US President-elect Donald Trump reckons that the cause of the losses in manufacturing jobs over the last 30 years has been the rigging of trade terms by low labour-cost manufacturing in China and Mexico. So it is trade and the shifting of production locations by US multi-nationals overseas – in other words, globalisation.

This claim has upset mainstream economists who see ‘free trade’ as a totem of economic theory. From Ricardo onwards, mainstream economic theory reckons that free trade is beneficial to all by applying the ‘comparative advantages’ that each trading nation has to make in exchanges of commodities. Such trade is then is mutually beneficial.

Actually, this theory is fraught with flaws, as Anwar Shaikh has only recently spelt out in his book, Capitalism: Competition, Conflict, Crises, while mainstream economist Dani Rodrik has pointed out that the so-called ‘Pareto optimum’ of equality of gains and losses cannot be achieved. Rodrik argues in his book, The Globalization Paradox that democracy, national sovereignty and global economic integration are mutually incompatible.

Keynesian guru Paul Krugman has always been a proponent of ‘free trade’. Indeed, he got his Nobel prize in economics for a ‘new’ theory of international trade that reckoned, even with tariffs and market imperfections, international trade would be beneficial to all participants.

From this position, Krugman has recently been at pains to argue against the Trump thesis that the loss of American manufacturing jobs is down to ‘nasty foreigners’ with their trading trickery and to American companies taking their factories overseas and selling their goods back into the US.

In a recent short paper and on his blog, Krugman shows that very few US manufacturing jobs would have been saved with different trade policies or by not agreeing to NAFTA, for example.

Manufacturing employment in the US fell from around a quarter of the work force in 1970 to 9% in 2015. Krugman finds that “trade is less than half the story”. Absent the US trade deficit, manufacturing may be a fifth bigger than it is. “That wouldn’t make much difference to the long-run downward trend, but looms larger relative to the absolute decline since 2000.”

Another study by Autor et al reckons competition from China led to the loss of 985,000 manufacturing jobs between 1999 and 2011. That’s less than a fifth of the absolute loss of manufacturing jobs over that period and a quite small share of the long-term manufacturing decline. “So America’s shift away from manufacturing doesn’t have much to do with trade and even less to do with trade policy.”

The biggest reason Trump — or anyone else — can’t bring back home these manufacturing jobs is because they have been lost in large part to the success of efficiency. Manufacturing output in the US was at an all-time high in 2015. Over the past three-and-a-half decades, manufacturers have shed more than seven million jobs while producing more stuff than ever. The Economic Policy Institute (EPI) reported in The Manufacturing Footprint and the Importance of U.S. Manufacturing Jobs that “If you try to understand how so many jobs have disappeared, the answer that you come up with over and over again in the data is that it’s not trade that caused that — it’s primarily technology,”…Eighty percent of lost jobs were not replaced by workers in China, but by machines and automation. That is the first problem if you slap on tariffs. What you discover is that American companies are likely to replace the more expensive workers with machines.”

What these studies reveal is what Marxist economics could have told them many times before. Under capitalism, increased productivity of labour comes through mechanisation and labour shedding i.e. reducing labour costs. Marx explained in Capital that this is one of the key features in capitalist accumulation – the capital-bias of technology – something continually ignored by mainstream economics, until now it seems.

Marx put it differently to the mainstream. Investment under capitalism takes place for profit only, not to raise output or productivity as such. If profit cannot be sufficiently raised through more labour hours ( more workers and longer hours) or by intensifying efforts (speed and efficiency – time and motion), then the productivity of labour can only be increased by better technology. So, in Marxist terms, the organic composition of capital (the amount of machinery and plant relative to the number of workers) will rise secularly.

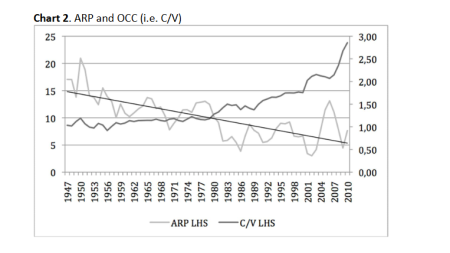

Marxist economists have already provided empirical evidence for this tendency. G Carchedi in a recent paper shows that the ‘technical composition’ of capital (the value of machinery and plant relative to the number of workers) in productive sectors has risen in the last 60 years in the US (while profitability has fallen secularly (ARP)) – see ‘OCC’ in the graph below. My own estimates show that the US organic composition of capital (the value of technology and plant to the value of labour power in wages etc) rose 46% in the last 70 years.

This ‘capital bias’ in technology could also explain the falling labour share and growing inequalities. Workers can fight to keep as much of the new value that they have created as part of their ‘compensation’ but capitalism will only invest for growth if that share does not rise too much that it causes profitability to decline. So capitalist accumulation implies a falling share of value to labour over time or what Marx would call a rising rate of exploitation (or surplus value).

It used to be argued in mainstream economics that inequalities were the result of different skills in the workforce and the share going to labour was dependent on the race between workers improving their skills and education and introduction of machines to replace past skills. But even Krugman now recognises that inequalities of income and wealth across US society and the declining share of income going to labour in the capitalist sector are not due to the level of education and skill in the US workforce, but to deeper factors.

