Before Donald Trump was elected, stock markets went down every time he improved in the public opinion polls. Finance capital did not want him to win. But since his surprise election, stock markets have not slumped. On the contrary, they have risen substantially along with a strengthening dollar. It seems that ‘the Donald’ could be a good thing for Capital after all.

Much of this optimism will turn out to be wishful thinking. But wishful thinking can work the markets for a while. The thinking is based on the policies that Trump is proposing: in particular, tax cuts for the corporate sector and personal income tax cuts that will benefit the top 1% of income earners the most. Also, he claims that he will spend up to $1trn on new infrastructure and investment projects around the country and deregulate the banks and reduce labour rights (what’s left of them).

The stimulus measures are music to the ears of Keynesian economics, despite the general distaste that the top Keynesian gurus have had for the attitudes and rants of ‘the Donald’. Indeed, if these policies are implemented over the next year or so, Trumponomics will be the next test of the Keynesian solution for the world economy to get out of this Long Depression. Abenomics in Japan, following similar policies of public spending, tax cuts and quantitative easing, has miserably failed. Japan’s GDP growth has hardly moved, while wage incomes and prices remain transfixed.

But now some Keynesians are applauding Trump’s approach as ‘a break from neoliberalism’. The great historian and biographer of Keynes, Robert Skidelsky tells us that “Trump has also promised an $800bn-$1tn programme of infrastructure investment, to be financed by bonds, as well as a massive corporation tax cut, both aimed at creating 25m new jobs and boosting growth. This, together with a pledge to maintain welfare entitlements, amounts to a modern form of Keynesian fiscal policy”. So Skidelsky goes on: “As Trump moves from populism to policy, liberals should not turn away in disgust and despair, but rather engage with Trumpism’s positive potential. His proposals need to be interrogated and refined, not dismissed as ignorant ravings.” Well, liberals of the Keynesian persuasion may want to ‘engage’ with Trump and adopt Trumponomics, but those who want to improve the lot of Labour, the majority not the top 1%, will take a different view.

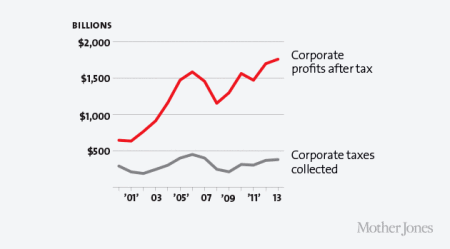

Indeed, let’s look at Trumponomics. Apparently, Skidelksy thinks that cutting corporation tax will create new jobs and raise growth. Well, there is no evidence that previous cuts in corporation tax have done so anywhere in the major economies. Corporate tax rates were slashed during the neoliberal period and yet economic growth has floundered. What has happened is a rise in the share going to the profits of capital at labour’s expense and a rise in unproductive financial speculation. Officially, the US has a 35% marginal tax rate on corporations but after various exemptions, it is effectively only 23%, among the lowest in the world.

Trump’s infrastructure plan is badly needed. In my blog, I have often shown the terrible state of the public services and communications in the US. The average age of America’s fixed assets is 22.8 years — the oldest in data back to 1925. Infrastructure spending is at 30-year lows and bridges, roads and railways are crumbling before our eyes. According to the 2013 report card by the American Society of Civil Engineers, the US has serious infrastructure needs of more than $3.4 trillion through 2020, including $1.7 trillion for roads, bridges and transit; $736 billion for electricity and power grids; $391 billion for schools; $134 billion for airports; and $131 billion for waterways and related projects. But federal investment in infrastructure has dropped by half during the past three decades, from 1% to 0.5% of GDP.

Undoubtedly, public investment in infrastructure would help the US economy and raise growth a little – Goldman Sachs reckons by 0.2% pts a year. But Trump’s proposal of $1trn spending over four years is a fake. Most of this would not be public investment at all. The funds would come from private sources which would get incentives to provide money: the big construction companies and developers (like Trump Inc itself) will be offered tax breaks and also the right to own the bridges, roads, etc built with toll charges to the users of these. Direct public spending and construction will be limited.

Moreover, as I have argued in many posts, there is little evidence that Keynesian stimulus programmes work to deliver jobs and growth. Skidelsky talks about the Roosevelt era of the 1930s. Actually, very few permanent or new jobs were created under Roosevelt. The unemployment rate stayed right up to the start of the war. As Paul Krugman, the American Keynesian guru, pointed out in his book, End Depression now, it took the war to deliver full employment and economic recovery.

