I have been attending a two-day workshop on the current state of capitalism from a Marxist view point. This was organised by Alex Callinicos at King’s College, London University who managed to collect a number of Marxist scholars from the UK and Europe to come and present some papers to be followed by discussion and debate among participants.

The first day started with a discussion on whether Marx himself had a theory of crises under capitalism and, if so, what was it? Readers of my blog will know that this is a controversial issue and scholars like Michael Heinrich consider that Marx never really developed a clear theory of crises and also that Marx’s law of the tendency of the rate of profit to fall had nothing to do with crisis theory (see my posts, http://gesd.free.fr/mrhtprof.pdf

and

https://thenextrecession.wordpress.com/2015/05/19/the-two-michaels-heinrich-and-roberts-in-berlin-dogmatism-versus-doubt/).

Professor Michael Kratke kicked off this discussion with a paper entitled “Marx’s theory of theories of crisis” (Kraetke Marx’s theory or theories of crisis). As an eminent scholar on Marx’s writings in their original manuscripts and on the history of Marxist crisis theory, MK adopted what you might call a ‘middle way’. According to MK, Marx did not stop trying to develop a theory of crisis and he made progress on it; but on the other hand, MK reckons that Marx did not consider his law of the tendency of the rate of profit to fall as part of that theory. You could find several different versions of crisis theory in Marx, but not the LTRPF.

MK says that, for Marx: “The tendency of the rate of profit to fall does not matter at all! On the contrary, Marx is explicitly criticizing the view, as he finds it in Adam Smith, that a fall in the ‚general rate of profit would lead to crises (hence, the often quoted statement that there are no permanent crises”. In my view, however, Marx was really criticising Smith’s description of the falling rate of profit as being a long-term gradual fall, in contrast to his own view based on his law which led to cyclical convulsions in capitalist production as the rate of profit fell. Moreover, his own explanation of the falling profit rate was entirely different from Smith‘s.

Anyway, in MK’s view, the LTRPF was irrelevant to Marx’s theory (theories?) of crisis. And he never mentioned it in any of his studies of capitalist crises in the 1860s, 1870s or at the start of the Long Depression of the 1880s. I have dealt before with this argument about Marx not mentioning the law in previous posts dealing with Michael Heinrich‘s view (see above). But what MK did say was that he did not agree with Heinrich that Engels had distorted or misrepresented Marx’s view on the LTRPF as propounded in Chapters 13-15 of Volume 3. MK reckoned Engels had indeed made a faithful job of editing. Also MK mentioned that Marx had begun to work on understanding the nature of depressions rather than just slumps in his last studies in the 1880s. As for this increasingly stale controversy on whether Marx changed his view on the relevance of the law on profitability and did not tell Engels; and what happened with all the drafts of Marx’s manuscripts, I can only refer you to the excellent scholarship by Fred Moseley here (Introduction3 and FRP-FRL).

Lucia Pradella dealt with a different issue in Marx’s theory of crisis and took a different angle (Pradella Workshop Abstract). She had looked closely at Marx’s writings in the 1850s on colonial expansion into India etc and found that Marx’s theoretical model was to consider captialism as one world economy and not a series of national capitals in order to understand how the capitalist mode of production led to colonial/imperialist expansion. And at this level of astraction, Marx appeared to conclude that colonial expansion was part of the tendency under capitalism for the organic composition of capital to rise in the mature economies (its mirror image being a fall in profitability under the LTRPF) and thus colonial expansion was a counteracting tendency to the law of falling profitability.

Gomes de Deux presented a paper on Marx’s Notebooks (Leonardo G Deus Et Al Marx Notebooks) prepared in 1868 and 1869 that revealed that after Marx finished the manuscripts that became Capital, he continued a broad study of crises, highlighting an emerging transformation of capitalism through leading industrial sectors (railways), financial innovations (such as limited liability firms and new types of shares and titles). Sparked by the crisis of 1866, Marx’s investigations on stock exchanges and related structural changes seem to have given him a new perspective from which to investigate changes in capitalism. But again, there was no evidence (either way, if you like) that Marx changed his view on the law of profitability.

In the next session, we had papers on the nature of crises from a Marxist point of view. Alex Callinicos and Joseph Choonara presented a searching critique of the views of Professor David Harvey on Marx’s theory of crises (Callinicos & Choonara How Not to Write about the Rate of Profit). Readers of this blog will know the debate that has taken place between Harvey and myself and others like Andrew Kliman on (yet again) whether Marx’s law of profitability is logical and empirically proven and relevant as a theory of crises (see my posts,reply-to-harvey). Callinicos and Choonara showed that Harvey used to have a more open-minded view on these issues in his earlier work but now he has hardened his rejection of the law and looks instead to various and vague ‘multicauses’ for crises, to the detriment of his analysis, in their view.