As he put it a few years ago: “The effect of technological progress on wages depends on the bias of the progress; if it’s capital-biased, workers won’t share fully in productivity gains, and if it’s strongly enough capital-biased, they can actually be made worse off. So it’s wrong to assume, as many people on the right seem to, that gains from technology always trickle down to workers; not necessarily.”

So it depends on the class struggle between labour and capital over the appropriation of the value created by the productivity of labour. And clearly labour has been losing that battle, particularly in recent decades, under the pressure of anti-trade union laws, ending of employment protection and tenure, the reduction of benefits, a growing reserve army of underemployed and through the globalisation of manufacturing.

This is the real reason for American workers falling behind in wages relative to increased productivity and investment in new technology that sheds jobs. The falling share going to labour in national income began at just the point when US corporate profitability was at an all-time low in the deep recession of the early 1980s. Capitalism had to restore profitability. It did so partly by raising the rate of surplus value through sacking workers, stopping wage increases and phasing out benefits and pensions – and by the introduction of new technology to replace labour after a major slump in production.

Another study found that the “negative correlation between the (weaker) penetration of collective bargaining agreements and increased wage inequality is strong. This result applies to the relationship between the lowest and highest wages, but also between the median wage and the hi ghest wage. Lower trade union density and lower unemployment also increase wage inequality.” So it was the weakened bargaining power of unions and higher unemployment combined with a marked decrease in redistribution through taxes and transfers that was the main explanation why Americans have fallen behind in income since the 1980s.

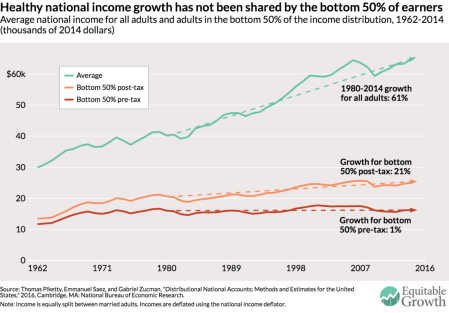

In this context, the latest report by the world’s top experts in the field, Thomas Piketty, Emmanuel Saez and Gabriel Zucman on the extreme inequality of incomes in the US, is perfectly explicable. The trio find that the bottom half of the income distribution in the US has been completely shut off from economic growth since the 1970s. From 1980 to 2014, average national income per adult grew by 61% in the US, yet the average pre-tax income of the bottom 50% of individual income earners stagnated at about $16,000 per adult after adjusting for inflation. In contrast, income skyrocketed at the top of the income distribution, rising 121% for the top 10%, 205% for the top 1% and 636% for the top 0.001%!

In 1980, adults in the top 1% earned on average 27 times more than bottom 50% of adults. Today they earn 81 times more. This ratio of 1 to 81 is similar to the gap between the average income in the United States and the average income in the world’s poorest countries, among them the war-torn Democratic Republic of Congo, Central African Republic, and Burundi. And the increase in income concentration at the top in the US over the past 15 years is due to a boom in capital income i.e. income from dividends, interest and rents, not higher wages.

It’s a tale of two countries. For the 117 million Americans in the bottom half of the income distribution, growth has been non-existent for a generation while at the top of the ladder it has been extraordinarily strong. And this stagnation of national income accruing at the bottom is not due to population aging. Quite the contrary: for the bottom half of the working-age population (adults below 65), income has actually fallen. From 1980 to 2014, for example, none of the growth in per-adult national income went to the bottom 50%, while 32% went to the middle class (defined as adults between the median and the 90th percentile), 68% to the top 10% and 36% to the top 1%. The trio comment: “An economy that fails to deliver growth for half of its people for an entire generation is bound to generate discontent with the status quo and a rejection of establishment politics.” Indeed.

And because progressive income taxation has been eroded and social benefits cut back, government taxation and transfers have had little redistributive effect on the inequality caused by the market. “There was almost no growth in real (inflation-adjusted) incomes after taxes and transfers for the bottom 50 percent of working-age adults over this period”. As the trio say: “The diverging trends in the distribution of pre-tax income across France and the United States—two advanced economies subject to the same forces of technological progress and globalization—show that working-class incomes are not bound to stagnate in Western countries. In the United States, the stagnation of bottom 50 percent of incomes and the upsurge in the top 1 percent coincided with drastically reduced progressive taxation, widespread deregulation of industries and services, particularly the financial services industry, weakened unions, and an eroding minimum wage.”

So the loss of US manufacturing jobs, as it has been in other advanced capitalist economies, is not due to nasty foreigners fixing trade deals. It is due to the inexorable attempt of American capital to reduce its labour costs through mechanisation or through finding new cheap labour areas overseas to produce. The rising inequality in incomes is a product of ‘capital-bias’ in capitalist accumulation and ‘globalisation’ aimed at counteracting falling profitability in the advanced capitalist economies. But it is also the result of ”neo-liberal’policies designed to hold down wages and boost profit share. Trump cannot and won’t reverse that with all his bluster because to do so would threaten the profitability of America capital.

No comments:

Post a Comment