Keynesian economist Brad DeLong recently reprised the argument made by John Maynard Keynes back in 1931 that capitalism might be in a depression now, but if we take the long view, we can see that capitalism has been the most successful mode of production for people’s needs in human history; so don’t worry, it will be again.

Keynes made this argument in a lecture to his economics students at Cambridge, called The economic possibilities of our grandchildren. He argued that within a hundred years, average incomes would have increased eight-fold and everybody would be working a 15-hour week. So, he said, keep faith in capitalism and don’t go off adopting stupid Marxist ideas – as many were doing at the time.

Now Brad DeLong has become the Keynes of 2016, in the midst of the latest Long Depression.

In his blog, he recognises that “economic growth since 2008 has been profoundly disappointing. There is no reasoned case for optimistically expecting a turn for the better in the next five years or so. And the failure of global institutions to deliver ever-increasing prosperity has undermined the trust and confidence which in better times would serve to suppress the murderous demons of our age.” But fear not: “if we look at global economic growth not just five years out, but over the next 30-60 years, the picture looks much brighter…..The reason is simple: the large-scale trends that have fueled global growth since World War II have not stopped. More people are gaining access to new, productivity enhancing technologies, more people are engaging in mutually beneficial trade, and fewer people are being born, thus allaying any continued fears of a so-called population bomb….. Moreover, innovation, especially in the global north, has not ceased, even if it has possibly slowed since the 1880s. And while war and terror continue to horrify us, we are not witnessing anything on the scale of the genocides that were a hallmark of the twentieth century.”

DeLong claims that “these major trends are likely to continue, according to data from the Penn World Table research project, the best source for summary information on global economic growth. The PWT data on average real (inflation-adjusted) per capita GDP show that the world in 1980 was 80% better off than it was in 1950, and another 80% better off in 2010 than it was in 1980. In other words, our average material well-being is three times what it was in 1950.”

Actually that evidence shows that Keynes was way too optimistic back in 1931. I did estimates like DeLong a few years ago and found that if we look at the world economy as a whole (something JMK does not), then world per capita GDP rose only about 2.5 times from 1930 to 1990. JMK was far too optimistic. And the average working week in the US in 1930 – if you had a job – was about 50 hours. It is still above 40 hours (including overtime) now for full-time permanent employment. Indeed, in 1980, the average hours worked in a year was about 1800 for advanced economies. Currently, it is about 1800 hours – so again, no change there.

DeLong echoes Keynes in 1931 by concluding that “short of a nightmare scenario like terror-driven nuclear war, you can expect my successors in 2075 to look back and relish that, once again, their world is three times better off than ours is today.”

This pro-capitalist optimism was also recently promoted by Nobel prize winner Angus Deaton. Deaton is an expert on world poverty, the consumption patterns of households and how to measure them. He emphasises that life expectancy globally has risen 50% since 1900 and is still rising. The share of people living on less than $1 a day (in inflation-adjusted terms) has dropped to 14 percent from 42 percent as recently as 1981. The greatest progress against cancer and heart disease has come in the last 20 to 30 years. “Things are getting better,” he writes, “and hugely so.”

But Deaton makes it clear that progress in living conditions and quality of life is a relatively recent development. And much of this improvement in the quality and length of life comes from the application of science and knowledge through state spending on education, on sewage, clean water, disease prevention and protection, hospitals and better child development. These are things that do not come from capitalism but from the common weal.

Moreover, things are not that rosy. Back in 2013, the World Bank reported that there were roughly 1.2 billion people completely destitute (living on less than $1.25 a day), one-third of which are 400 million children. One of every three extremely poor people is a child under the age of 13. So there are over one billion people, one-third of them children, who are virtually starving in the 21st century. While extreme poverty rates have declined in all regions, the world’s 35 low-income countries (LICs) – 26 of which are in Africa — registered 103 million more extremely poor people today than three decades ago. Aside from China and India,“ individuals living in extreme poverty [in the developing world] today appear to be as poor as those living in extreme poverty 30 years ago,” the World Bank said.

Deaton himself recognises this: “the number of those who live on less than $2 a day is rising according to the most recent estimates.” In 2010, 33 percent of the extreme poor lived in low-income countries (LICs), compared to 13 percent in 1981. In India, the average income of the poor rose to 96 cents in 2010, compared to 84 cents in 1981, and China’s average poor’s income rose to 95 cents, compared to 67 cents. China’s state-run still mainly planned economy saw its poorest people make the greatest progress. But the “average” poor person in a low-income country lived on 78 cents a day in 2010, compared to 74 cents a day in 1981, hardly any change.