Guiglemo Carchedi presented a paper that sought to show that Marx’s law of profitability was relevant to crises, and in particular to the Great Recession (Carchedi Presentation). This was an empirical analysis and revealed that post-war crises in the US occurred when there was a fall in new value created (profits and wages combined). This can happen even if the rate of profit had been rising before. As soon as the organic composition of capital starts rising more than the rate of surplus value, profitability will fall and so will new value. This conformed to Marx’s law and shows a causal connection between the law and slumps under capitalism, in Carchedi’s view.

Jan Toporowksi presented a paper in which he argued that the real cause of the Great Recession was not a credit-driven housing bubble as most think, but actually the financialisation of the non-financial corporate sector through bond issuance (Toporowski THE CRISIS OF FINANCE King’s May 2015). This had led to over-indebtedness that, at a certain point, could not be serviced. So the hidden cause of the Great Recession was excessive corporate debt, not the sub-prime mortgage ‘house of cards’. This is an interesting idea, if not entirely convincing at least for the GR. I actually think that this could be the Achilles heel of the next slump, as evidence shows that corporate sector debt has not shrunk in any way since the end of the GR, on the contrary. So the build-up of corporate debt could be a trigger for a new slump in both advanced and emerging economies.

The final day brought to a head the divergent views within the workshop on the nature of capitalist crises and their cause. Gerard Dumenil, the well-known Marxist economist and former Research Director at the Centre National de la Recherche Scientique in France and joint author of many books and papers with Dominique Levy, had already expounded his view on the previous day that capitalism is in a ‘neo-liberal crisis’, a new structural stage in capitalism since the 1970s (Dumenil Neoliberalism).

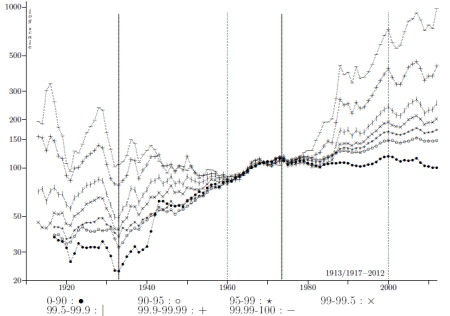

While the great crisis and depression of the 1880s and 1890s could be attributed to one of falling profitability (a classic crisis, if you like) and so could the ‘crisis of the 1970s’ (whatever that was), neither the Great Depression of the 1930s nor the Great Recession could be. They were a product of the establishment of ‘financial hegemony’, or if you like the dominance of the financial sector over the productive sector in capitalism. The neoliberal period is characterised by a sharp increase in the inequality of wealth and income, as the very rich (the top 0.1%) engaged in a “crazy chase to become rich” at the expense of the rest of us and eventually of capitalism itself. Dumenil illustrated this for the 20th century in the US with an excellent graph (see below).

US average income per household in seven fractiles – inequality in 1920s and 1930s, equality in post-war period; then inequality again

In the neoliberal period, we have a new exploitation of the poor through deregulation of mortgages, the expansion of derivatives, leading to the super bonuses of the top executives. In Dumenil’s view, the neoliberal crisis comes about when this crazy venture can no longer be sustained. So the neoliberal crisis and that of the Great Depression in the 1930s were really ones of greed and class exploitation and had nothing to with falling profitability, which was rising not falling.

What worries me about this analysis is several. First, why did the crazy drive for money start just after the ‘classical crisis’ of falling profitability in the 1970s? Was not this neoliberal period a reaction by capitalism in trying to reverse falling profitability through the classic counteracting factors that Marx had outlined in the law: rising rate of exploitation, cheapening of constant capital through new technology, or by just slowing new investment and above all by a switch to investing in fictitious capital rather than in the productive sectors, as Carchedi had shown the day before?

Second, I have considered these arguments of Dumenil before (see my post of over four years ago

(https://thenextrecession.wordpress.com/2011/03/03/the-crisis-of-neoliberalism-and-gerard-dumenil/)

and I have also looked at the rate of profit using Dumenil’s own data for the Great Depression and it looks like a ‘classic’ profitability crisis to me – profitability had peaked in 1924 in the US, well before the 1929 crash (see my post). As for the neoliberal period, I have argued that profitability rose from the 1980s too, but it stopped rising in all the major economies in the late 1990s (see my paper) and entered a downphase that laid the basis for the Great Recession later, as in the Great Depression. And Dumenil’s own figures confirm that for the US too.

Behind Dumenil’s neoliberal crisis theory is his view that, in effect, that there are now three classes in captialism: workers, capitalists and managers. And it is the managers who now hold the ‘balance of power’. In the neoliberal period they have taken the big bonuses and supported finance capital against labour. No change is possible until the managers come over to the side of labour. So we have a political theory of crises rather than an economic one. And it seems to call for class collaboration as a way out of this crisis. I doubt Marx would have agreed.

In my own paper (Capitalism workshop presentation), I tried to identify that the neoliberal period had really been a very weak recovery within the long-term decline of the profitability of capital in the major economies. Using the work of Esteban Maito, I showed that there has been a secular decline in profitability over the lifetime of capitalism, interspersed with upturns, either caused by crises reducing the value of capital, or by periods of counteracting factors, as in the neoliberal period. But these upturns come to an end then the law works to drive down profitability and create new slumps.