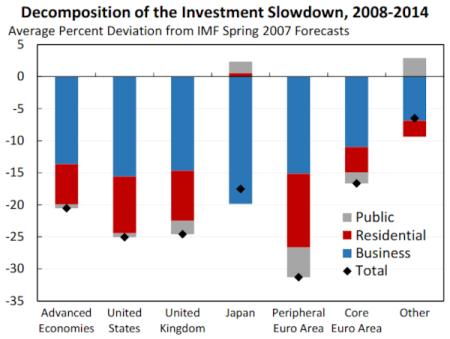

During the period of ‘austerity’, from 2009, when governments tried to run budget surpluses and wants to cut public debt after the Great Recession – a period we are still in – we were told by Keynesians that the ‘multiplier’ of austerity was huge (i.e. growth was being reduced drastically by more than one-to-one by cutting budget deficits or government spending). Well, again in previous posts, I have shown that this ‘strong multiplier’ is seriously open to question. Indeed, there is little correlation between reducing or raising government deficits or spending and growth since 2009. The best correlation with growth is with profits, not government spending.

Recently, Nora Traum of North Carolina State University presented a paper titled Clearing Up the Fiscal Multiplier Morass. She found that “different assumptions create different multipliers”. She asked nine modelers, using three different kinds of models, to predict the effect on growth of three different tax reform proposals. For one reform, predictions on growth varied from –4.2 percent to 16.4 percent in the short run, and from 1.7 percent to 7.5 percent in the long run.

Recent research has shown that the best news for capital is cutting government spending rather than raising taxes to apply austerity. Reducing government spending gives more room for private capital than raising taxes like corporate taxes, which is much more damaging to capital and thus to growth. If we are now to expect fiscal expansion not austerity from Trump (we shall see), then capital will like the tax cut but will not want government spending (except for those developers which get the contracts) especially if it directly interferes or replaces private investment. Such was the point against Keynesian stimulus made by post-Keynesian Michal Kalecki himself.

Marxist economics explains why. What really drives investment and in modern capitalist economies, where private capital investment dominates, is the profitability of projects. Private investment has failed to deliver because the profitability is too low, but even so the public sector must not interfere.

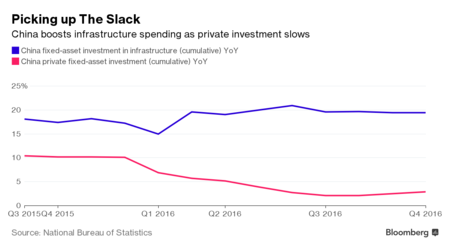

That’s the difference between Trump’s plan and that of the Chinese government in its massive infrastructure and urbanisation investment since 2009. China has spent about $11 trillion on infrastructure in the last decade — more than 10 times what Trump is proposing. This public investment, bankrolled by state banks and carried out by state companies, has weakened the private sector’s growth in China. But as the Chinese state controls the economy, not domestic or foreign big business (much to the chagrin of the World Bank), such investment can go ahead and deliver 6-7% annual real growth during this Long Depression.

So the likelihood that Trumponomics will work and take economic growth up to 4% a year, as Trump claims, is very low. It is ironic that when Bernie Sanders’ advisers suggested that a program similar to Trump’s be adopted and would achieve 4% or more real GDP growth, romer-and-romer-evaluation-of-friedman1, saying it was a pipe dream – correctly, in my view. But now Trump advocates it, financial markets and Keynesians find it attractive and even possible.

Like Abenomics, Trumponomics is really a combination of Keynesianism and neoliberalism. The new spending and tax cuts are to be paid for, apparently, by more deregulation of markets and labour conditions to boost profits. This is supposed to boost the growth rate in a ‘dynamic model’, or what used to be called ‘trickle-down economics’, where the rich get tax cuts and spend it on the goods and services so that the rest of us get some more income and jobs. The main incentive according to Trump’s own economic expert is not from reductions in the personal or corporate tax rate, but from allowing businesses to write off their investments immediately instead of over time.

What Skidelsky ignores in his paeon of praise for Trump’s policies is the hallmark of Trumponomics: trade protectionism and restrictions on immigration. These policies are much more likely to be imposed than his Keynesian-style stimulus. Trump plans to drop TTP (the regional trade deal with Japan and Asia) and TTIP (with Europe) and ‘renegotiate’ NAFTA, the regional trade pact with Mexico and Canada. The aim is to ‘protect’ American jobs and end cheap Mexican labour.

