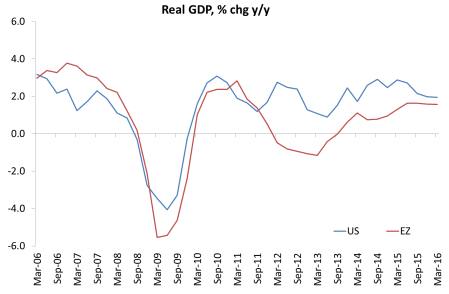

Anyway you look at it, the US economy is slowing down. Indeed, real GDP growth in the US based on the last quarter (Q 2106) has slowed to 1.9% year over year, not much above the rate of growth in the Eurozone. The decline in growth is the product of a decline in investment. The investment drag is clear with GFCF in the Eurozone outpacing its US equivalent for the last two quarters.

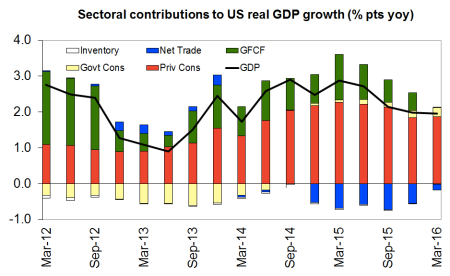

Total investment in the US is now making no contribution at all to the expansion of the economy. See how the green part of the bars below has disappeared.

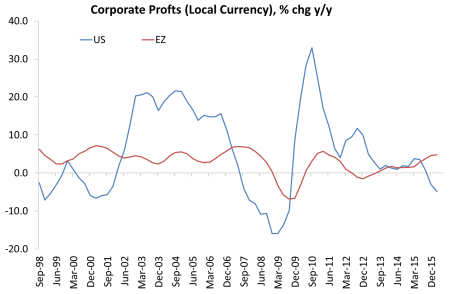

As I have shown before, this weak investment mirrors the deterioration in corporate profitability, which is now falling in the US.

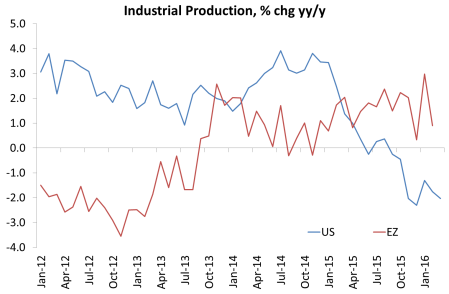

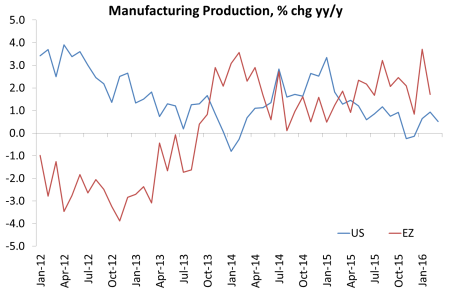

The productive sector of the US economy has particularly weakened and is now heavily contracting – in contrast to weak but steady growth in the Eurozone.

Most commentators argue that this is due to temporary hit to the energy sector following the collapse in oil prices. But even if you exclude energy production, US manufacturing output is crawling along.

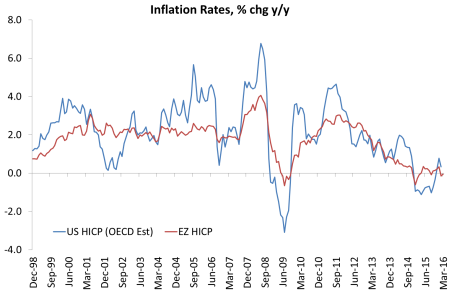

Alongside slowing real output, inflation in prices of goods and services has disappeared in both the US and the Eurozone. Deflation is still close – another indicator of the long depression in the major economies.

But here is the real irony that should confound the Keynesians who reckon that the cause of the depression is the failure of governments to raise spending to compensate for ‘weak demand’. Since 2008, the US economy has grown faster than the Eurozone. And yet in the US government spending has made a negative contribution to that growth while, despite all the talk of German-imposed austerity, government consumption has provided a net boost to real GDP in most European countries since the crisis broke. In other words, there has been more ‘austerity’ in the US than in Europe and yet the US economy has recovered better from the Great Recession!

The graph below shows that since 2008, the US economy has grown 10.8% but government spending (yellow bar) has shrunk, while the German economy has risen only 5.5% with government spending contributing over 2% pts of that. Even ‘austerity’ UK has seen more government spending in its recovery.

Nevertheless, the Keynesians continue to claim that this low growth world is due to the lack of fiscal and monetary injections into the economy and has nothing to do with the underlying problems of the capitalist economy: low profitability, high debt and weak investment and poor productivity growth. Only this week, Martin Wolf told us, yet again, that weak growth in the Eurozone is due to the failure of Germans to spend or invest rather than save. Germany needs to absorb its ‘excess savings’ by spending to get Europe and the world going.

This is nonsense. As I explained in some detail in a previous post, there is not a global savings glut that needs to be absorbed. And German corporate savings as a share of GDP are not particularly high compared to other countries. The issue is low investment, yes. But why? Wolf seems to think it is due to ignorant, rigid attitudes in Germany and elsewhere. But the objective reason is low profitability from future investments and existing relatively high corporate debt. Another way of looking at this is to say that it is a ‘supply-side’ problem, not one of the lack of demand.

An argument in these terms has broken out between the Keynesians and the neo-classical wing of mainstream economics. A new paper by some top Keynesian economists, couched in extremely obtuse mathematical models, seeks to show that the current weak US economy is due to the inability of central banks to get interest rates low enough to stimulate investment. The US economy is ‘zero-bound’ and so we have ‘secular stagnation’. This is the Summers-Krugman explanation of this long depression.

In response, neoclassical economist John Cochrane has shown that these assumptions are just unrealistic. “I read this paper as a brilliant negative result. It shows just how extreme the implicit assumptions are behind the policy blather. It shows just how empty the idea is, that our policy-makers understand any of this stuff at a scientific, empirically-tested level, and should take strong actions to offset the supposed problems these buzzwords allude to”. Cochrane’s alternative view is simple, he says. Interest rates are low because inflation is near zero. Growth is low because productivity growth is low. Productivity growth is low because investment growth is low so the productive potential of the US economy has fallen back. This is much closer to the Robert J Gordon explanation of the depression.

The policy conclusion of the Keynesian position is to pump yet more money into the banks and the economy (helicopter money next) and for governments to launch spending programmes. The neoclassical supply-side policy position is to make companies more efficient by cutting wages and employment and reduce the ‘regulation’ of the capitalist companies to allow the ‘market’ to work; while cut government spending to reduce the level of debt.

Neither option has worked or will work. (Explaining the last ten years: Keynes or Marx – who is right?)

No comments:

Post a Comment