Crises occur, I argued (in a similar vein to Carchedi), when falling profitability leads to a fall in the mass of profit and it is not long after that investment and GDP also slumps. Contrary to Keynesian/Kalecki theory, profits lead investment and investment leads employment and consumption – something that Dumenil confirmed in his own data that showed consumption was not a factor in the Great Recession; it was the slump in investment.

My data on the changes in US profits leading to changes in investment were challenged by Jim Kincaid and Pete Green in the discussion. They argued that how could the mass of profits rise and the rate of profit be falling – this must be contradictory. Also the causal correlation between profits and investment found by Tapia Granados, that I always quote (Does investment call the tune – RPE), was only 44%. And that’s hardly conclusive of a causal connection.

Well, since the workshop, I went back to look at my data. I found that if I measured the correlations between the rate of profit, the mass of profit and investment using official US data for the years 2000 to 2013, that there were very high correlations between profitability, profits and investment. First, the correlation between changes in the rate of profit and investment was 64%; second, the correlation between the mass of profit and investment was 76%; and third, the correlation between the rate of profit (lagged one year) and the mass of profit was also 76%. It was necessary to lag the rate of profit as the data are annual for that not quarterly.

Anyway, that provides some more support for the Carchedi/Roberts papers. Tapia Granados has a new paper out that also provides increased statistical support for these causal connections. His new data show that (a) investment is not autonomous, profits raise future investment; (b) investment tend to decrease future profits; and (c) little evidence is found that government spending may stimulate future investment and in this way may pump-prime the economy. Now that the latest data on US corporate profits are out for Q1 2015, I shall return to these issues in a new post.

The main attack on my view of the causes of crises, as based on the LTRPF and its counteracting factors, was delivered by Professor Kratke in the summary of this session and by Professor Dumenil in his comments. Dumenil attempted to rubbish Esteban Maito’s work (Maito, Esteban – The historical transience of capital. The downward trend in the rate of profit since XIX century). “It was a joke!” Dumenil said. He and his colleague Levy were world experts on data; they looked at hundreds of bits of data every day (apparently unlike the rest of us). And so he knew it was impossible to get an ROP for the world going back to 1850s as Maito has done. He tried it for just France and could not do it. So the data were a joke, or a concoction. We cannot prove there is a long term secular decline.

I replied that Maito’s data for the US were based on Dumenil’s own (very accurate!) data and so presumably that was not a joke. Using national statistics, surely you could do that for other countries with the usual caveats and gaps? Anyway, the data all showed the same trend direction as Dumenil’s US data. By the way, Maito does not do France as well; so presumably he had the same problem as Dumenil on that country. Indeed, Maito provides a detailed explanation of his sources and methods in his paper including excel files and he intends to publish even more detail on his statistics for scholars to consider (according to a recent email that I have had from him). So that will be more data for Professor Dumenil to absorb in his rigorous way.

Again, I found the argument against the role of profitability in crises presented by Professor Kratke and others somewhat weird. Dumenil at least recognised that the “crisis of the 1970s” was a ‘profitability crisis’. At the workshop I asked: was anybody in the room that thought that the ‘1970s crisis’ (whatever that was) was not due to falling profitability? And nobody said anything.

The debate seemed to end in a separation between those who reckon that Marx did have a theory of crises and those who say he did not. And between those who consider Marx’s theory of crises was not something as ‘crude and fundamentalist’ as Marx’s law of profitability but was much more ‘complex, multicausal (even Keynesian)’; and those who remain ‘dogmatically’ committed to the law. I think this is an artificial divide. After all, Professor Dumenil did support the view that falling profitability was the cause of the depression of the 1880s, when Marx was alive; and the crisis of the 1970s. And those of us who support the law of profitability also recognise the role of credit/debt (fictitious capital) in triggering crises (see my papers, Amsterdam and Debt matters.Amsterdam presentation 140314 and Debt matters)

There was an interesting and innovative paper presented at the end by Eduardo Albuquerque that may be sets the scene for future capitalism (Albuquerque Workshop Paper). Albuquerque, using new sources, showed that there were new leading technology-driven sectors in capitalism that could eventually lead the next stage of capitalist development.

In my view, there is no permanent crisis of capitalism. It moves in cycles, as my paper argued. So at a certain point, a revival in capital accumulation will begin. Profitability will recover and these new technologies will be utilised. But that probably won’t happen without another huge slump before the end of this decade. I say that because profitability is still too low in most economies and debt deleveraging has still some way to go from the build-up prior to the Great Recession. (I’ll be coming back to this issue in a future post.) If capitalism does enter a revival in the 2020s, it will do so on the basis of robots and artificial intelligence (AI). And that poses a whole new stage in capitalism and in the nature of crises. Again I shall take up the issue of robots and AI in a future post – if I ever get to it!

No comments:

Post a Comment