balance the budget with another $2trn by 2027. That is double-counting. One ludicrous part of this calculation is that the budget aims to cut $300bn in estate taxes over the next decade and yet forecasts a rise in estate tax revenue from faster economic growth. So will estate tax revenue rise or fall? – it cannot be both!

This is an interesting quirk for mainstream economists to mull over, but what those who look to the interests of working people should note in the budget are the huge hits to federal public services (while increasing military and national security spending). In the so-called ‘Taxpayer First Budget’, the plan is to strip down expenditure on all sorts of civil services by $3.6trn over ten years. Funding for Medicaid, the health-care program for low-income Americans will be cut by $800bn. The federal nutrition program (food stamps) that benefits 44m of the poorest Americans (yes, it is that many on food stamps) would be cut by nearly 30%. The budget director said that too many of these programs “spend other people’s money” and that we should have “compassion for folks who are paying for it”. So much for the concept of ‘society’.

At the same time, corporate tax rates will be slashed from 35% to 15%; foreign aid grants (outside of military spending) will be eliminated and $1.6bn will be allocated for building the wall on the Mexican border. Consumer finance protection measures will be removed and financial regulations relaxed.

As for personal taxation, the top income tax rate is to be cut to 33 percent from 39.6 percent. There will be a cut in taxes on capital gains, 70 percent of which flow to the top 1 percent. The estate tax will be eliminated. This applies to a tiny number of people, couples that have estates bigger than $10.8 million. The 3.8 percent surtax on high earners’ investment income that has been used to subsidize health care for poorer Americans will be stopped. And the alternative minimum tax, which currently limits deductions for high earners, will also go. And there will be lower taxes on cash flow and income that passes from small businesses to their owners, which also primarily benefits wealthier America

The nonpartisan Tax Policy Center, a joint project of the Urban Institute and Brookings Institution, found “high-income taxpayers would receive the biggest cuts, both in dollar terms and as a percentage of income… Three-quarters of the tax cuts would benefit the top 1 percent of taxpayers,” if the plan were put into effect this year, it said. The highest-income households — the top 0.1 percent — would get “an average tax cut of about $1.3 million, 16.9 percent of after-tax income.” Those in the middle fifth of incomes would get a tax cut of almost $260, or 0.5 percent, while the poorest would get about $50. That split would worsen down the road, the Tax Policy Center says: “In 2025 the top 1 percent of households would receive nearly 100 percent of the total tax reduction.”

Even the conservative-leaning Tax Foundation concluded that those in the top 1 percent of the income scale would save at least 10 times as much, or 5.3 percent. That’s nearly $40,000 extra for those at the top, compared to $67 for those smack dab in the middle of the income scale.

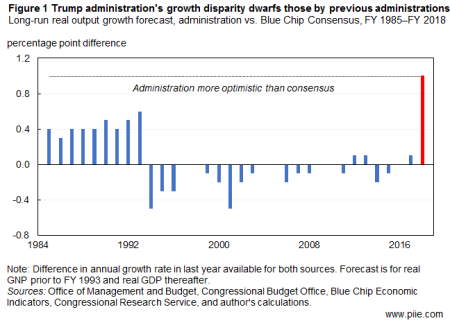

But leaving aside the inequities of the Trump administration’s budget plan and its basic accounting errors, the biggest flaw is in its forecast of average 3% real GDP growth in the US economy over the next ten years. This forecast is essential in justifying the ‘dynamic scoring’ of the budget revenue projections. But it is fairyland. Jason Furman at the Petersen Institute points out that the divergence between this forecast (3%) and the consensus forecast of mainstream economists (2%) is the widest in half a century. And 1% point of growth each year makes a huge difference.

Furman ran 10m simulations (yes 10m) of the likely possibility that 3% growth could be achieved as a random possibility from the median forecast of economic growth of 1.8% a year. The odds of getting 3% were 4%.

The real problem is that across the advanced capitalist economies, productivity growth has plummeted in the last ten years of the Long Depression…..

while employment and population growth has slowed.

Thus, the potential growth rates of the top capitalist economies have dropped away. The Trump target of 3% (it used to be 4%) is just not going to happen. And all this assumes that there is no new major economic slump in capitalist production, employment and investment in the next ten years. If the history of capitalist economic cycles are to be relied upon, then that is almost ruled out, even if my own forecast of a new slump by 2018 turns out to be wrong.

No comments:

Post a Comment