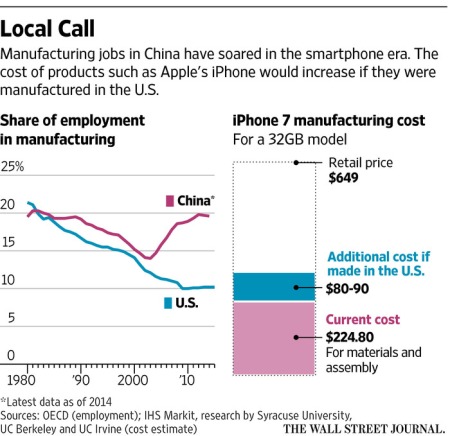

As the Donald said last March: “I’m going to get Apple to start making their computers and their iPhones on our land, not in China.” And he wants to impose a 45% tariff on Chinese imports. It’s been estimated this could drag down China’s GDP by 4.8% and Chinese exports to the US by 87% in three years, according to Daiwa Capital Markets. Even if Apple finds enough workers to assemble in the US, the cost of making an Apple iPhone 7 could increase $30-40, estimates Jason Dedrick, a professor at the School of Information Studies at Syracuse University. Since labour accounts for only a small part of an electronic device’s overall costs, most of these higher expenses would come from shipping parts to the US. If the iPhone components were also made in the US, the device’s costs could climb up to $90. That means that, if Apple chose to pass along all these costs to consumers, the device’s retail price could climb about 14%. So Trump’s trade policies would mean a sharp rise in prices of goods in the US for a start, even assuming there is no retaliation by China.

As John Smith has shown in his powerful book, Imperialism in the Twenty-First Century: Globalization, Super-Exploitation, and Capitalism’s Final Crisis :“about 80 percent of global trade (in terms of gross exports) is linked to the international production networks of TNCs.” UNCTAD estimates that “about 60 percent of global trade . . . consists of trade in intermediate goods and services that are incorporated at various stages in the production process of goods and services for final consumption.”. A striking feature of contemporary globalization is that a very large and growing proportion of the workforce in many global value chains is now located in developing economies. In a phrase, the centre of gravity of much of the world’s industrial production has shifted from the North to the South of the global economy.”, as Smith quotes Gary Gereffi.

Reversing this key feature of what has been called ‘globalisation’ can only be damaging to American corporations, while at the same time shifting the burden of any cost and prices rises onto average American households.

Globalisation – the cross-border expansion of world trade and capital flows and the development of value-added chains internationally – has been an important counteracting factor to the falling rate of profit experienced after the mid-1960s up to the early 1980s in the major advanced economies. Deregulating labour rights, crushing trade union power, privatising public sector assets domestically went with global expansion by multinationals. Trump now talks about reversing this counteracting factor to benefit his supposed electoral support in the ‘rust-belt’ of mid-West America that has suffered the most from the movement of American multinationals to exploit cheaper labour in Mexico, Asia and Latin America.

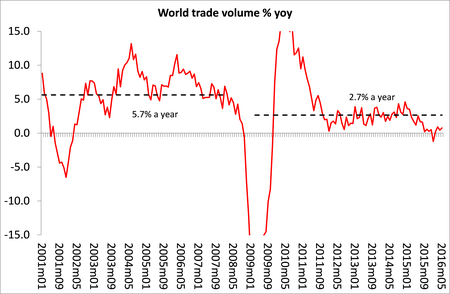

The irony (and the worry for capital) is that the Great Recession and the ensuing Long Depression seems to be ending globalisation anyway. Globalisation was already in trouble before Trump and Brexit. The global financial crash, the Great Recession and ensuing Long Depression (similar to that of the 1930s) since 2009 had brought the expansion of world trade to a grinding halt.

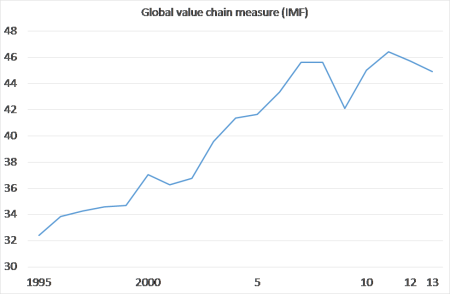

On a standard measure of participation in global value chains produced by the IMF, the rise in profitability for the major multi-nationals is now stalling.