But here is the crucial underlying story behind the improvement that has been registered under capitalism since 1950. It is mostly due to the rapid rise of the economic colossus of China, and in the last decade, to a lesser extent, India (where the figures have been cooked a little). As DeLong shows, China’s real per capita GDP in 1980 was 60% lower than the world average, but today it is 25% above it. India’s real per capita GDP in 1980 was more than 70% below the world average, but India has since closed that gap by half.

DeLong thinks that China’s progress is down to having “strong leaders” like Deng Xiaoping, and in India like Rajiv Gandhi (!). Apparently China’s economic model had nothing to do with it. But when we look at the evidence, as David Rosnick has done with Branco Milanovic’s data from his new book Global Inequality, Rosnick finds that global growth was much lower without China in the equation.

As “China implemented different policies, often in opposition to reforms that much of the rest of the world was adopting (e.g. state ownership of most the banking system, government control over most investment including foreign direct investment, industrial policy, and lax enforcement of intellectual property rights.) If this period’s successes in development are mostly driven by China, then we may reach different conclusions regarding the success of widespread global reforms.”

The problem with the optimism of the likes of DeLong and Deaton with the continued ‘success’ of capitalism is that capitalism appears to heading past its use-by date. Deutsche Bank economists, in a recent study, make the point that ‘globalisation’ (the spread of capitalism’s tentacles across the world) has ground to a halt. And growth in the productivity of labour, the measure of future ‘progress’, has also more or less ceased in the major economies.

Deutsche strategists Jim Reid, Nick Burns, and Sukanto Chanda comment that “It feels like we’re coming towards the end of an economic era. Such eras often come and go in long waves. In the past 30 years a perfect storm of factors — China re-entering the global economy in the 70s, the fall of the Soviet Union, and to some extent, the economic liberalisation of India — added more than a billion workers into the global labour market.” This, Deutsche notes “has coincided with a general surge in the global workforce population in absolute terms and also relative to the overall population, thus creating a perfect storm and an abundance of workers.”

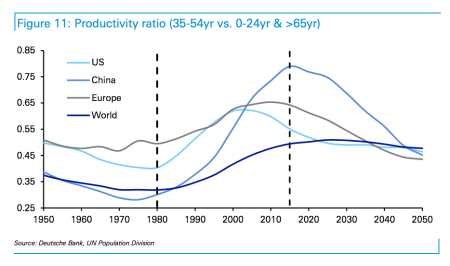

But the era of the ‘baby-boomers’ in the advanced economies is over and the expansion of the workforce in the emerging economies is beginning to slow – the graph below shows how the ratio of productive workers to total population in the major economies is set to fall from hereon.

At the same time, the world economy is in a downwave of profitability and investment. “With demographics deteriorating it seems highly unlikely that the next couple of decades (possibly longer) will see real growth rates returning close to their pre-crisis, pre-leverage era levels. Obviously if there is a sustainable exogenous boost to productivity then a more optimistic scenario (relative to the one below) can be painted. At this stage it is hard to see where such a boost comes from – and even if it does, time is running out for it to prevent economic and political regime change given the existing stresses in the system.”

Indeed, the Deutsche study hints at my own view of long waves in economic development under capitalism. In this blog, and in my books, I have argued that world capitalism is in a major downwave in prices, productivity and profitability which won’t come to an end without further major convulsions in capitalist production similar to that in 2008-9. If that is right, the optimistic predictions of DeLong and Deaton will be confounded.

American economist Robert J Gordon has emphasised that productivity growth everywhere has slowed to a trickle despite the new technological advances of the internet, big data, social media, 3d printing etc. And the debate continues on whether the current era of ‘disruptive’ new technologies will drive capitalism forward and with the majority of people.

Mainstream economics remains divided on the issue. On the one hand, economists at the Bank of England reckon that the new technologies will deliver renewed economic growth and employment, as they have done in the past. The BoE reckons that technological progress won’t create mass unemployment and while it probably won’t make your working week much shorter and it’ll probably push up average wages. So “robots are (probably) our friends”.

On the other side, the IMF’s economists are less sanguine. They argue that “robot capital tends to replace workers and drive down wages, and at first the diversion of investment into robots dries up the supplies of traditional capital that help raise wages. The difference, though, is that humans’ special talents become increasingly valuable and productive as they combine with this gradually accumulating traditional and robot capital. Eventually, this increase in labor productivity outweighs the fact that the robots are replacing humans, and wages (as well as output) rise. But there are two problems…it takes 20 years for the productivity effect to outweigh the substitution effect and drive up wages. Second, capital will still likely greatly increase its role in the economy. It will take a higher share of income, even in the long run when wages are above the pre-robot-era level. Thus, inequality will be worse, possibly dramatically so.” So, not so great.

Keynes’ 1930s optimism gained credence with the boom during a major world war and the subsequent post-war Golden Age that restored the profitability of capital for a generation. Let’s hope it does not take another world war to confirm the optimism of the modern Keynesians like DeLong.

No comments:

Post a Comment