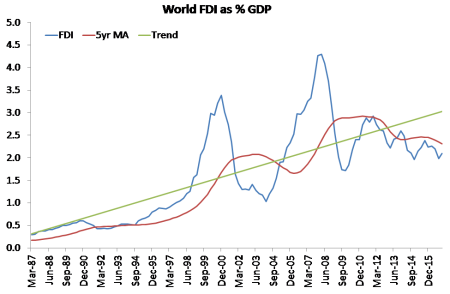

Sure, information flows (internet traffic and telephone calls, mainly) have exploded, but trade and capital flows are still below their pre-recession peaks. Global foreign direct investment as share of GDP is now falling.

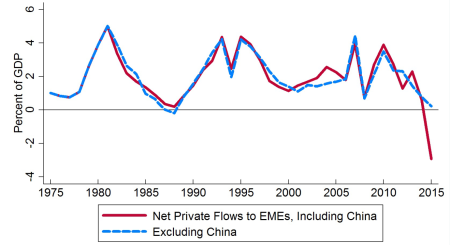

And capital flows to the so-called emerging economies have plummeted.

The G20 leaders met recently before the Trump victory and they could already see the writing on the wall for globalisation. They said they were opposed to trade protectionism “in all its forms”. As Deutsche Bank economists put it: “It feels like we’re coming towards the end of an economic era… and time is running out to prevent economic and political regime change given the existing stresses in the system.”

The strategists of capital are worried that Trumponomics will only makes things worse for profitability globally. Bin Smaghi, ex member of the ECB and leading strategist of finance capital, commented: “Trying to reverse globalisation can be damaging, particularly for the country that takes the first step. It is the advanced economies that are facing the greatest challenges in its most recent wave, which is why anti-globalisation movements are gaining support and governments are tempted to become inward looking. However, because their economies are so large, and so bound by the web of globalisation, they cannot reverse its course, unless emerging markets also retreat.”

And the risk is that the emerging economies could be driven into a slump as trade falls further and capital inflows dry up. Emerging economies have been building up large amounts of debt (credit) raised from US and European banks to invest, not always in productive sectors. This has not caused any problem up to now because interest rates globally have been very low and the US dollar has been weak so that borrowing in dollars has not been a problem.

But this is beginning to change, partly due to Trumponomics. Moody’s Investors Service has issued 35 credit downgrades this year in countries including Austria, Turkey, and Saudi Arabia, while only issuing five upgrades. And 35 of the 134 countries assessed by the ratings firm currently have a negative outlook hanging over them. That puts at least $7 trillion of government debt at risk of a downgrade, according to data from the Bank of International Settlements for the end of last year. This proportion of countries with a negative outlook from Moody’s is the largest it has been since 2012, and it couldn’t come at a worse time. Interest rates on bonds, especially ones with longer maturities, are now rising sharply. If this is the end of a 35-year bull run in the bond market, governments, after years of low interest rates, might have to prepare for significantly higher borrowing costs.

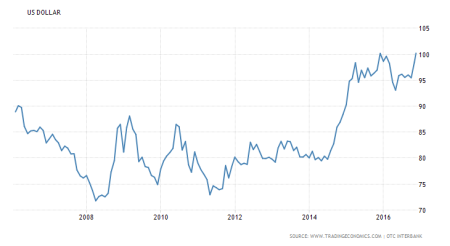

At the same time, the US dollar has spiralled upwards in strength compared to other major trading currencies.

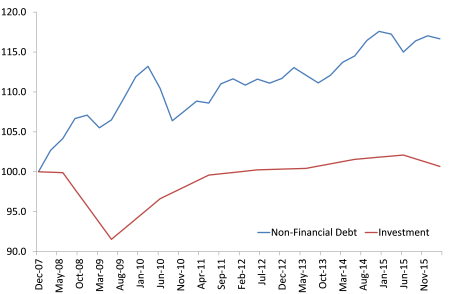

Global debt relative to productive investment has been sharply increasing.

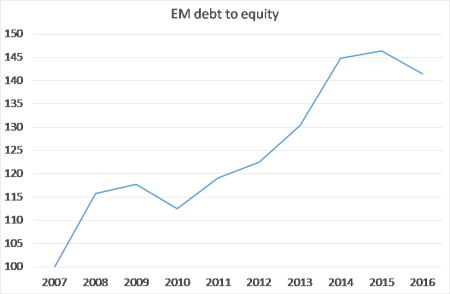

And emerging economies’ corporate sector debt to capital ratio has also risen sharply.

Low and slowing economic growth globally along with a rising cost of borrowing and stagnant trade, now threatened by Trumponomics, will increase the risk of a global slump, not avoid it.

No comments:

Post a Comment